Major stock markets in the Gulf fell in early trade on Thursday, extending losses from the previous session, after Iran’s ballistic missile strike on Israel heightened fears of a wider regional conflict.

Israel bombed central Beirut early on Thursday, killing at least six people, after its forces suffered their deadliest day on the Lebanese front in a year of clashes against Iran-backed armed group Hezbollah.

The strike comes a day after Iran fired more than 180 ballistic missiles at Israel in an escalation of hostilities, which have seeped out of Israel and occupied Palestinian territories into Lebanon and Syria.

Saudi Arabia’s benchmark index lost 0.2%, with Al Rajhi Bank down 0.4% while the country’s biggest lender Saudi National Bank slipped 0.3%.

Meanwhile, the pace of growth in the kingdom’s non-oil sector accelerated to a four-month high in September, a survey showed on Thursday, as strong demand supported faster growth in new orders.

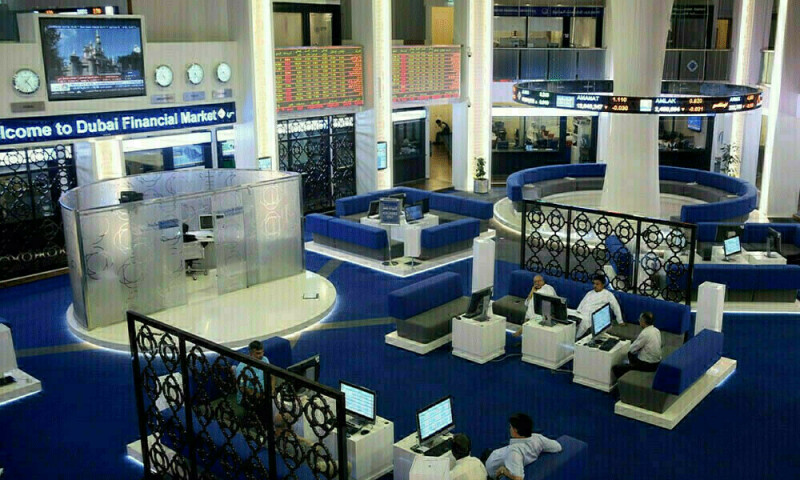

Most Gulf markets retreat on heightened regional tensions

Dubai’s main share index dropped 0.5%, hit by a 1.3% fall in blue-chip developer Emaar Properties, while Emirates NBD lost 0.5%.

In Abu Dhabi, the index fell 0.3%. Oil prices – a catalyst for the Gulf’s financial markets – rose as the prospect of a widening Middle East conflict that could disrupt crude oil flows from the key exporting region overshadowed a stronger global supply outlook.

The Qatari benchmark eased 0.1%, with Islamic lender Masraf Al Rayan down 1%.

Source: Brecorder