Investing.com – Market focus this week was largely attuned to signs that an economic slowdown in China was spreading, fueling fears over the outlook for the global economy.

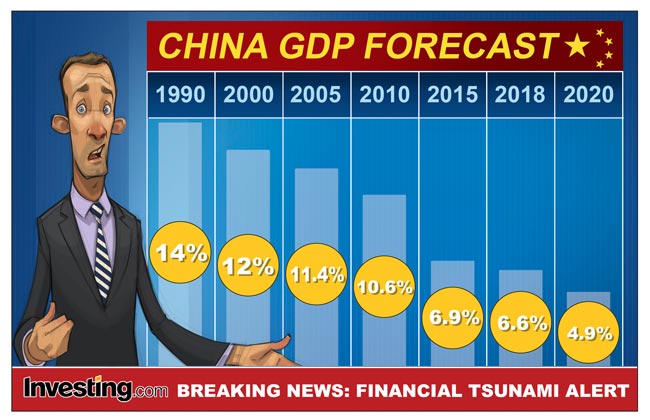

China’s fourth-quarter gross domestic product (GDP) grew at the slowest pace since the global financial crisis, the National Bureau of Statistics said on Monday, easing to on-year.

That pulled full-year growth down to 6.6%, the slowest annual pace , as faltering domestic demand and bruising U.S. tariffs weighed.

Analysts at Capital Economics warned that China’s economic slowdown looks set to be of a similar scale to that in 2015-16, though there are some significant differences so far, most notably less downward pressure on the yuan and no signs of major capital outflows.

“Against a backdrop of various concerns about other economies, weakness in China adds to reasons to expect a marked global slowdown,” they wrote in a note.

Indeed, the International Monetary Fund (IMF) its 2019 global growth forecast on Monday – its second downgrade in just three months – citing a bigger-than-expected slowdown in China and the eurozone.

The IMF added that a failure to resolve trade tensions could further destabilize a slowing global economy.

“Trade tensions are the most dominant factor for investor sentiment right now and will drive market flows,” said Nick Twidale, chief operating officer at Rakuten Securities.

— Reuters contributed to this report

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Investing.com