The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index closed 229 points higher on Thursday as late-session profit-taking trimmed some intra-day gains.

The KSE-100 started the session with a strong buying spree, hitting an intra-high of 78,709.14.

However, profit-taking in the second half provided the bears some relief but could not bring the index back below 78,000.

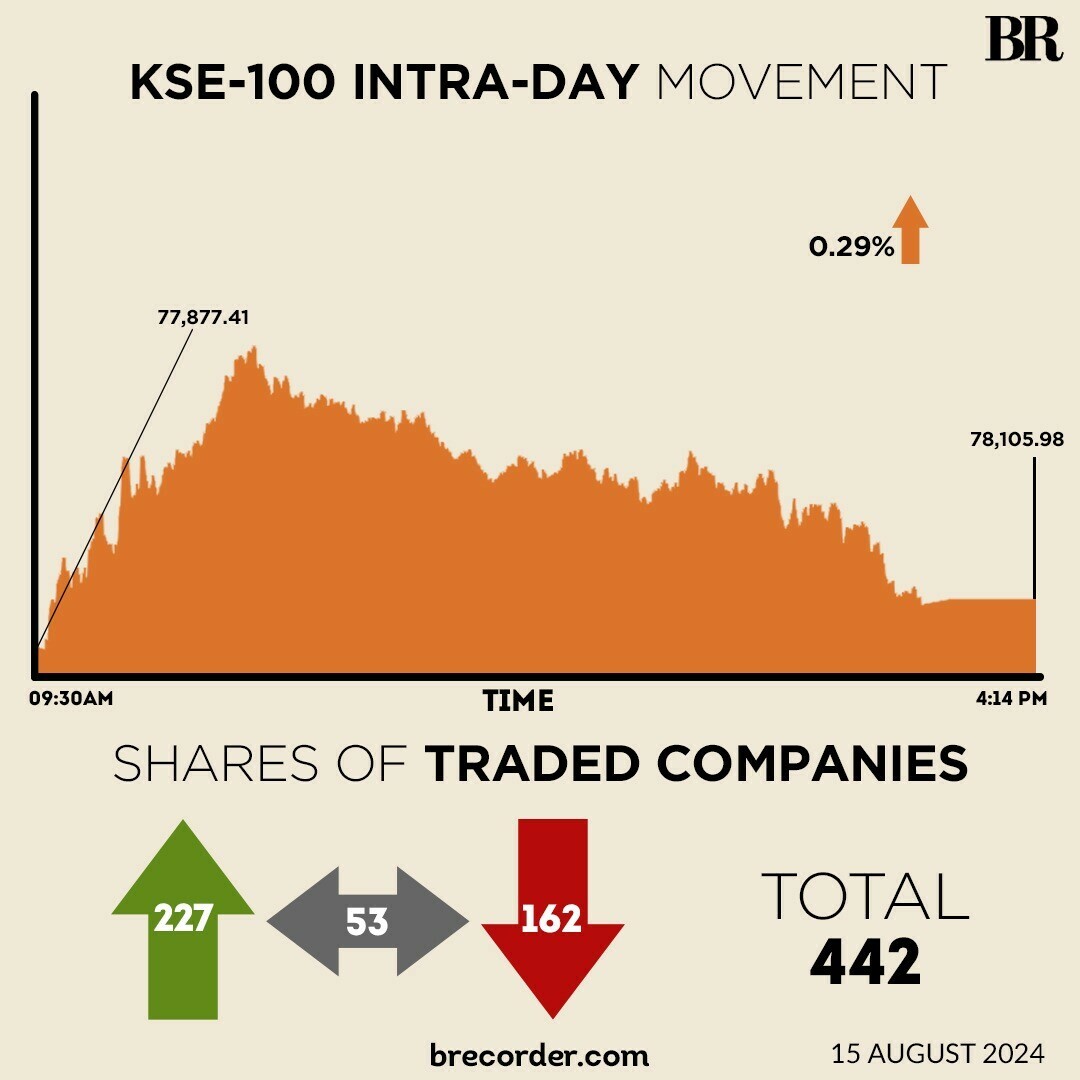

At close, the benchmark index settled at 78,105.98, up by 228.56 points or 0.29%.

The fertiliser, exploration and production (E&P), IT, and banking sectors saw significant contributions from FFC, POL, MCB, SYS, and MEBL, which together accounted for 253 points, brokerage house Topline Securities said in its post-market report.

Experts remain optimistic that the International Monetary Fund (IMF) Executive Board will approve Pakistan’s $7 billion Extended Fund Facility (EFF) in the coming days.

Last month, IMF reached a staff level agreement (SLA) with Pakistan for a $7-billion, 37-month loan programme aimed at cementing stability and inclusive growth.

On Tuesday, PSX’s benchmark index endured a range-bound session as it faced both bullish and bearish pressures before closing marginally in the red. The KSE-100 had settled at 77,877.42, down by 102.87 points or 0.13%.

The stock market was closed on Wednesday due to the Independence Day holiday.

Globally, Asian stocks were firm on Thursday while the dollar remained on the back foot amid lower US Treasury yields after benign consumer inflation data overnight reinforced bets for the Federal Reserve to start cutting interest rates next month.

Regional equities took their lead from gains on Wall Street, with Japan’s Nikkei rising 0.5% as of 0139 GMT and Australia’s stock benchmark up 0.1%.

Mainland Chinese blue chips added 0.4%, although Hong Kong’s Hang Seng slipped 0.3%.

Traders remain convinced that the Fed will reduce rates on Sept. 18 for the first time in 4-1/2 years, but are split on whether policy makers will opt for a super-sized 50 basis-point reduction.

Volume on the all-share index decreased to 591.06 million from 604.147 million a session ago.

However, the value of shares increased to Rs20.10 billion from Rs19.98 billion in the previous session.

Kohinoor Spinning was the volume leader with 91.02 million shares, followed by Yousuf Weaving with 65.31 million shares, and WorldCall Telecom with 60.62 million shares.

Shares of 442 companies were traded on Thursday, of which 227 registered an increase, 162 recorded a fall, while 53 remained unchanged.

Source: Brecorder