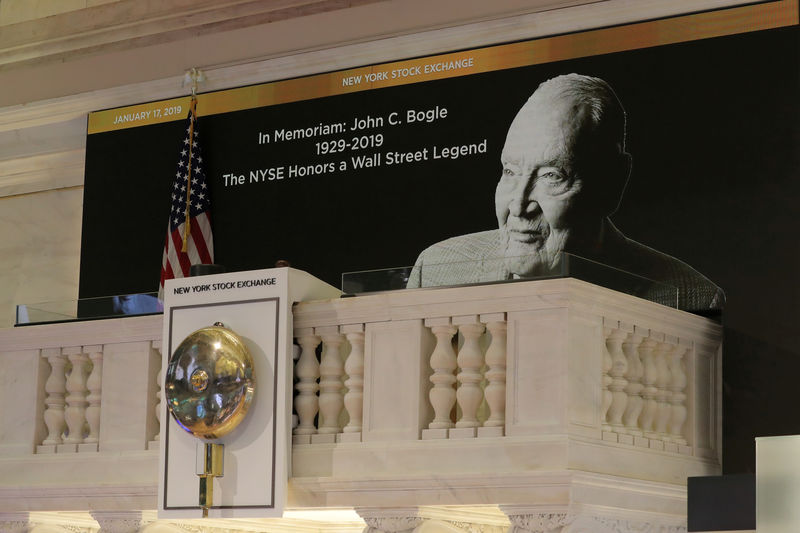

© Reuters. FILE PHOTO: A tribute to Jack Bogle, founder and retired CEO of The Vanguard Group, is displayed on the bell balcony over the trading floor of the NYSE in New York

© Reuters. FILE PHOTO: A tribute to Jack Bogle, founder and retired CEO of The Vanguard Group, is displayed on the bell balcony over the trading floor of the NYSE in New YorkBy Chris Taylor

NEW YORK (Reuters) – America just lost a true giant in investing legend and Vanguard Group founder Jack Bogle.

The creator of the first indexed mutual fund died on Wednesday https://reut.rs/2Cu5i09 in his longtime home of Bryn Mawr, Pennsylvania. He was 89.

Bogle could have been a billionaire many times over, but he structured Vanguard so that proceeds would return to shareholders, which tells you all you need to know about the man.

In 2016, I interviewed Bogle for Reuters’ “Life Lessons” http://reut.rs/2dAMG1I series about what he had learned over the course of his remarkable life.

One problem with that conversation, as was often the case with Jack, was that there was too much good stuff to squeeze into a single article about a man who was often dubbed by the industry as the ‘patron saint’ of the investing business.

Here are some outtakes from that exchange on creating a life of legacy.

Bogle on growing up in the Depression: “There were three of us Bogle boys, and we all started working at the age of 12. I worked as a pinsetter in the bowling alley of the Sea Girt, New Jersey fire department. You put ‘em up, and they knock ‘em down. After six hours of doing that every day, I realized that wasn’t what I wanted to do for my career. Then those automatic pinsetters came along, and I was disrupted out of a job.”

Bogle on wealth: “It takes a long time to get to that point, but you have to handle it with care. Luckily, my wife and I get along very well financially. Many couples are not on the same agenda, and spend too much money. But we always knew exactly how much was coming in and going out every week, even when we weren’t making much at all.”

Bogle on living a meaningful life: “You are rich if you have more money than you need. It is nice to have money, but it is not so good if you are just throwing it away on useless objects. I prefer money going towards something that has meaning, like our family home in the Adirondacks. I have 12 grandchildren now, and the whole summer, I don’t think there is a day where someone isn’t there.”

Bogle on role models: “I never tried to copy anybody, because they are who they are and I am who I am. But there are some people I think are exceptional. Like [value investing legend] Benjamin Graham, although I didn’t know him personally. Warren Buffett is another, and I have gotten to know him pretty well. (Former Federal Reserve Chairman) Paul Volcker, David Swensen at Yale, Cliff Asness from AQR. I have also been close to a couple of economists, like Peter Bernstein and Paul Samuelson.”

“What those people all mean to me is not only their common sense and sound thinking, but also that they are people of high character. They are just solid human beings, and that comes before any other measure of success.”

Bogle on success: “I would define success as using your God-given talents for the greatest advantage of society. And that doesn’t have anything to do with money. It has a little bit to do with leadership. You could even be a loner and be a success. I’m a bit of a loner. I keep my own counsel and live in my own little world of investing and family. But I’m happy that way, and happy with who I am.”

Bogle on his heart transplant: “This gets to the person that I am…I received a transplant from a donor whose heart was still beating. Now I’m getting old, but after all these years, I’m still vigorous in voice and attitude. So I have no complaints about life.”

Bogle on indexing: “I haven’t done any active trading in the stock market for 35 years. I got rid of all my individual stocks at that time, and haven’t held any since. I learned the hard way. It wasn’t like I lost a lot of money, but I never really examined what I owned.”

“I swear if a broker calls you up and says ‘Buy A and sell B,’ you’re better off doing the opposite. A broker has to sell you something, or he doesn’t eat at the end of the month. In any trade, there is someone who is right and someone who is wrong. The only one who is always right is the man in the middle.”

Bogle on investing: “My advice is typical. Diversify, focus on low costs, invest for the long term. Don’t speculate – and don’t be distracted by volatility.”

Source: Investing.com