Market Review

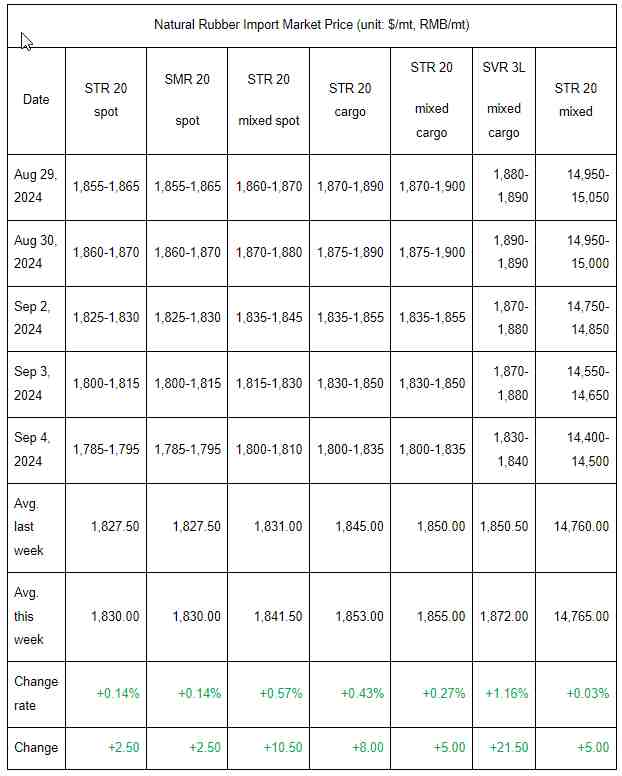

Prices of RMB-denominated natural rubber spot resources inched lower this week. The average market prices mainly saw minor ups and downs. Within this week, prices of Shanghai natural rubber futures fell from highs, dragging down the spot price accordingly. Thus, the weekly average prices of spot natural rubber changed slightly. Due to rising prices in the early period, downstream enterprises registered thin appetites for high-priced natural rubber, with sluggish dealings. After constant increases in price, the overall natural rubber market began to move sideways. Besides, within this week, it was heard that some natural rubber resources at the National Food and Strategic Reserves Administration would flow into the market, triggering players’ bearish sentiment. Therefore, the natural rubber price began to move down. In terms of demand, downstream users mainly purchased natural rubber for rigid demand. Yet, with the price dropping, some of them stocked up, so the overall trading atmosphere improved from last week.

Market Forecast

Forecast: China’s natural rubber market will possibly be range-bound next week. In the short run, the market price of natural rubber may continue to be bolstered by insufficient output release of new rubber as well as low spot inventory in China. Yet, in terms of demand, downstream tire enterprises may face high cost and inventory pressure. Thus, the increment in demand may improve limitedly. Besides, the external macro environment is likely to remain lackluster, leading to a weak trading atmosphere in the commodity market. Thus, it may be hard for natural rubber prices to see a further rise. Therefore, in the short term, the natural rubber price may be range-bound. It is estimated that the weekly average price of SCRWF in Shanghai may be RMB 14,850/mt, and its mainstream prices may be in the range of RMB 14,500-15,200/mt. In the short run, players should pay attention to the status of resource outflow from the National Food and Strategic Reserves Administration, impacts of typhoon weather as well as expected interest rate cuts of Fed, etc.

Supply: In the short run, rainfalls in China’s and overseas producing areas are likely to curb the rubber tapping work. Thus, the output release of new rubber may fall short of expectations. The spot inventory of natural rubber in China may continue to remain low, bolstering the natural rubber price from the bottom.

Demand: In the short run, downstream tire enterprises may face high cost and inventory pressure. Thus, they may show weak interest in buying feedstock. The demand may fail to prop up the natural rubber market.