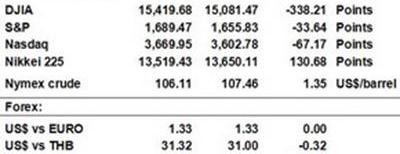

Shanghai and Tokyo rubber futures ended higher on Friday compared with an earlier Friday. The two bellwether rubber futures in Asia were mainly buoyed by positive industrial output figures of China released late an earlier week, a weak yen against the greenback and high oil futures during the week. That lent support for physical rubber markets in the region to follow suit even though most of global stock markets stayed in a downward trend except for European stock markets.

At this juncture, investors are still concerned about a possible slowdown in bond buying by the U.S. Federal Reserve (Fed) that is likely to start this September. Actually, U.S. financial tapering indicates a sign of U.S. economic improvements. It is expected that if the U.S. Fed starts tapering this September and investors adjust themselves to this global economic change, global economies will steadily improve for the rest of this year.

Back to rubber market fundamentals, demand for tires in developed countries has picked up, according to the Rubber Bulletin, July 2013, reported by LMC International. India’s natural rubber (NR) imports jumped 39.2% in July from a year earlier to 29,311 tons as domestic output fell due to heavy rainfall, according to Reuters Newswires on Monday. China’s NR imports rose 13.7% to 1.32 million tons year on year in the first seven months, released by the General Administration of Customs on 9 August, while China’s rubber inventories have fallen about 20% since record high levels in April, said Dow Jones Newswires on Friday.

In addition, IRCo’s technical indicators also showed that investors on rubber markets in the region have turned onto long positions as NR demand is improving while NR supply in producing countries remains steady. And this situation is expected to continue in the coming weeks amid some profit-taking during the period.

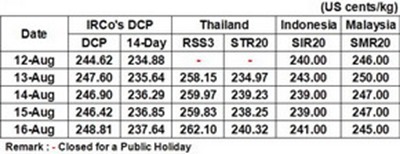

Source: IRCo