Most stock markets in the Gulf were subdued on Wednesday, with geopolitical tensions in the region taking center stage, although the Egyptian bourse bucked the trend to close higher.

An escalation of fighting in Lebanon and the ongoing one-year-old war between Israel and Hamas in Gaza has raised fears of a wider Middle East conflict.

Rocket sirens sounded constantly across northern Israel on Wednesday, including in the major port city of Haifa, following heavy fire from Lebanon. Israel’s military said about 40 projectiles were launched in one barrage at Haifa, some of which were intercepted while others fell in the area.

The downturn in Gulf markets began after Iran launched a missile barrage on Israel on Oct. 1. Israel has sworn to retaliate and is weighing its options, with Iran’s oil facilities considered a possible target.

Saudi Arabia’s benchmark index dropped 0.8%, weighed down by a 1.1% fall in aluminium products manufacturer Al Taiseer Group and a 2% decline in Al Rajhi Bank.

Major Gulf bourses edge higher, Arabian Mills jump on debut

Elsewhere, oil giant Saudi Aramco was down 0.4%.

Oil prices – a catalyst for the Gulf’s financial markets – erased early gains as weak demand fundamentals and rising supply countered the elevated risk of supply disruption from conflict in the Middle East and Hurricane Milton in the United States.

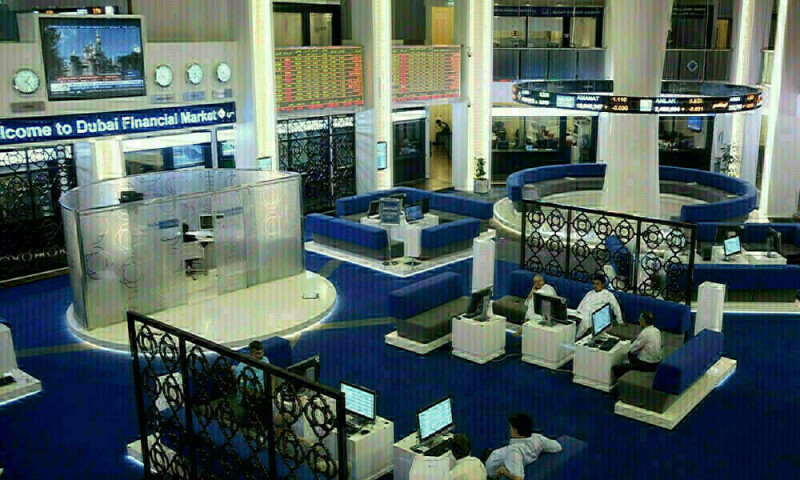

Dubai’s main share index eased 0.2%, with top lender Emirates NBD losing 1%.

In Abu Dhabi, the index edged 0.3% higher.

Outside the Gulf, Egypt’s blue-chip index advanced 1.1%, as most of its constituents were in positive territory, including Talaat Mostafa Holding, which was up 2.9%.

—————————————–

SAUDI ARABIA dropped 0.8% to 11,927

ABU DHABI rose 0.3% to 9,283

DUBAI down 0.2% to 4,422

QATAR finished flat at 10,510

EGYPT gained 1.1% to 31,175

BAHRAIN ended flat at 2,000

OMAN added 1.2% to 4,743

KUWAIT was up 0.1% to 7,577

—————————————–

Source: Brecorder