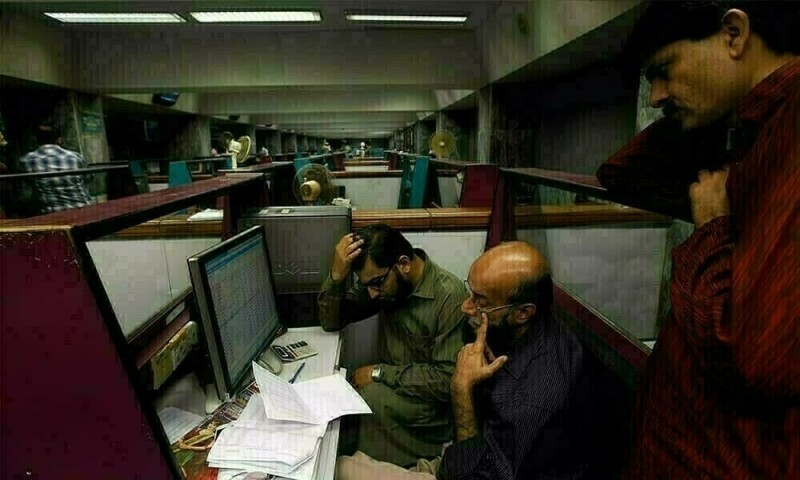

Broad-based selling pressure was seen at the Pakistan Stock Exchange (PSX), as the benchmark KSE-100 Index was down over 650 points during the intra-day trading on Tuesday.

However, by 1:15pm, the benchmark index had recovered slightly to hover around 81,422, still a decrease of 428.81 points or 0.53%.

Across-the-board selling was witnessed in key sectors including automobile assemblers, cement, chemical, commercial banks, oil and gas exploration companies and OMCs.

Index-heavy stocks including OGDC, PPL, SNGPL, PSO, MCB, NBP and MEBL traded in the red.

Experts said investors have resorted to profit-taking after days of a bullish trend.

Investors are also awaiting the release of funds from the International Monetary Fund (IMF), as the IMF Executive Board is scheduled to take Pakistan’s 37-month Extended Fund Facility (EFF) of about $7 billion on its agenda on September 25.

On Monday, PSX’s benchmark KSE-100 Index witnessed some profit-taking and closed the day below 82,000 after losing 224 points to settle at 81,850.50.

Globally, Asian stocks rose on Tuesday to their highest in more than two and half years, boosted by a slew of Chinese stimulus measures while expectations for more U.S. rate cuts kept risk sentiment aloft and the dollar under pressure.

In an eagerly awaited press conference, China’s top financial regulators unveiled a slate of measures, saying it would cut bank reserves by 50 basis points while reducing mortgage rates to try to spur sluggish economic growth.

The moves sent Chinese stocks higher, with the blue-chip CSI300 Index opening 1% higher, while the broader Shanghai Composite index was also up 1% at the open.

That pushed MSCI’s broadest index of Asia-Pacific shares outside Japan 0.41% higher to 588.43, levels last seen in April 2022.

This is an intra-day update

Source: Brecorder