- China launches options contracts for corn, cotton and rubber

- Biggest commodity consumer trying to attract more hedgers

Three new commodities options contracts are set to start trading in China on Monday as the world’s biggest consumer of raw materials seeks to build confidence in its febrile markets.

The launch of corn, cotton and rubber contracts will double the amount of options listed across China’s three major commodity exchanges. There’s already trading in soybean meal, sugar and copper.

The growing array of derivatives on offer shows how China is trying to lure more hedgers to its exchanges. They have no problem with attracting liquidity — the pace of trading can make other bourses around the world look docile — but it’s largely driven by speculators whose herd mentality can cause exaggerated swings in prices. That can deter the producers and consumers needed for the contracts to be reliable tools for risk management.

“Options contracts are an attempt to attract more hedgers with commercial interests, such as producers, farmers, and manufacturers,” said Jim Huang, chief executive officer of China-data.com.cn, a consultant to the agriculture industry. “Institutional traders are encouraged to be options sellers to take the risks off the hedgers, or apply for options market makers to be liquidity providers.”

The biggest consumer of most of the world’s commodities, China wants more control over how much it pays and is trying to establish its domestic contracts as price benchmarks. It launched oil futures last year, the first Chinese contract to allow foreign participation, and it later opened up iron ore contracts to overseas investors too.

Weaker Penetration

Huang, who worked for more than 10 years at CME Group, coordinating options market maker programs, predicts that the new derivatives will be a “moderate success.”

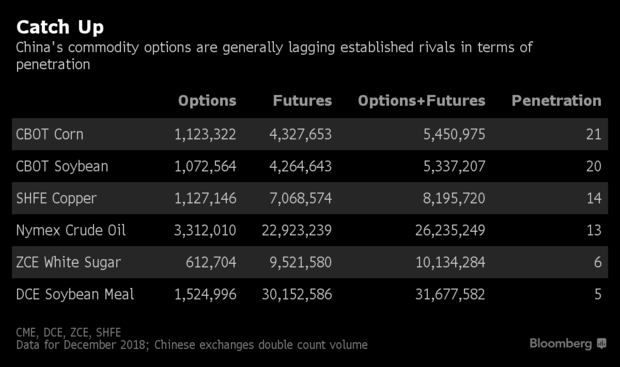

The options already trading in China are a much smaller part of their respective markets than those on established exchanges, such as corn on the Chicago Board of Trade.

Comparing options volume against the that of both options and the underlying futures gives an indication of what Huang calls their “penetration”. On Chinese exchanges it’s about 5 percent for soybean meal and sugar, compared with about 20 percent on for corn and soybeans in Chicago. SHFE copper options were about 14 percent in December.

For the new contracts, trading restrictions and requirements are likely to deter speculators and put the options markets off limit to small time retail traders, he said. Commercial participation in commodities exchanges is also generally low and it will take “many years” of promotion for that to change, he said.

Finally, recent turmoil in stock markets may limit the ability of institutional investors to trade in the new commodities derivatives, he said.

Huge Demand

Still, the Shanghai Futures Exchange says its new rubber options will help enhance the push for more pricing control and that there is a “huge and urgent” demand for risk management. “Natural rubber prices fluctuate sharply and have a high fluctuation level among the listed agricultural futures,” it said in a statement.

Du Hui, an analyst with Brilliant Futures Co. Ltd, said rubber options could be the most active among the three new contracts as investors are lured by volatility in the underlying futures. “The options offer a tool for them to cut hedging costs,” he said. Besides funds, many rubber trading companies are heavily involved in futures trading as well.

Corn options may be less popular because farmers and small trading firms play a large role in the market and they often have no interest in derivatives, said Jiang Boheng, an analyst with Luzheng Futures Co.

But the Dalian Commodity Exchange, where they will be listed, believes they will appeal to everyone. Corn is China’s largest grain crop and recent agricultural reforms have given markets a greater role in deciding prices. As they fluctuate more as a result, there’s a greater need for better risk management tools, it said. The exchange is also planning options for iron ore, palm oil and soybean oil, it said.

Greater swings in cotton futures over recent years will also encourage investors to trade the new options, according to the Zhengzhou Commodity Exchange, where they will be listed. “Options can effectively meet risk management needs of enterprises and further reduce cost of hedging,” it said in a statement on its website.

“Options contracts are a good enhancement to China’s futures markets,” said Huang. “But changes come slowly and the gap between the more advanced U.S. markets and the Chinese markets is still very wide.”

— With assistance by Shuping Niu