After three consecutive negative sessions, positivity returned to the Pakistan Stock Exchange (PSX) as the benchmark KSE-100 Index closed higher by 357 points on Thursday.

The KSE-100 started the session with a buying spree that largely continued till the end.

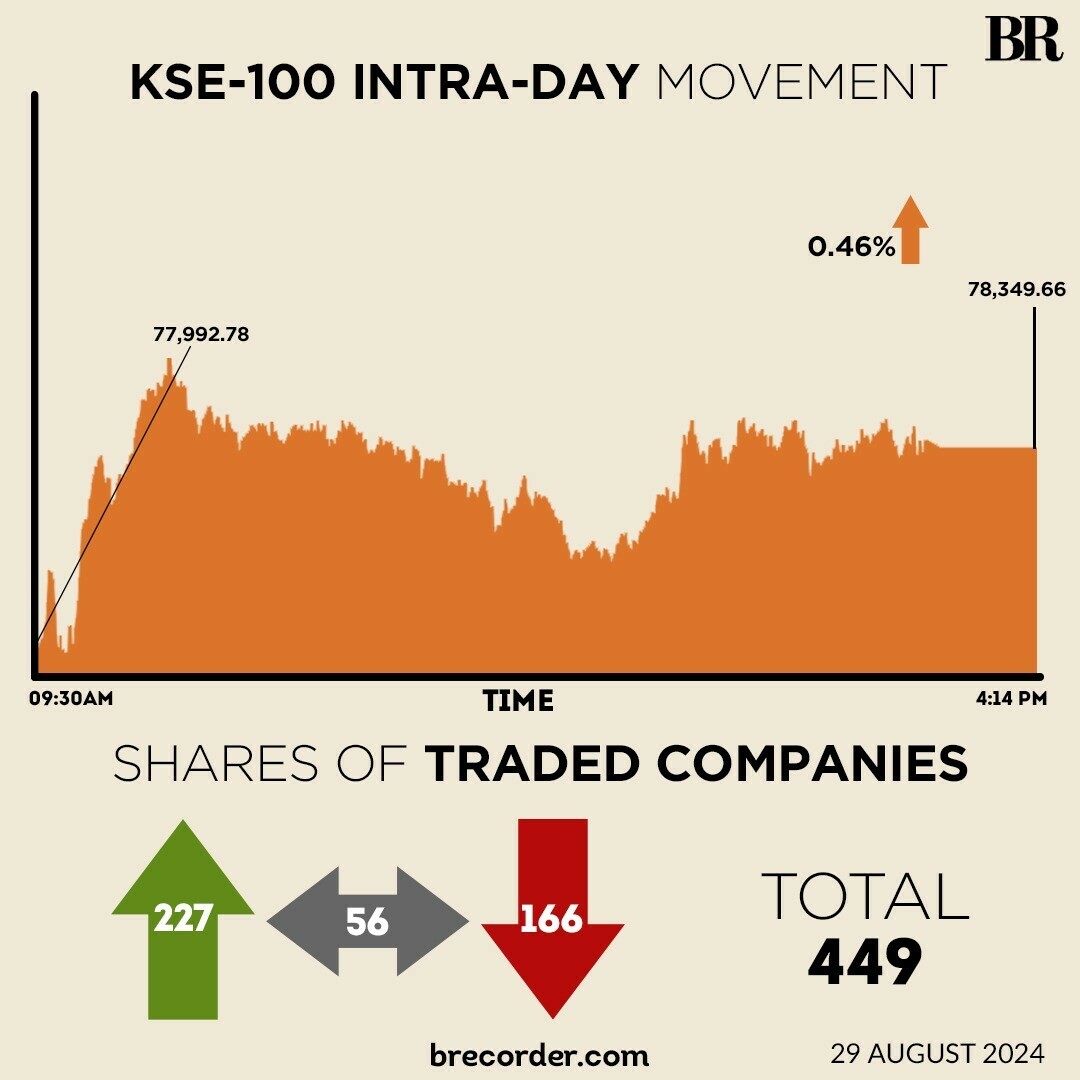

At close, the benchmark index settled at 78,349.66, up by 356.88 points or 0.46%.

“The index exhibited notable volatility, reaching a peak of 78,514 and dipping to 78,017 points during the session,” brokerage house Topline Securities said in its post-market report.

The rally was fuelled by significant gains in heavyweights such as MTL, ENGRO, NBP, COLG, and HUBC, contributing to a substantial 427 points increase, it added.

On Wednesday, the KSE-100 closed marginally lower by 91 points as the index failed to sustain intra-day gains amid lack of positive triggers.

In the previous three sessions, the KSE-100 lost more than 800 points as investors have looked for fresh positive triggers such as approval for a $7 billion bailout programme from the Executive Board of the International Monetary Fund (IMF).

Another brokerage house Ismail Iqbal Securities said the equity market ended on a positive note on Thursday.

“However, investors are still looking for a significant catalyst, particularly positive news from the IMF front,” it said.

In its notice to the PSX, Fauji Foundation, one of the largest conglomerate in Pakistan, expressed its intention to acquire shares and controlling stake in Agha Steels Industries Limited (AGHA).

“The company has received a notice of public announcement of intention (PAI) from potential acquirer i.e., Fauji Foundation, wherein the potential acquirer has expressed its intention to acquire shares and control of the Company,” AGHA said in its notice.

The National Bank of Pakistan (NBP), one of the country’s largest commercial banks, registered a massive consolidated loss to the tune of Rs8.98 billion during the quarter ended June 30, 2024.

The bank had registered a profit after tax of Rs15.85 billion in the same period of the preceding year.

As per a notice sent to the Pakistan Stock Exchange (PSX) on Thursday, NBP’s loss per share (LPS) stood in at Rs4.28 in 2QCY24, as compared to earnings per share (EPS) of Rs7.42 in same period last year.

Meanwhile, the Board of Directors (BoD) of the PSX announced the appointment of Nadeem Naqvi, a Shareholder Director, as the interim Chief Executive Officer (CEO) of the company.

Globally, Asian shares followed Wall Street futures lower on Thursday as Nvidia’s results disappointed some bullish investors, while the dollar steadied and the Treasury yield curve came within a whisker of turning positive.

Investors now await U.S. weekly jobless claims, which have gained prominence given the Federal Reserve’s focus on the health of the labour market, as well as inflation readings from Germany and Spain, for clues on rate-cut prospects beyond September.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.6% as tech stocks dragged. The Nikkei eased 0.4% while South Korea dropped 0.7%.

The Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.07% in the inter-bank market on Thursday. At close, the currency settled at 278.64, a loss of Re0.19 against the US dollar.

Volume on the all-share index decreased to 599.82 million from 636.02 million on Tuesday.

However, the value of shares jumped to Rs20.41 billion from Rs16.27 billion in the previous session.

Symmetry Group Ltd was the volume leader with 64.3 million shares, followed by National BankXD with 42.6 million shares, and Kohinoor Spinning with 41.14 million shares.

Shares of 449 companies were traded on Thursday, of which 227 registered an increase, 166 recorded a fall, while 56 remained unchanged.

Source: Brecorder