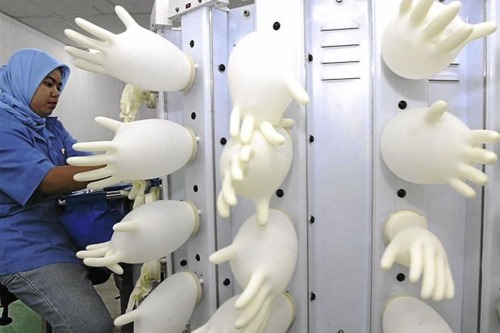

PETALING JAYA: Rubber glove manufacturers gained some investor interest despite the lacklustre half-day trading session.

Counters which saw some movement included Supermax Corp Bhd, which gained two sen to RM2.30. Top Glove Corp rose eight sen to RM6.08, Hartalega Holdings Bhd was up six sen to RM6.85 and Kossan Resources Industries Bhd added six sen to RM6.04.

Investors, both long- and short-term, were taking immediate cues from Hartalega’s latest first quarter net profit which rose 17.8% to RM62.9mil from a year ago.

The profit growth had been bolstered by several factors that were deemed bottomline positive to all companies involved in the industry such as a weakened ringgit versus the greenback and lower raw material prices.

The ringgit, which last traded at 3.255 to the US dollar, had weakened 9.85% from the strongest level in the year-to-date period recorded on May 8.

A weaker currency boosts exporters such as rubber glove manufacturers.

Main cost components natural latex had also seen their prices declining 15.37% in the year-to-date period to RM512 per kg on the Malaysian Centrifuged Latex Contract Board as seen on the Bloomberg terminal.

Analysts said interest in these counters may be sustained once more as results from such compannies are announced, noting certain favourites among the four counters such as Hartalega’s nitrile glove capacity and Top Glove’s ongoing efforts to automate its factories while increasing the efficiency of its workforce.

Maybank Investment Bank Bhd analyst Lee Yen Ling has rated Hartalega a hold with a raised target price of RM6.71 with the company’s dominant position in the nitrile segment justifying premium valuations at this juncture.

Affin Investment Bank Bhd analyst Mandy Teh said in a report that Top Glove’s nitrile glove sales are improving, comprising 18% of the group’s overall sales volume and that the company is aggressively expanding its market share in the nitrile gloves segment. She rated Top Glove an “add with” a target price of RM7.

Source: thestar.com.my