Tightening stimulus, soaring energy costs and falling consumer confidence weigh on markets

US debt ceiling negotiations at standstill

Bitcoin recovered after two days of declines

Key Events

US futures and European shares reversed some of the damage from Tuesday’s Wall Street session collapse on Wednesday, ahead of the New York market open. Contracts on the Dow, S&P, NASDAQ and Russell 2000 all rallied strongly while Treasury yields declined, slowing the dollar’s advance and gold’s slide lower.

Global Financial Affairs

All four futures contracts on the major US benchmarks gained this morning. Dow futures were up the least, just 0.6%, while NASDAQ 100 futures outperformed, rebounding 1%.

Today’s performance of contracts on the indices ahead of the US open is the opposite of yesterday’s activity during the US session, when the Dow declined 1.6%, compared to the 2.8% slump in the NASDAQ.

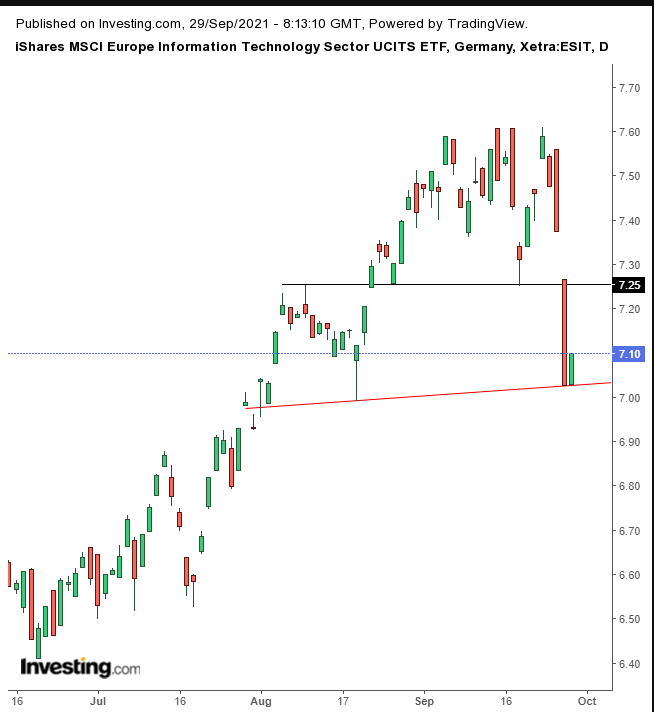

The European tech sector also rallied after a three-day selloff. Nevertheless, the iShares MSCI Europe Information Technology Sector UCITS ETF (DE:ESIT) may have already topped out.

ESIT Daily

ESIT Daily

If the ETF rebounds to 7.25 it will complete a H&S top.

In Asia, most benchmarks were in the red, keeping them on course for the worst quarterly performance since COVID-19 hit the market in 2020. Investors dumped assets denominated in Asian currency in order to buy US Treasuries, notwithstanding the risks in play as US lawmakers seem unable to move forward on raising the country’s debt ceiling.

If Congress fails to push the debt limit higher, parts of the US government will have to be shut down. But the real, even if unlikely, danger is that America will default on its debt requirements. This could cause a catastrophic shock with unknown potential fallout.

Earlier, Japan’s Nikkei 225 was hit the hardest, shedding more than 2% of its value, as investors monitored the voting in the ruling Liberal Democratic Party’s presidential election.

There are multitude of culprits one can point to in order to explain why yesterday a global rally turned into the worst selloff in months. Among the headwinds are a concerted effort by central banks worldwide to start withdrawing emergency stimulus that was handed out during the coronavirus pandemic, even as energy costs across the globe soar.

At the same time the American consumer’s confidence declined in September for the third month in a row, as prices continue to increase due to COVID-related supply chain disruptions. Also, ongoing fears persist regarding the still-unresolved debt crisis at China-based Evergrande (HK:3333) (OTC:EGRNY). Markets are worried the situation could be just the first signs of serious problems in that country’s real estate sector and possibly other market segments there which could cause a global selloff similar to the 2008 crash after the collapse of Lehman Brothers in the US.

Stocks on Wall Street suffered their worst rout since May yesterday as Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen both warned in a Senate hearing that a failure to resolve the debt-ceiling impasse could have devastating results. On the same day, the Republicans blocked Democrats from raising the debt limit, a mere three weeks before the Treasury could run out of funds to avert a federal payments default.

The S&P 500 led the selloff driven by cyclical stocks. That sector stands to lose the most in an economic contraction. Ironically, it was the NASDAQ 100—the quintessential growth stock index which should have enjoyed the reflationary fall out—that underperformed, dropping the most since March.

NASDAQ 100 Daily

NASDAQ 100 Daily

The tech index fell below its rising channel.

Today’s rebound in US futures and European shares comes as the rally in 10-year Treasuries eased. Falling yields allayed concerns about valuations, as higher rates reduce the present value of equity cash flow.

10-year Treasuries Daily

10-year Treasuries Daily

Yields dropped for the first time in six days, after completing an ascending triangle.

The dollar gave up session highs but was still boosted to its highest level since November.

Dollar Index Daily

Dollar Index Daily

The greenback may have blown out a H&S top, while completing a larger double-bottom.

Surprisingly, gold retained its value, despite a strengthening dollar, as investors rotated into safe havens.

Gold Daily

Gold Daily

Note, the yellow metal could still complete a H&S bottom.

Bitcoin rose for the first time in three days.

Bitcoin Daily

Bitcoin Daily

The cryptocurrency is filling out a bearish pennant, after completing a H&S top.

A surprise jump in US stockpiles pushed the oil price lower but it remains at a critical technical juncture.

Oil Daily

Oil Daily

The price fell after developing a High Wave Candle on Monday, below the July high. If it continues higher, that will trigger a long-term uptrend.

Up Ahead

On Thursday, China releases Caixin Manufacturing PMI.

US Initial Jobless Claims are released on Thursday.

ISM Manufacturing PMI is published on Friday.

Market Moves

Stocks

The STOXX 600 rose 1% as of 8:29 a.m. London time

Futures on the S&P 500 rose 0.8%

Futures on the NASDAQ 100 rose 1%

Futures on the Dow Jones Industrial Average rose 0.6%

The MSCI Asia Pacific Index fell 1.2%

The MSCI Emerging Markets Index fell 0.8%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.1% to $1.1667

The Japanese yen rose 0.2% to 111.32 per dollar

The offshore yuan was little changed at 6.4684 per dollar

The British pound was unchanged at $1.3537

Bonds

The yield on 10-year Treasuries declined three basis points to 1.51%

Germany’s 10-year yield was little changed at -0.21%

Britain’s 10-year yield declined two basis points to 0.97%

Commodities

Brent crude fell 1.9% to $77.62 a barrel

Spot gold rose 0.3% to $1,739.94 an ounce

Source: Investing.com