SINGAPORE, Oct 9 (Reuters) –

-

Japanese rubber futures recovered on Wednesday, buoyed by concerns of wet weather disrupting supply globally, although fading enthusiasm from top consumer China’s stimulus measures and lower oil prices capped gains.

-

The Osaka Exchange (OSE) rubber contract for March delivery JRUc6, 0#2JRU: was up 6.4 yen, or 1.62%, at 402.0 yen ($2.71) per kg, as of 0205 GMT.

-

The January rubber contract on the Shanghai Futures Exchange (SHFE) SNRv1, however, dipped 15 yuan, or 0.08%, to 19,205 yuan ($2,718.60) per metric ton.

-

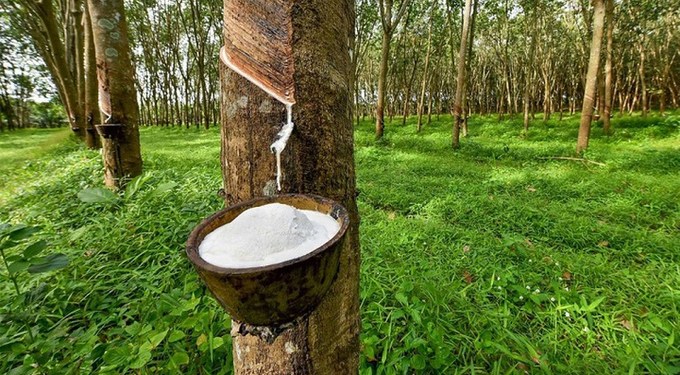

Raw material prices are currently high, as limited improvement in weather conditions across various production areas has restricted upstream output, with continuous rainfall affecting the rubber-tapping process, said Chinese futures site Beite Futures.

-

Thailand’s meteorological agency warned of heavy rains that may cause flash flood in the East and South of the country from Oct. 8-14.

-

Meanwhile, Qingdao’s natural rubber inventories edged 1.77% lower from the previous week, commodities service provider Longzhong Information said.

-

Although support from the cost side remains strong, the rubber market’s bullish sentiment weakened after the holiday, with demand mainly coming from buying orders to replenish and rotate warehouse stocks for the month, Longzhong Information said.

-

Mainland China stocks opened sharply lower and were poised to snap a 10-day rally after officials failed to inspire confidence in stimulus plans intended to revive the economy.

-

Oil prices slid on Tuesday, settling down more than 4% on news of a possible ceasefire between Hezbollah and Israel, although prices found some support on fears of a potential attack on Iranian oil infrastructure. O/R

-

Natural rubber often takes direction from oil prices as it competes for market share with synthetic rubber, which is made from crude oil.

-

The front-month November rubber contract on Singapore Exchange’s SICOM platform STFc1 last traded at 206.2 U.S. cents per kg, up 1.7%.

($1 = 148.1200 yen)

($1 = 7.0643 yuan)

Reporting by Gabrielle Ng; Editing by Sherry Jacob-Phillips