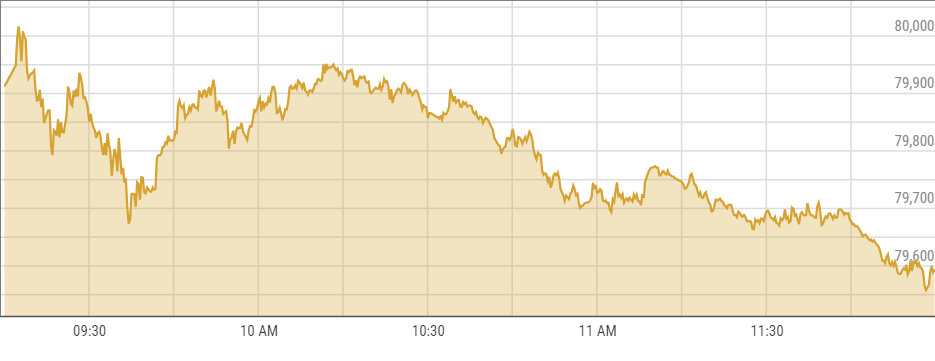

The KSE-100 Index on Friday saw a relatively muted reaction to news over the International Monetary Fund (IMF) board meeting being set for September 25 and the central bank’s 200 basis point cut, increasing around 0.73% by the mid-session break.

A jump at the start of the session was followed by gradual profit-taking as investors digested a heavy dose of positivity that drove pre-session buying at the Pakistan Stock Exchange (PSX).

Source: PSX

The euphoria came after it was finally confirmed that the IMF Executive Board will take up Pakistan’s $7-billion bailout on its agenda this month. A 200bps reduction in the key policy rate was also the State Bank of Pakistan’s (SBP) most aggressive monetary easing stance in over four years, but participants found the 80,000 level still hard to swallow.

Profit-taking at this level meant the KSE-100 fell to around 79,597.89, an increase of 580.28 points or 0.73%, by noon.

Some buying was witnessed in sectors that directly benefit from the rate cut including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs and power generation.

Analysts said the PSX will gradually recover, but there are still some fears over the tax authorities missing their targets, and if the government would be able to follow a strict reform agenda given its weak footing in the political spheres.

However, there were some who say the index is likely to power past these obstacles and see greater upside in months to come.

On Thursday, some buying was also witnessed at the bourse, with the benchmark KSE-100 Index closing higher by 366 points to settle at 79,017.62.

Globally, Indian shares were set to open flat on Friday, after a sharp rally in the previous session to an all-time high, with traders expecting markets to consolidate near current levels.

The GIFT Nifty was at 25,384.5 points, as of 08:17 a.m. IST, indicating the NSE Nifty 50 will open near Thursday’s record closing high of 25,388.9.

Nifty 50 and S&P BSE Sensex rose about 2% each on Thursday in their best session since early June to hit record highs.

The rally, led by commodities, was sparked by foreign inflows and expectations that top metals consumer China is likely to cut interest rates on mortgages to boost consumption.

This is an intra-day update

Source: Brecorder