The Pakistan Stock Exchange (PSX) maintained its upward momentum as buying continued with Friday’s session attracting interest in index-heavy banking and oil & gas stocks. The benchmark KSE-100 closed above 83,000 level for the first time in history on Friday.

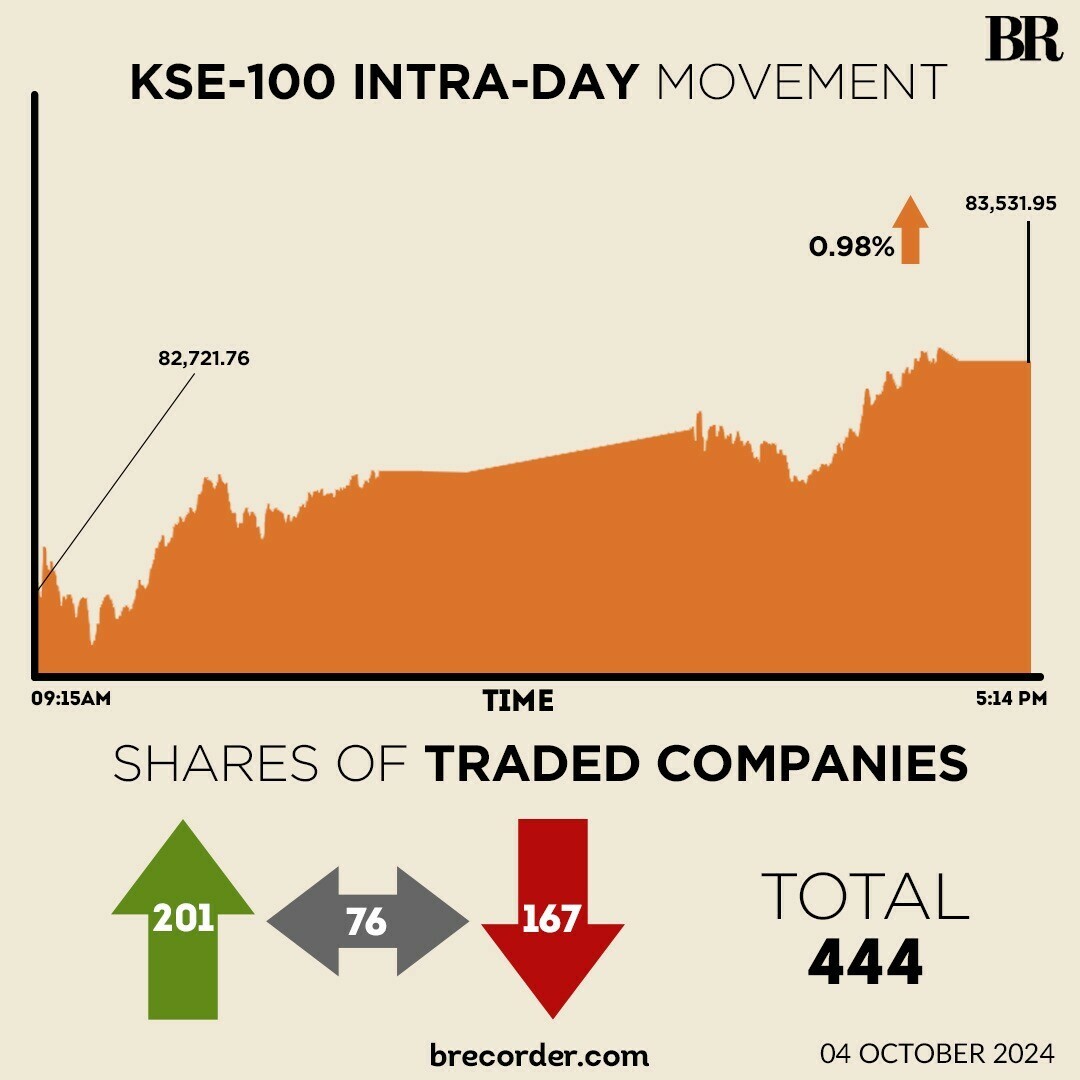

At close, the benchmark index settled at 83,531.96, up by 810.19 points or 0.98%.

“This gain can be attributed to decline in yields in secondary market on government bills (T-Bill and PIB) and investor interest in the E&P sector following dispatch of PPL detailed financials to the exchange where key takeaway was that cash collection ratio of the company has improved to 81% in FY24 as compared to 53% in FY23 due to upward revision in gas prices,” brokerage house Topline Securities said in its post-market report.

Major positive contribution to the index came from PPL, OGDC, MEBL, LUCK and POL, as they cumulatively contributed 517 points to the index, it added.

Air Link was also positive after Business Recorder reported that the company imported two units of an electric vehicle to test the waters.

The improved market sentiment also comes on account of positive macroeconomic indicators, said experts.

The State Bank of Pakistan’s foreign exchange reserves surpassed the $10 billion mark, reaching two-and-a-half-year high level following the recent disbursement of a loan tranche from the International Monetary Fund (IMF).

The central bank’s reserves rose by $1.168 billion, climbing from $9.533 billion to $10.702 billion mark.

On Thursday, the PSX hit its highest closing level on the back of local investors’ interest coupled with institutional support. The benchmark KSE-100 Index surged by 754.76 points or 0.92 percent and closed at the highest-ever level of 82,721.77 points.

Globally, Asian stocks retreated on Friday while oil prices headed for their sharpest weekly gain in more than a year, as escalating tensions in the Middle East kept markets on edge ahead of a US jobs report later in the day.

US President Joe Biden said on Thursday that the US is discussing strikes on Iran’s oil facilities as retaliation for Tehran’s missile attack on Israel, while Israel’s military hit Beirut with new air strikes in its battle against Lebanese armed group Hezbollah.

His comments sparked a surge in oil prices, which had already been on the rise this week following the widening conflict in the Middle East.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.32% and was set to end the week little changed.

Meanwhile, the Pakistani rupee registered marginal improvement against the US dollar, appreciating 0.08% against the US dollar in the inter-bank market on Friday. At close, the currency settled at 277.52, a gain of Re0.22 against the greenback.

Volume on the all-share index increased to 381.53 million from 319.88 million on Thursday.

The value of shares increased to Rs20.52 billion from Rs16.41 billion in the previous session.

Pace (Pak) Ltd. was the volume leader with 59.3 million shares, followed by Pak Petroleum with 21.64 million shares, and Kohinoor Spinning with 19.5 million shares.

Shares of 444 companies were traded on Friday, of which 201 registered an increase, 167 recorded a fall, while 76 remained unchanged.

Source: Brecorder