Tokyo – Natural rubber (NR) futures pricing has maintained its upward momentum of recent weeks, on data indicating that demand was outpacing supply.

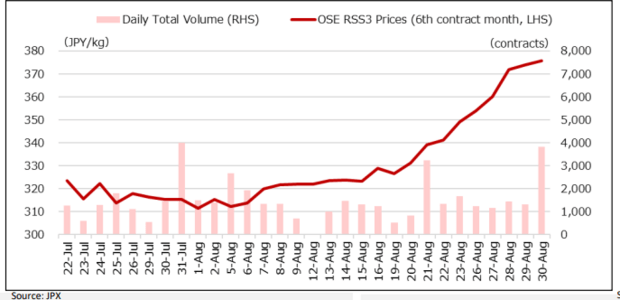

Major NR markets reached a five-week high during the trading week ended 30 Aug, driven by growing concerns over supply shortages, reported Japan Stock Exchange (JPX).

These concerns were heightened by the onset of the rainy season in producing countries, accordng to the latest JPX market report issued 2 Sept.

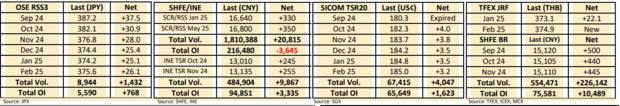

The bulling pricing trend was particularly evident in Osaka, Japan, where OSE rubber futures surged 7.4% week-on-week, fuelled by strong overseas demand.

In China, meanwhile, pricing on the SHFE and INE exchanges gained 2.0% and 1.9% respectively, supported by short-covering and fresh speculative buying.

Singapore’s SICOM rubber also saw a 2.1% week-on-week growth, reflecting renewed buying interest, continued the weekly JPX review.

The gains came as the Association of Natural Rubber Producing Countries (ANRPC) reported a modest 0.7% year-on-year increase in production, totalling 7.1 million tonnes in the first seven months of 2024.

In contrast, demand grew at a faster pace: rising by 1.2% year-on-year to 9 million tonnes over the same period, according to the ANRPC data.

According to JPX, heavy rain and flash floods in parts of Thailand were expected to impact tapping activities, further supporting the recent pricing price rally.