Market Review

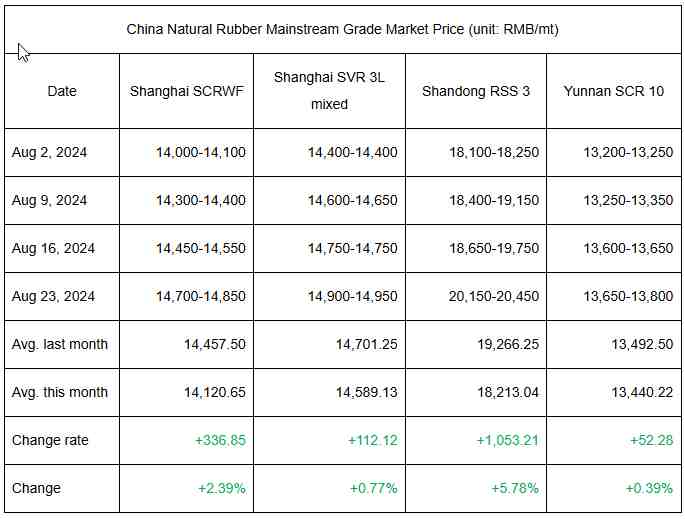

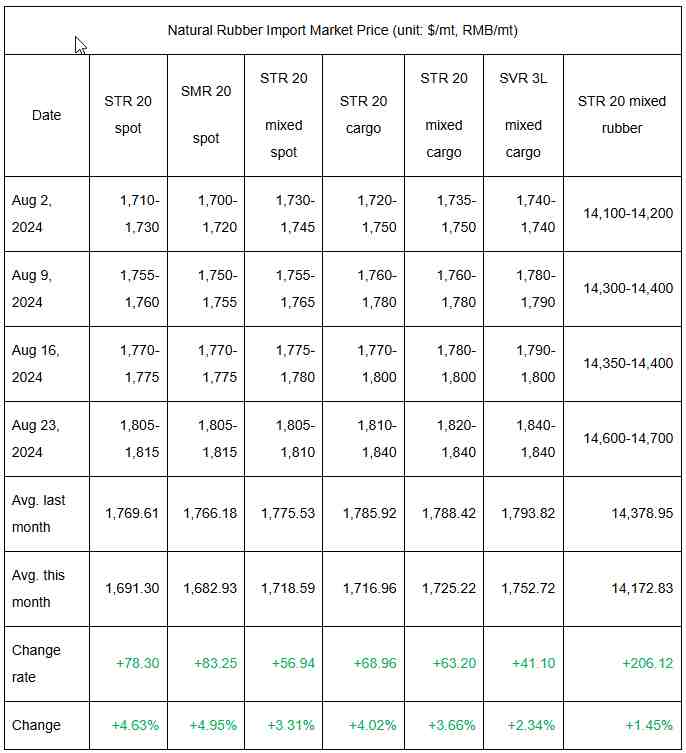

In August, the average market price of RMB-denominated natural rubber moved up M-O-M. The overall natural rubber price trended up, mainly driven by low supply. In August, there were still many rainfalls in China’s and overseas producing areas, subduing the rubber tapping work. Therefore, the output of new field latex was released slowly. Besides, the purchase price of feedstock remained at a high level. High cost greatly underpinned the natural rubber price. Coupled with tight spot circulation, the supply continued to push up the market price. In terms of demand, orders at downstream enterprises were sluggish. Some tire enterprises took maintenance of their units amid hot weather. Thus, the overall operating rate faced headwinds in rising. Meanwhile, due to profit reduction, downstream enterprises showed thin purchasing appetites for high-priced feedstock. They mainly purchased natural rubber for rigid demand when its price was low. The overall dealing atmosphere was average in the natural rubber market.

Market Forecast

In September, the natural rubber price may fluctuate at highs. In terms of supply, from the perspective of normal seasonality, the output of new field latex in China’s and overseas markets is released in succession. The pressure from new supply may climb gradually in the natural rubber market. The spot supply of natural rubber in China is expected to grow. In terms of demand, in September, downstream demand is likely to improve M-O-M. Yet, end consumption may weaken, and there may be a lack of increment in exports. Therefore, the overall demand from the tire sector is likely to gain limitedly. On the whole, due to rising supply and demand, the spot inventory of natural rubber may pile up. However, the overall supply-demand contradiction may be not obvious. The natural rubber price may hover at highs.

It is estimated that SCRWF prices in Shanghai will probably fluctuate at RMB 14,300-15,500/mt in September. Players should pay attention to the disturbance of abnormal weather on output release as well as the influence of commodity co-movement from the external macro environment.