The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index closed flat on Thursday after witnessing range-bound trading amid lack of fresh triggers.

Trading activity remained range-bound with the index swaying in both directions throughout the session. It hit an intra-day high of 79,154.30 against an intra-day low of 78,578.02.

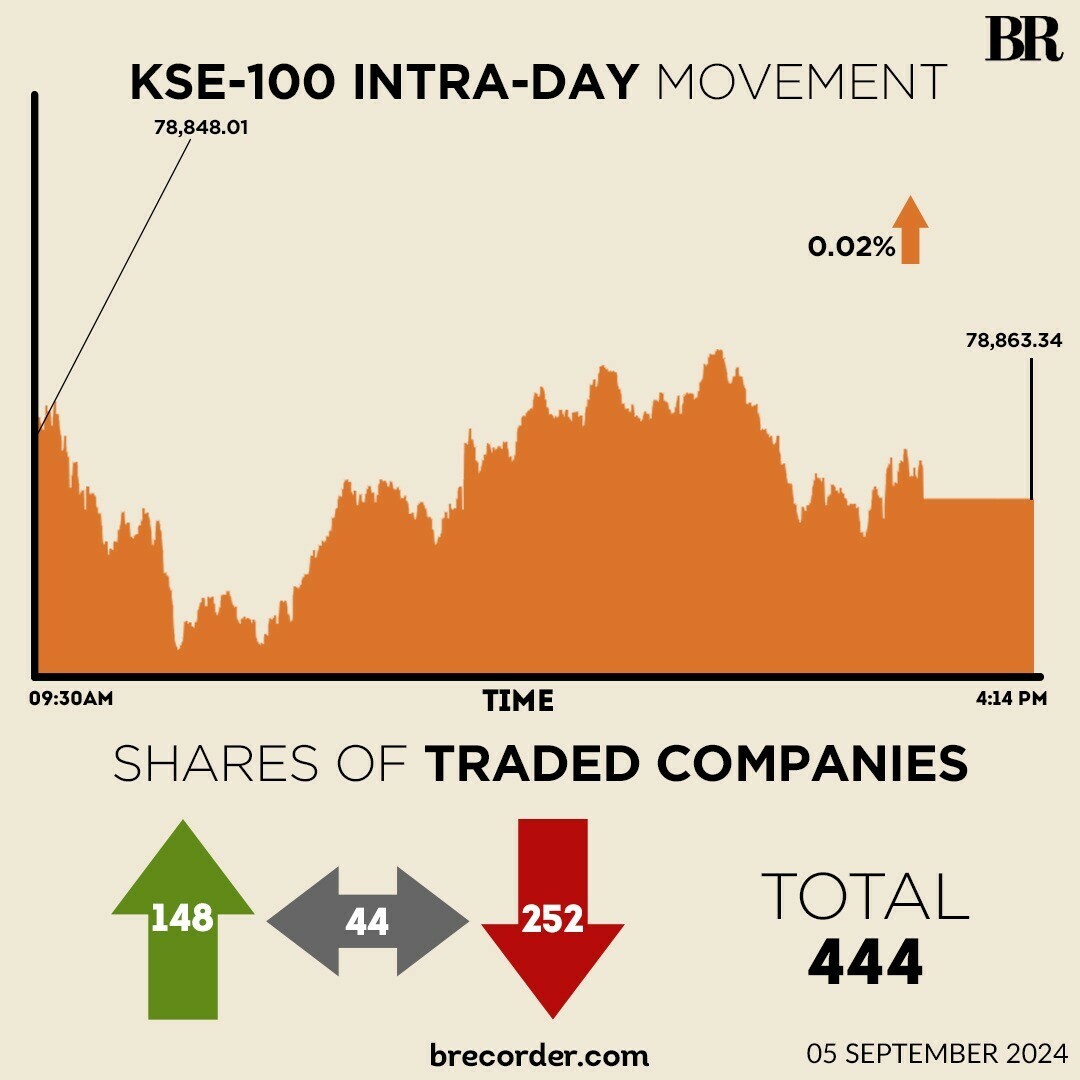

At close, the benchmark index settled at 78,863.34, marginally up by 15.33 points or 0.02%.

“The equity market closed the day relatively flat, with the benchmark index experiencing volatility throughout the session,” brokerage house Ismail Iqbal Securities said in its post-market report.

Sectors that contributed positively included banking, fertiliser, cement, and technology, while E&Ps, power, OMCs, auto, and pharma sectors closed in the red.

On Wednesday, the PSX had witnessed a bullish sentiment as the KSE-100 rallied 492 points on the government’s assurance that Islamabad was in the advanced stages of securing external financing required to win a $7-billion International Monetary Fund (IMF) deal.

The market is also bracing for the State Bank of Pakistan (SBP) to announce the key policy rate on September 12 (Thursday). It has reduced the rate by a cumulative 250 basis points in its previous two meetings.

Analysts expect the central bank to continue with its easing stance as slower inflation and improved macroeconomic indicators boost sentiment of a third-successive reduction.

Meanwhile, Siddiqsons Tin Plate Limited (STPL) said it had initiated the formal process to shut down its plant located in Balochistan, owing to sales decline and labour strike.

The listed company shared the development in its notice to the PSX on Thursday.

“As per the decision of the Board of Directors recorded on 04th September 2024, the company has initiated the formal process for the closure of the tinplate plant located at Winder, Balochistan,” read the notice.

Globally, Asian share markets tried to regain their footing on Thursday after a steep sell-off, while a rally in Treasuries dented the dollar and lifted the yen as US economic worries raised the odds of the Federal Reserve going big on rate cuts.

Japan’s Nikkei fell 0.5% to its lowest in three weeks, although tech-heavy Taiwan and South Korean stocks were both 1% higher after sliding on Wednesday.

That helped lift MSCI’s broadest index of Asia-Pacific shares outside Japan by 0.6%, having tumbled nearly 3% over the course of a three-day losing streak.

The Pakistani rupee registered marginal improvement against the US dollar, appreciating 0.03% in the inter-bank market on Thursday. At close, the currency settled at 278.68, a gain of Re0.09 against the US dollar.

Volume on the all-share index decreased to 770.52 million from 969.77 million on Wednesday.

The value of shares declined to Rs14.29 billion from Rs17.51 billion in the previous session.

WorldCall Telecom was the volume leader with 87.10 million shares, followed by Pace (Pak) Ltd with 66.58 million shares, and Kohinoor Spinning with 42.18 million shares.

Shares of 444 companies were traded on Thursday, of which 148 registered an increase, 252 recorded a fall, while 44 remained unchanged.

Source: Brecorder