Market Review

Market Review

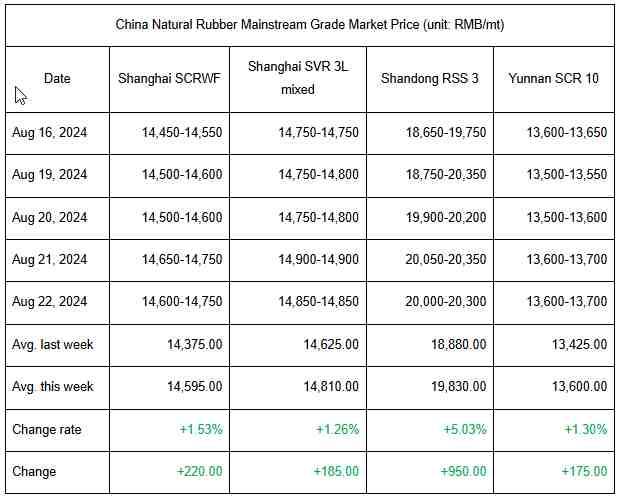

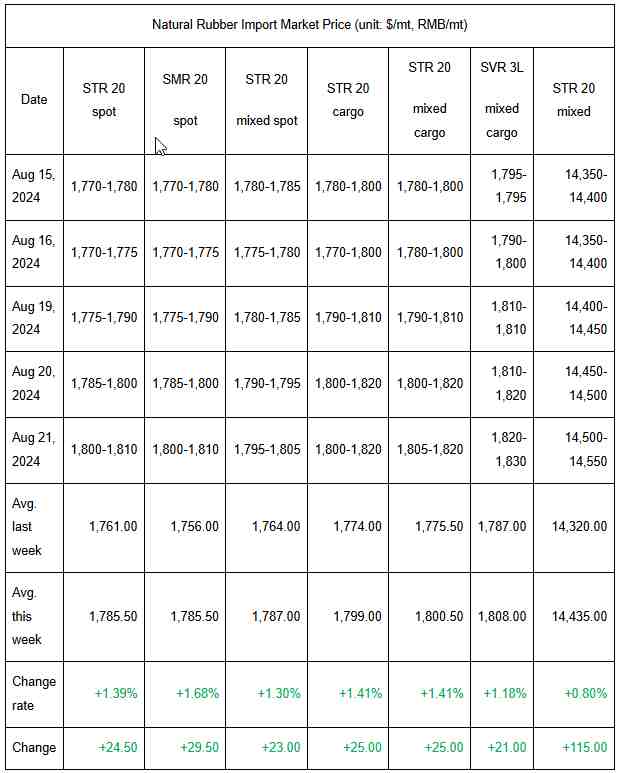

Prices of RMB-denominated natural rubber spot resources headed up this week. Within this week, prices of Shanghai natural rubber futures first climbed and then moved sideways. Thus, the overall spot price of natural rubber went up, in tandem with rising futures prices. At present, China’s natural rubber market still experiences a supply-demand imbalance. In terms of supply, the output release of new field latex fell short of expectations in China’s producing areas. Besides, the spot circulation remained tight in the domestic natural rubber market. Bolstered by those factors, China’s natural rubber market gained ground. In terms of demand, the operating rate at tire enterprises recovered gradually. Yet, curbed by high cost, tire enterprises showed thin buying appetites and mainly purchased spots for rigid demand. Therefore, the overall trading atmosphere remained insipid in China’s natural rubber market.

Market Forecast

Forecast: China’s natural rubber market will possibly fluctuate at highs next week. In the short run, the market price of natural rubber may continue to be bolstered. In terms of supply, the output release of new field latex may be sluggish. Thus, the cost of natural rubber is likely to remain firm. Meanwhile, some spot resources are likely to be tight, bolstering the natural rubber price. However, as seen from demand, the inventory of all-steel tire may pile up, and end demand may underperform. Thus, the operating rate at all-steel tire enterprises may level up limitedly. What’s more, high costs may subdue downstream appetites for purchasing feedstock. Therefore, the demand may fail to underpin the natural rubber price. On the whole, the natural rubber price is likely to remain at highs in the short term. It is estimated that the weekly average price of SCRWF in Shanghai may be RMB 14,700/mt, and its mainstream prices may be in the range of RMB 14,500-15,000/mt. Players should pay attention to influences of commodity co-movement from the external macro environment as well as weather and leaf cast disease in Yunnan producing areas.

Supply: In the short run, China’s and overseas producing areas will be affected by rainfalls. Thus, the output release of new field latex may fall short of expectations. The feedstock price is likely to stay firm. High cost may support the natural rubber price.

Demand: Downstream all-steel tire production may resume gradually. However, high inventory pressure and slack end demand may drag down the operating rate of the all-steel tire industry. Meanwhile, high costs may curb downstream purchasing appetites. Thus, the demand may lend limited support to the natural rubber price.