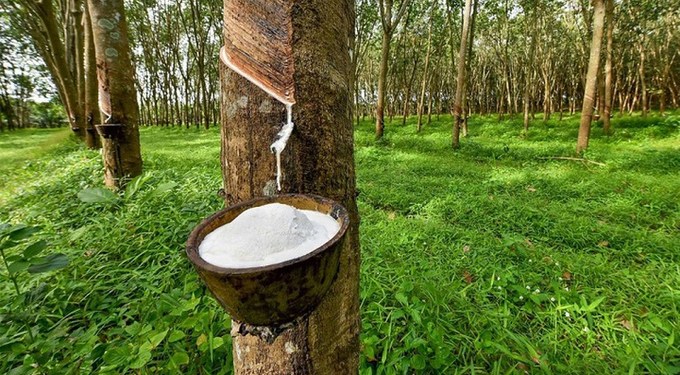

From the beginning of August, raw rubber latex prices in provinces and cities have not fluctuated much. At some rubber companies, the purchase price of raw rubber latex remains around VND 345-390 per TSC.

In July 2024, Vietnam’s rubber exports reached 186.03 thousand tons.

According to the Import-Export Department, Ministry of Industry and Trade, raw rubber prices have not fluctuated much. Specifically, Phu Rieng Rubber Company reported a purchase price of VND 345-390 per TSC. Ba Ria Rubber Company reported a purchase price of VND 375-385 per TSC. Mang Yang Rubber Company reported a purchase price of VND 367-372 per TSC, stable compared to the end of July 2024.

The Association of Natural Rubber Producing Countries (ANRPC) has adjusted its forecast for global rubber demand up to 15.74 million tons; at the same time, it has adjusted its forecast for global natural rubber supply down for the whole year to 14.50 million tons. This will cause a shortage of up to 1.24 million tons of natural rubber in the global market this year.

According to statistics from the General Department of Vietnam Customs, in July 2024, Vietnam’s rubber exports reached 186.03 thousand tons, worth USD 307.91 million, up 21.2% in volume and 24.7% in value compared to June 2024. Compared to July 2023, it still decreased by 15.3% in volume, but increased by 7.3% in value. This is the fourth consecutive month that rubber exports have decreased compared to the same period in 2023.

In the first 7 months of 2024, Vietnam’s rubber exports reached 912.72 thousand tons, worth over USD 1.41 billion, down 7.5% in volume but up 5.9% in value compared to the same period in 2023. Regarding export prices: In July 2024, the average export price of rubber reached USD 1,655 per ton, up 2.9% compared to June 2024 and 26.8% compared to July 2023.

In July 2024, China remained Vietnam’s largest rubber export market, accounting for 68.62% of the country’s total rubber exports, reaching 127.66 thousand tons, worth USD 206.73 million, up 17.4% in volume and 21.5% in value compared to June 2024.

By the end of July 2024, Vietnam exported 617.03 thousand tons of rubber to China, worth USD 924.63 million, down 18.6% in volume and 8.2% in value compared to the same period in 2023.

Notably, in July 2024, rubber exports to some markets grew well compared to July 2023, such as: Russia, the United States, Malaysia, Sri Lanka, Brazil, Japan, Bangladesh, France, Germany…

In the context of the export market, which has many positive and negative factors intertwined, if the market does not experience major fluctuations in the last months of the year, rubber exports will hardly increase sharply compared to 2023. However, with India expected to increase rubber imports due to a lack of domestic supply, world rubber prices are expected to continue to be high, thereby positively affecting the high export turnover of Vietnam’s rubber.

Regarding the Chinese market, according to data from the Chinese Customs Administration, in June 2024, China imported nearly 490.9 thousand tons of rubber worth USD 849.4 million, down 24.8% in volume and 13% in value compared to the same period in 2023. It is the fourth consecutive month that China’s rubber imports have decreased compared to the same period in 2023.

According to the forecast, the demand for rubber purchases will increase at the end of the year after customers forecast their business situation for the following year. The second half of this year will be the critical time to determine rubber price fluctuations in the next 12 months (second half of 2024 – first half of 2025). Therefore, rubber prices will likely remain high until the first half of 2025.

In addition, Thailand – the world’s leading natural rubber exporter, is having to overcome the consequences of natural disasters, along with the trend of people changing industries due to the characteristics of rubber trees requiring a long time for basic construction (5-7 years).

Therefore, the shortage of supply from Thailand and other major rubber-producing countries will occur until the replacement rubber plantations of Thailand begin to be exploited, and other countries enter the high productivity period; this process may take 4-5 years.

The above factors are expected to impact Vietnam’s rubber export activities positively. According to SSI Research’s calculations, a 1% increase in rubber prices will help the gross profit margin of Vietnam Rubber’s rubber production segment increase by 0.5%.

Due to the characteristics of rubber trees, rubber exploitation will take place strongly from March to December every year, so the second quarter onwards is when Vietnam Rubber’s output reaches its peak, opening up room for business growth. Forecasts from some securities firms show that this year’s rubber segment of Vietnam Rubber could grow by 15% compared to 2023.

Author: Do Huong

Translated by Huong Giang