Market Review

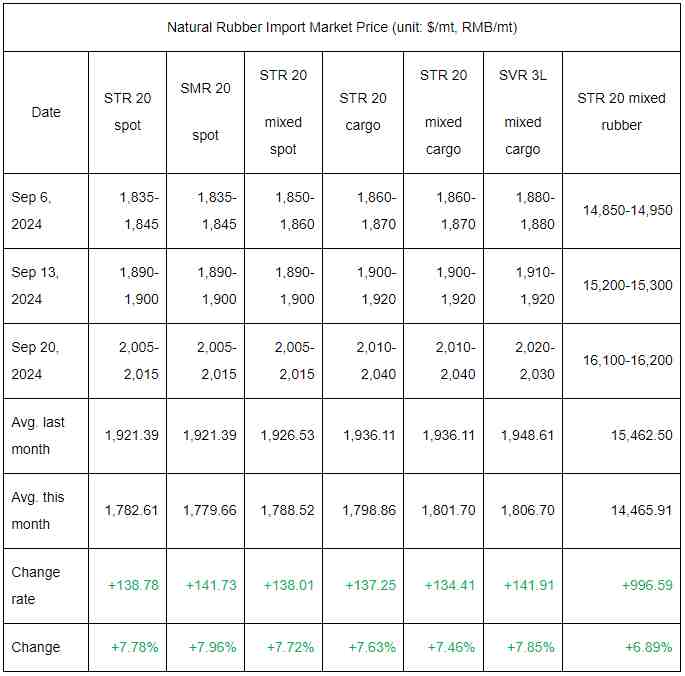

In September, the average market price of RMB-denominated natural rubber perked up MoM. Within this month, the natural rubber price surged, mainly boosted by macro environment and industry factors. In September, affected by the typhoon weather, many rainfalls occurred in major producing areas, curbing the rubber tapping work. Therefore, the output release of new field latex was sluggish. The purchase price of feedstock remained at a high level, strongly pushing up the natural rubber price from the cost. Besides, the People’s Bank of China launched several blockbuster policies at the same time. Thus, a series of monetary policies supported the overall commodity market. Driven by the co-movement, the natural rubber price went higher. Yet, due to high natural rubber prices, downstream tire enterprises faced increasing cost pressure. Therefore, the rigid demand from buyers remained insipid. Only several enterprises replenished inventory when the natural rubber price was lower.

Market Forecast

In October, the natural rubber price may fall from highs, but the monthly average price is likely to inch up MoM. As seen from the normal seasonality, the global producing areas may usher in the supply peak season. Thus, the output of new field latex is expected to ramp up both at home and abroad. Besides, some natural rubber resources from the National Food and Strategic Reserves Administration may flow into the market. Therefore, the supply of natural rubber is likely to pick up. The destocking status of natural rubber may change. As seen from the demand, affected by the National Day holiday, some tire enterprises may halt production and take holidays. Meanwhile, the feedstock price may remain firm, so tire enterprises may face high cost pressure, subduing the operating rate. Thus, the demand may fail to prop up the natural rubber price. The support from fundamentals is predicted to weaken. However, as seen from the macro environment, with the launch of a series of monetary policies, a bullish external macro environment may boost the commodity market. Driven by the co-movement, the natural rubber price may be supported. On the whole, in October, the natural rubber price is likely to fall from a high level.

It is estimated that SCRWF prices in Shanghai will probably fluctuate at RMB 15,500-17,000/mt in October. Players should pay attention to the weather changes in China’s and overseas producing areas as well as the influence of commodity co-movement from the external macro environment.