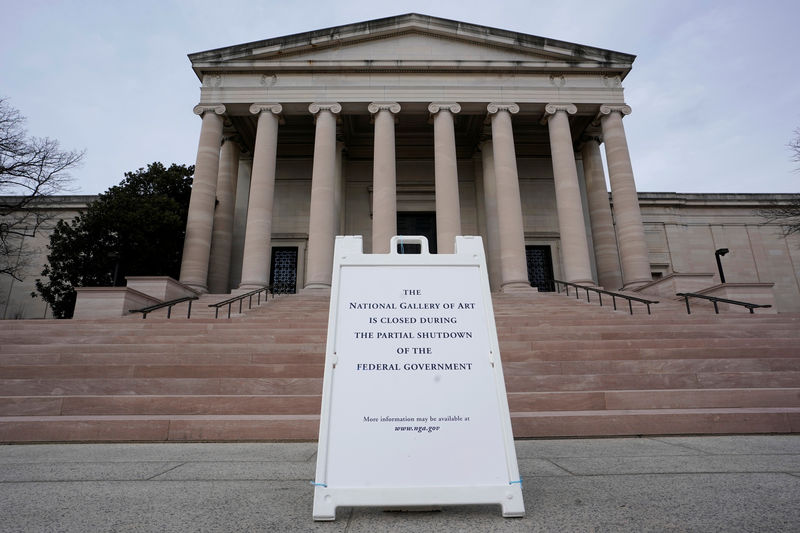

© Reuters. A closing sign is seen outside the National Gallery of Art in Washington

© Reuters. A closing sign is seen outside the National Gallery of Art in WashingtonBy Howard Schneider

WASHINGTON (Reuters) – Slowing global growth and the 35-day partial federal government shutdown weighed on the U.S. economy in the first weeks of 2019, but it continued growing amid still-tight labor markets, the Federal Reserve reported on Wednesday.

“Economic activity continued to expand in late January and February,” even as concerns took root at the U.S. central bank about a possible slowdown, the Fed said in its regular “Beige Book” compendium of anecdotes compiled from industry and business contacts around the country.

The pace of growth was “slight-to-moderate” in 10 of the Fed’s 12 districts, with those in Philadelphia and St. Louis reporting “flat economic conditions.”

Still, the overall tenor of the Beige Book may relieve some of the concerns about growth in the real economy that prompted the Fed to pause its cycle of interest rate hikes in January after a sharp correction in financial markets and other risks began increasing late last year.

Tighter credit conditions were cited as damping consumer spending; concerns about tariffs continued to weigh on the minds of executives and crimp profits as input costs rose more than could be passed along to consumers; and the government shutdown “led to slower economic activity in some sectors” including manufacturing, retail and real estate, across roughly half of the Fed’s districts.

Job and wage gains, however, continued, with the St. Louis district reporting that opportunities for work were so plentiful that college enrollment was dropping “as potential students were increasingly choosing to enter the labor market.”

In the Philadelphia district, business contacts “continued to note that the labor market was very tight … Firms are responding by raising wages, increasing job flexibility, training new hires who have fewer skills than desired, and making greater use of trial periods of temp agency placements.”

The Fed’s policy-setting committee is scheduled to meet in two weeks to make its latest interest rate decision, and is widely expected to leave borrowing costs unchanged, consistent with the “patient” strategy it outlined in January.

PRICE PRESSURES

Inflation will be a key element of any decision about when or if to raise rates again, and the Beige Book reported that prices increased at only a “modest-to-moderate pace” in the period.

But it also hinted at price pressures building in parts of the economy. The Fed’s Cleveland district, for example, outlined an economy where price hikes were being passed among firms, with some feeling they were able to pass them along to consumers, and others not.

“Construction companies passed on strong input cost increases. By contrast, manufacturers’ prices remained more stable … Transportation companies raised prices, but retailers did not raise prices to cover transportation cost increases,” the Fed reported.

Although much about the U.S. economic outlook remained positive, businesses cited continued concern about trade and tariffs and the health of the global economy in general.

Manufacturers in particular “conveyed concerns about weakening global demand, higher costs due to tariffs, and ongoing trade policy uncertainty.” In some areas, including the Philadelphia district, that caused regional growth to grind to a halt.

The economy in that area was reported slowing from “modest growth in the prior period to little or no change in the current period,” the Fed said.

While the impact of the government shutdown is expected to be small on a nationwide basis, it was noticeable in some parts of the country.

The Richmond Fed, whose area includes Washington, said “a sharp decline in tourism was reported by several firms in and around the District of Columbia.”

Source: Investing.com