Market Review

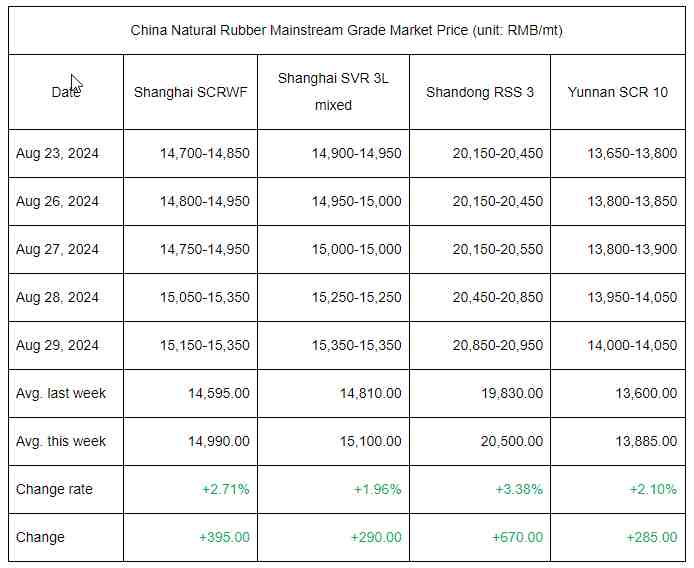

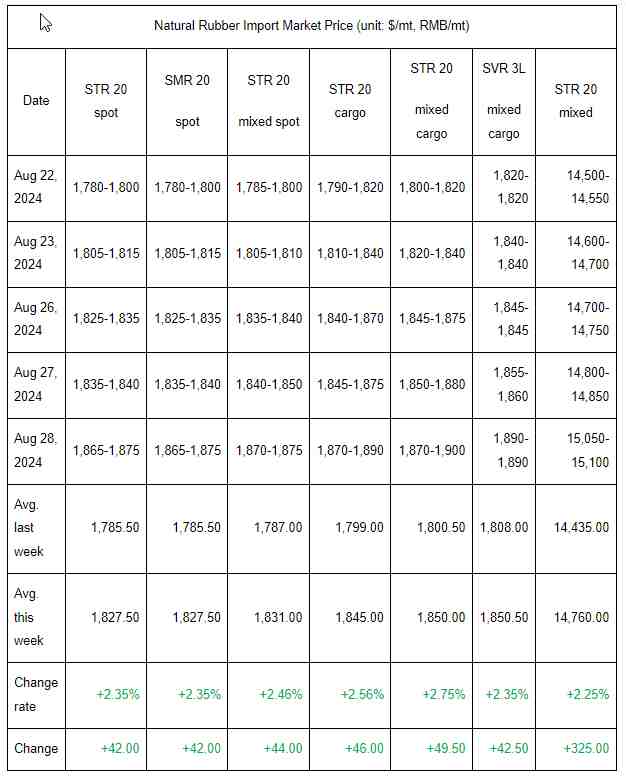

Prices of RMB-denominated natural rubber spot resources perked up this week. Within this week, prices of Shanghai natural rubber futures remained in an uptrend, driving up the spot price accordingly. Currently, in terms of supply, the rubber tapping work was still affected by rainfalls in main producing areas both at home and abroad. Thus, the output release of new field latex was slow. Feedstock price continued to remain high, bolstering the natural rubber price from the cost. As seen from demand, the operating rate at downstream tire enterprises ramped up. Yet, high cost curbed downstream purchasing appetites. Thus, downstream users mainly purchased spot natural rubber for rigid demand. The overall trading atmosphere stayed insipid in the natural rubber market.

Market Forecast

Forecast: China’s natural rubber market will possibly fluctuate at highs next week. In the short run, the market price of natural rubber may continue to be underpinned by tight supply. On the one hand, the output release of new field latex may be limited in producing areas both at home and abroad. On the other hand, the spot circulation of natural rubber may still be tight in China. Meanwhile, the cost supply for natural rubber prices may be strong due to high feedstock prices. Especially, the USD-denominated natural rubber price may remain firm, driving up China’s spot market. In terms of demand, downstream demand may improve, but high feedstock prices may lead to a profit drop, dampening the overall buying sentiment. Besides, with futures prices rising, profit gainers close positions, subduing the constant increments in natural rubber prices. On the whole, the natural rubber price is likely to remain at highs in the short term. It is estimated that the weekly average price of SCRWF in Shanghai may be RMB 15,000/mt, and its mainstream prices may be in the range of RMB 14,800-15,500/mt.

Supply: At present, the output of new field latex will be released gradually both at home and abroad. Yet, in the short run, rainfalls in some areas may curb the release of new output. The spot circulation in China may be limited in the short term, supporting the natural rubber price.

Demand: The operating rate of the downstream tire industry may tick up next week, but high feedstock price is likely to restrain downstream purchasing appetites. Tire enterprises may mainly stock up for rigid demand.