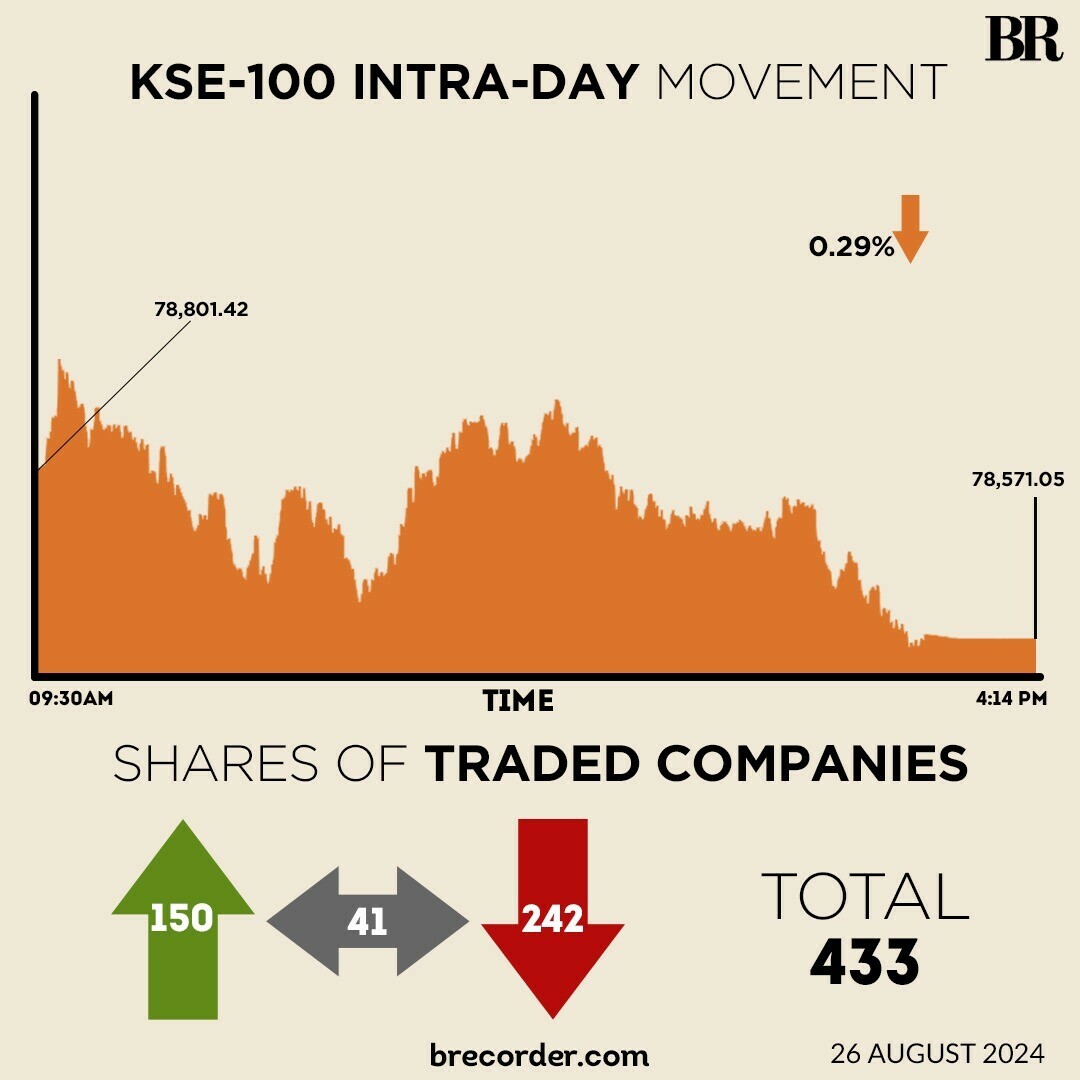

The Pakistan Stock Exchange (PSX) endured a volatile session on Monday as its benchmark KSE-100 Index swayed in both directions before closing the day lower by 230 points.

The KSE-100 started the session positive, hitting an intra-day high of 79,160.40.

However, the bears managed to push the index back every time it crossed 79,000 in today’s session.

At close, the benchmark index settled at 78,571.06, down by 230.37 points or 0.29%.

“The equity market closed on a negative note today. The benchmark index remained volatile throughout the session,” brokerage house Ismail Iqbal Securities said in its post-market report.

On Friday, the PSX saw a roller-coaster trading session and the KSE-100 closed flat after a volatile ride.

In a key development, Hub Power Holdings Limited (HPHL) has entered into a joint venture agreement with a mining company Ark Metals (Private) Limited for exploration and development of mineral mines in Pakistan.

The development was shared by HUBCO, the parent company of HPHL and a strong player in Pakistan’s energy sector, in a notice to the PSX on Monday.

Hub Power Company Limited (HUBCO), Pakistan’s largest Independent Power Producer (IPP), saw its profit increase by over 21% to Rs75.29 billion in fiscal year 2023-24 that ended June 30.

On a consolidated basis, the company registered a profit of Rs62 billion in the same period of the previous year, according to a notice sent to the bourse.

Shell Pakistan Limited (SPL), a subsidiary of Shell Petroleum Company Limited, announced a profit of Rs1.13 billion in the three-month period that ended June 30, 2024.

The results of the April-June quarter released on Monday are a far cry from a profit of Rs8.3 billion it reported in the same period of the previous year, a year-on-year decline of over 86%.

Globally, Eurozone stock markets diverged in opening deals on Monday after US Federal Reserve chief Jerome Powell declared last week that the central bank was ready to cut interest rates.

The Paris CAC 40 was up 0.2 percent at 7,589.50 points while the Frankfurt DAX was down 0.3 percent at 18,578.25 points.

The London FTSE 100 index was closed for a holiday.

Mainland China stocks inched lower on Monday, dragged down by property shares, while Hong Kong tracked regional peers higher following Federal Reserve Chair Jerome Powell’s dovish pivot suggesting an imminent rate cut in the world’s largest economy.

Meanwhile, the Pakistani rupee registered slight improvement against the US dollar, appreciating 0.03% in the inter-bank market on Monday. At close, the currency settled at 278.42, a gain of Re0.08 against the US dollar.

Volume on the all-share index decreased to 512.34 million from 682.41 million on Friday.

The value of shares marginally increased to Rs18.89 billion from Rs18.17 billion in the previous session.

Symmetry Group Ltd was the volume leader with 59.37 million shares, followed by Kohinoor Spinning with 50.62 million shares, and WorldCall Telecom with 24.44 million shares.

Shares of 433 companies were traded on Monday, of which 150 registered an increase, 242 recorded a fall, while 41 remained unchanged.

Source: Brecorder