SINGAPORE (ICIS)–Asia’s ethylene-propylene-diene monomer (EPDM) prices have been falling since October 2018 because of a supply glut and slowing demand, which may not pick up in the near future.

- Regional prices down 16-26% from October 2018

- Deep-sea cargo flows weigh on market

- Demand enters off-peak season

Chinese workers assemble cars at Changan Ford in Harbin city, China.(Source: Imagine China/Shutterstock)

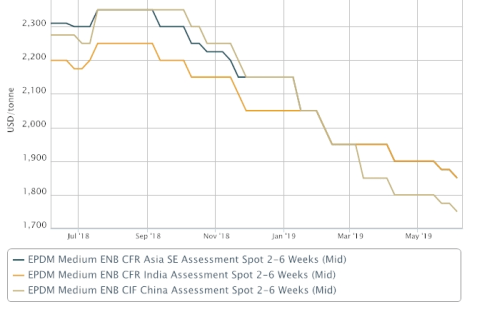

In the key China market, spot EPDM prices in the week ended 5 June to $1,700-1,800/tonne CIF (cost, insurance & freight) China, down by 26% from the beginning of October 2018, according to ICIS.

In southeast Asia and India, prices of the material have shed 16% and 20% over the same period, respectively, to $1,800-1,900/tonne CFR SE (southeast) Asia/CFR India, the data showed.

Spot prices have been falling for eight straight months because of supply glut and weak performance of downstream automotive sectors in China and India.

EPDM is a synthetic rubber used in automotive and construction applications.

“We have to keep reducing prices as buyers are not willing to place orders amid poor demand,” a major supplier said.

Inflow of cheap cargoes from the Middle East following a start-up of a new plant in Saudi Arabia, also exerted downward pressure on the Asian market.

“Middle East producers cut prices in a bid to win … market share, which prompted other producers to follow suit,” a trader said.

Some Middle East cargoes were available at $1,400-1,500/tonne CIF China.

In the meantime, sluggish demand, especially from the automotive sector amid the escalating US-China trade war and the global economic slowdown is weighing on the market.

“Too much supply, so we don’t have to buy a lot. We only purchase minimum volumes to cover our basic requirement,” a downstream buyer in China said.

The weak market fundamentals may not change in the near future as demand has entered the off-peak season, market sources said.

“Demand may remain weak in summer season [June to August], which will not support the EPDM market,” a regional supplier said.

Focus article by Judith Wang