Rubber prices have been on the rise in India, charting a divergent trend vis-à-vis international price movements. But the anomaly could be short-lived, with demand for the commodity expected to take a hit due to the economic slowdown.

Rubber prices on the National Commodity and Derivatives Exchange have increased by 16.4 per cent since the start of 2013. In sharp contrast, prices of rubber have fallen by 24 per cent over the same period on the Singapore Commodity Exchange, one of the hubs for the global rubber trade.

SIGNIFICANT PRICE VARIATION

The differential between prices of rubber at home and abroad is also significant. Rubber was quoting at Rs 19,150 a tonne in India, compared with $253.8 (approximately Rs 15,210) a tonne on the Singapore Commodity Exchange as of July 19.

The uptrend in domestic rubber prices runs contrary to evidence pointing toward a sustained slowdown in the automobile sector, which will have implications for the tyre industry, the major consumer of global rubber production. Automobile sales have been on the wane in India, falling by 4.3 per cent in June.

The tyre industry accounts for about 60 per cent of total demand for rubber, while the remainder finds use in diverse sectors such as construction, health and mining. As such, any fall in vehicle sales will have a corresponding effect on tyre production, and consequently, on rubber demand.

While reduced demand for rubber in China, the world’s largest tyre manufacturer, has put a damper on global rubber prices, domestic rubber prices have been pushed up by supply side issues in the form of hoarding by producers.

LITTLE IMPACT

International price movements do not seem to have much influence on rubber rates in India. On the other hand, stockists and speculators have a significant role in determining the prices.

“This kind of supply crunch, when internationally rubber prices are falling, has not been witnessed for a long time. We understand from the trade that due to the daily escalating prices, growers are possibly holding the stocks, leading to non-availability and further increase in prices,” All-India Rubber Industries Association President Niraj Thakkar recently told Business Line.

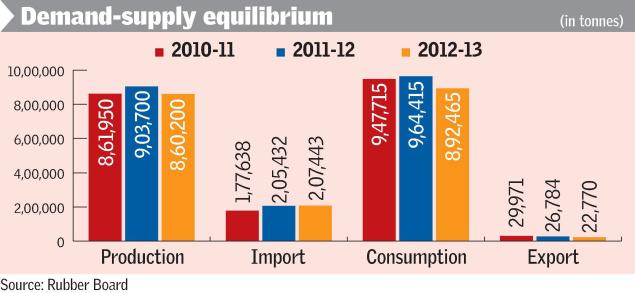

Reports also indicate that India’s natural rubber imports in 2013-14 are likely to dip by 25 per cent, the first drop in five years. This is the outcome of not only a slowdown in the automobile industry, but a proposed hike in import duties.

But it is unlikely that the vast differential between domestic and international rubber prices will persist indefinitely. A build-up of stocks at the producers’ end will eventually compel them to release their goods in the market, which will result in significant and rapid cooling down of rubber prices in India.

Rubber is a polymer produced from latex or field coagulum obtained from rubber trees. Thailand, Indonesia, Malaysia, India, Vietnam, China, Sri Lanka, the Philippines and Cambodia account for about 93 per cent of the global supply and 57 per cent of global demand for natural rubber.

Source: Business Line