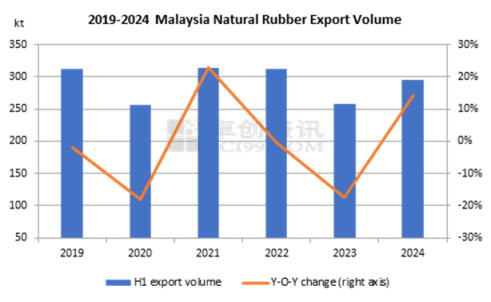

Introduction: As the world’s major producer and exporter of natural rubber, Malaysia’s natural rubber export volume increased by 14% Y-O-Y in H1, 2024. The increment was mainly supported by exports to non-China regions. However, the export volume was still at a low level because the natural rubber output in Malaysia declined. It is expected that Malaysia’s natural rubber export volume will rise Y-O-Y in H2, 2024, but the increment will be limited.

The export volume of natural rubber in Malaysia climbed by 14% Y-O-Y as overseas tire plants replenished inventory and the import volume mounted up.

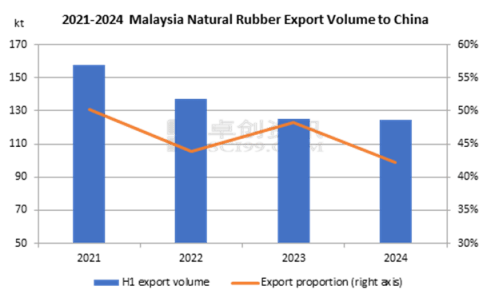

According to the Department of Statistics Malaysia, Malaysia’s export volume of natural rubber in H1, 2024 was 295.6kt, up 14% Y-O-Y. This was mainly because the inventory replenishment of overseas trie plants drove the export volume to non-China regions to go higher. In H1, 2024, the total export volume to non-China regions was 171kt, up 37.3kt or 27.87% Y-O-Y.

Source: The Department of Statistics Malaysia

Source: The Department of Statistics Malaysia

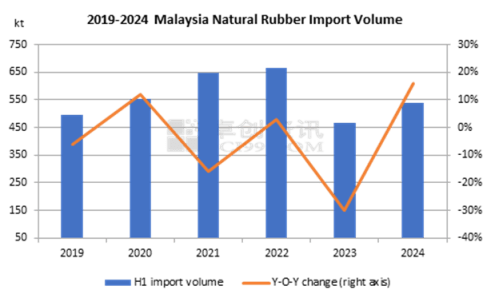

The import volume in Malaysia climbed Y-O-Y, providing a guarantee for export growth.

The Malaysian government encourages enterprises to transform and produce high value-added rubber industrial products, which also accelerates the transformation of the natural rubber industry. Every year, Malaysia imports a large amount of natural rubber feedstock and semi-finished products from surrounding natural rubber producing countries for processing and re-export, and it also imports NR latex to meet the development of the NR latex industry. Hereinto, Malaysia mainly imports NR latex from Thailand and feedstock from Africa. In H1, 2024, the import volume of natural rubber in Malaysia totaled 539.7kt, up 15.96% Y-O-Y.

Source: The Department of Statistics Malaysia

However, the export data in H1, 2024 was still lower than that in the same period in previous years, which was mainly related to the decline in Malaysia’s natural rubber output and changes in import structure.

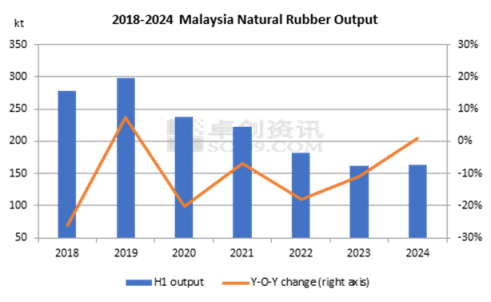

Natural rubber output in Malaysia slipped in H1, 2024 due to the industrial transformation.

In H1, 2024, the natural rubber output in Malaysia was 163.8kt, up 0.95% Y-O-Y, but it was at a historically low level for the same period. Malaysia’s natural rubber output ticked down after peaking in 2006, mainly because the low natural rubber prices led to a decline in industry profits. Then, a large number of natural rubber trees were cut down to plant other cash crops, and the enthusiasm for new planting and replanting of natural rubber trees was not high. The trees were aging, and the yield decreased. At the same time, the labor force was diverted to other cash crops, resulting in essential changes in the structure of the natural rubber industry. As a result, the output of natural rubber went down, which hardly underpinned the export growth.

Source: The Department of Statistics Malaysia

The import structure in Malaysia changed.

From the import structure, the proportion of imports from Africa rose, but that from Thailand fell, causing the import volume to drop below the high level of the same period in recent years. This was mainly related to the decline in natural rubber consumption in Malaysia. Malaysia is the world’s largest producer and exporter of rubber gloves, but in recent years the rubber glove industry has faced problems such as overcapacity and high inventory of finished products. Therefore, the proportion of natural rubber consumption in the glove industry fell from 75%-80% in previous years to less than 60% in H1, 2024.

It is predicted that Malaysia’s natural rubber exports in H2, 2024 may increase compared with H1, 2024, but the increment will be limited. On the one hand, the import volume rose in H1, 2024. Besides, Malaysia will enter the output growth season in H2, 2024, and the steady output growth will provide a guarantee for exports in H2, 2024. On the other hand, the demand from overseas inventory replenishment after the interest rate cuts will also support the growth of export volume. However, the Y-O-Y increase in export volume is expected to be limited, mainly because the phenology in the main natural rubber producing areas is abnormal, and there is uncertainty in the production changes in Thailand and Cote d’Ivoire, the main importers of Malaysian natural rubber, which may affect the import volume and thus the Y-O-Y increase in exports.