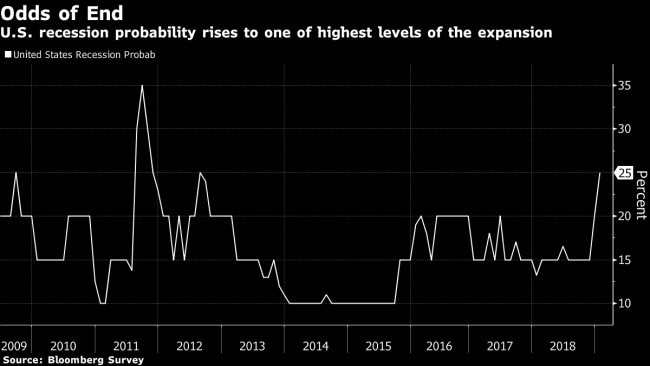

(Bloomberg) — Economists put the risk of a U.S. recession at the highest in more than six years amid mounting dangers from financial markets, a trade war with China and the federal-government shutdown.

Analysts surveyed by Bloomberg over the past week see a median 25 percent chance of a slump in the next 12 months, up from 20 percent in the December survey. The Federal Reserve is now projected to keep interest rates steady in the first quarter, instead of raising them, before two increases total this year — down from four moves in 2018.

The median projection for 2019 economic growth edged down to 2.5 percent following 2.9 percent in 2018 as the boost from fiscal stimulus fades. Growth is still expected to be buoyed by a strong jobs market, rising wages and some lingering effects of tax cuts. If the expansion that began in 2009 lasts until July, it would mark 10 years and become the country’s longest on record.

“It’s not our call that there’s a recession coming soon by any means, but financial conditions have tightened materially over the past two months, you have ongoing trade issues that are weighing on global growth, and you’re seeing business confidence waning a bit,” said Brett Ryan, a U.S. economist at Deutsche Bank AG (DE:). “The government shutdown weighs on business confidence and could weigh on consumer confidence.”

Ryan gave a 20 percent chance of recession, up from 12 percent in the December survey.

Analysts generally expect the partial government shutdown — which President Donald Trump said could last for months if not years, and is now in its third week — to weaken quarterly economic growth by 0.1 to 0.2 percentage points every one to two weeks it drags on.

It’s already affecting projections. On Thursday, JPMorgan Chase & Co. chief U.S. economist Michael Feroli cut his first-quarter growth forecast to a 2 percent annualized pace from 2.25 percent, citing the shutdown.

The shutdown has also delayed government data releases, such as retail sales and inventories, that investors and analysts use to assess the state of the economy. That puts more focus on companies such as retailers Macy’s Inc. and Kohl’s Corp., who gave disappointing reports on Thursday. Other figures from Johnson Redbook Research showed retail sales rising in recent weeks.

Less optimism among consumers would build on financial-market concern about a broader slowdown. Sectors where interest rates have been rising, such as the auto industry, will likely take a hit, according to Barclays Plc chief U.S. economist Michael Gapen.

He said the trade war with China, which is contributing to overall slowing global trade and has raised prices for some U.S. companies, also is weighing on growth and increasing the risk of a downturn.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com