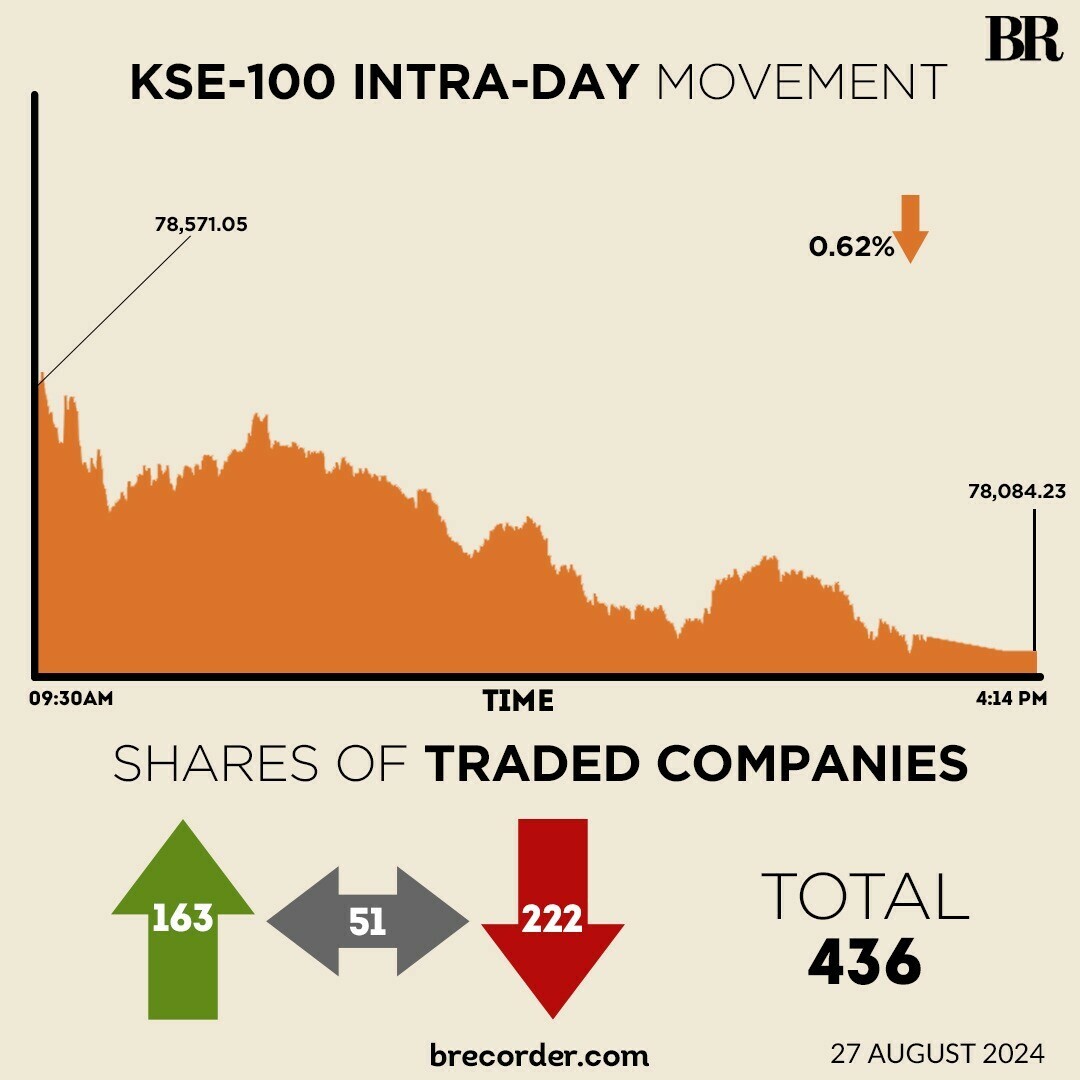

The Pakistan Stock Exchange (PSX) witnessed a bearish session for the second consecutive day on Tuesday, as its benchmark KSE-100 Index closed lower by 487 points despite a positive start.

The KSE-100 started the session positive, hitting an intra-day high of 78,857.62.

However, the bears again dominated the market, especially in the second half.

At close, the benchmark index settled at 78,084.24, down by 486.82 points or 0.62%.

“The equity market ended on a negative note today, due to the delay in the board’s approval of the $7 billion IMF loan programme. The IMF Executive Board’s schedule up to September 4 did not include Pakistan,” brokerage house Ismail Iqbal Securities said.

The decline was influenced by movements in the fertilizer, auto, and power sectors, with FFC, ENGRO, MTL, HUBC, and EFERT contributing to 281 points to the drop, Topline Securities said in its post-market report.

On Monday, the PSX had also endured a volatile session as the KSE-100 swayed in both directions before closing the day lower by 230 points.

In a key development, State Bank of Pakistan (SBP) Governor Jameel Ahmad on Tuesday said Islamabad was looking to raise up to $4 billion from Middle Eastern commercial banks by the next fiscal year (FY26).

Pakistan is also in the “advanced stages” of securing $2 billion in additional external financing required for International Monetary Fund (IMF) approval of the $7-billion bailout programme, according to SBP governor.

In its notice to the PSX, Pakistan State Oil Company Limited’s (PSO) posted a profit-after-tax (PAT) of Rs19.65 billion in the year June 30, 2024, which is double than the PSO’s profit last year.

In the same period of the previous year, the country’s largest oil marketing company (OMC) saw a PAT of Rs9.82 billion.

In another notice, JS Bank Limited (JSBL) posted massive earnings of Rs5.5 billion during the quarter ending June 30, 2024, up over 678% from the profit-after-tax of Rs708.2 million in same period last year.

Standard Chartered Bank (Pakistan) Limited (SCBPL), a subsidiary of Standard Chartered Plc, posted earnings of Rs10.24 billion in the three months that ended June 30, 2024, up nearly 7% from the profit-after-tax Rs9.59 billion recorded in the same period of the preceding year.

Meanwhile, Bawany Air Products Limited (BAPL) said on Tuesday it would raise Rs6 billion through a rights issue of nearly 600 million shares at a price of Rs10 per share.

The listed company, which at the time of the announcement was classified as a defaulter, shared the development in a notice to the PSX.

“The company shall issue 599,999,732 ordinary shares, at par that is at a price of Rs10 per share, aggregating to Rs5,999,997,320,” read the notice.

Globally, Asian stocks fell on Tuesday as investors pondered looming US interest rate cuts and awaited earnings from AI darling Nvidia, while rising tensions in the Middle East and supply concerns checked risk sentiment and lifted oil prices.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.36% lower on Tuesday, inching away from the one-month high it touched in the previous session.

Japan’s Nikkei eased 0.16%, while Chinese stocks were also on the back foot.

China’s blue stock index CSI300 fell 0.28% while Hong Kong’s Hang Seng index was 1% lower in early trading, dragged by lacklustre earnings from Temu-parent PDD Holdings due to lower consumer spending.

Meanwhile, the Pakistani rupee registered slight improvement against the US dollar, appreciating 0.03% in the inter-bank market on Tuesday. At close, the currency settled at 278.32, a gain of Re0.10 against the US dollar.

Volume on the all-share index increased to 591.51 million from 512.34 million on Monday.

The value of shares decreased to Rs17.12 billion from Rs18.89 billion in the previous session.

Kohinoor Spinning was the volume leader with 74.33 million shares, followed by WorldCall Telecom with 47.38 million shares, and Cnergyico PK with 43.91 million shares.

Shares of 436 companies were traded on Tuesday, of which 163 registered an increase, 222 recorded a fall, while 51 remained unchanged.

Source: Brecorder