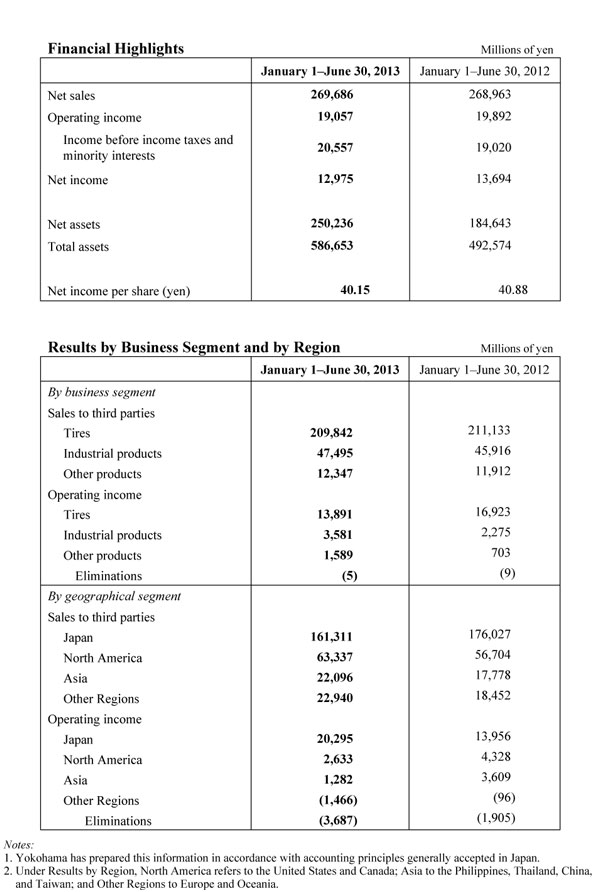

Tokyo – The Yokohama Rubber Co., Ltd., announced today that its net sales reached a record high in the first half of 2013. Net sales edged up 0.3% over the same period of the previous year, to 269.7 billion yen. Operating income declined 4.2%, to 19.1 billion yen, and net income was down 5.3%, to 13.0 billion yen.

Sales and earnings benefited overall from progress at Yokohama in trimming costs and from the weakening of the yen, and earnings benefited further from declining prices for raw materials. Yokohama recorded growth in sales and earnings its industrial products operations and other operations. Outweighing the positive earnings factors were a sharp decline in demand for original equipment tires in Japan, generally weak demand in overseas tire markets, and escalating price competition in tire markets worldwide.

In Yokohama’s tire operations, sales declined 0.6% from the same period of the previous year, to 209.8 billion yen, and operating income declined 17.9%, to 13.9 billion yen. The slackening demand for original equipment tires in Japan reflected the end of government incentives for purchases of fuel-efficient vehicles and Japanese automakers’ ongoing shift of production overseas. Yokohama achieved unit sales growth in Japan’s replacement tire market, led by gains in fuel-saving tires, but a market shift toward lower-priced tires and escalating price competition diminished the yen value of sales. Overseas, tire demand slumped in Europe and in China, and sales were weak in North America.

Sales increased 3.4% over the same period of the previous year, to 47.5 billion yen, in Yokohama’s industrial products operations, which consist mainly of high-pressure hoses, sealants and adhesives, conveyor belts, anti-seismic products, marine hoses, and marine fenders, and operating income increased 57.4%, to 3.6 billion yen. Contributing to the business growth were strong sales gains in automotive hoses in North America and sales gains in marine fenders, in marine hoses, and in conveyor belts.

Yokohama’s sales increased 3.7% over the same period of the previous year, to 12.3 billion yen, in other products, which consist mainly of aircraft fixtures and components and golf equipment, and operating income increased 126.1%, to 1.6 billion yen. In aircraft fixtures and components, sales were strong in lavatory modules for commercial aircraft. Business was weak overall in golf equipment, though Japanese demand showed signs of recovery and sales were brisk for Yokohama’s new iD nabla RED golf clubs.

For the full year, Yokohama has revised downward the 630 billion yen sales projection that it issued in February 2013, to 610 billion yen. That would be an increase of 9.0% over the previous year. The company retains the February projections of 59 billion yen for operating income, an increase of 18.7%, and 36 billion yen for net income, an increase of 10.4%. Yokohama has announced an interim dividend of 10 yen per share, and management has proposed a year-end dividend of 12 yen per share, which would bring the full-year dividend to 22 yen per share.

Source: .yrc-pressroom.jp