Major stock markets in the Gulf were mixed in early trade on Thursday in the backdrop of simmering geopolitical tensions in the region and ahead of a US inflation report.

Israel’s military said it had eliminated a Hezbollah member in Syria who relayed intelligence against Israel in the Israeli-occupied Golan Heights, while Syrian media reported on Thursday that Israeli airstrikes hit targets in Syria.

Israel has escalated its retaliation for the Hamas attack, sending troops into Lebanon and airstrikes into Iran, Yemen and Syria in the hunt for Iran-backed militants, raising fears of a wider Middle East conflict that could draw in Iran and the United States.

The Qatari benchmark eased 0.1%, hit by a 1.1% slide in telecoms firm Ooredoo. In Abu Dhabi, the index was down 0.1%.

Saudi Arabia’s benchmark index gained 0.3%, helped by a 0.6% rise in aluminium products manufacturer Al Taiseer Group and a 0.8% increase in Al Rajhi Bank.

However, the Saudi index was set for a second weekly loss. Among other gainers, oil behemoth Saudi Aramco was up 0.2%. Oil prices – a catalyst for the Gulf’s financial markets – rose, underpinned by a spike in fuel demand as a major storm barrelled into Florida and concerns about potential supply disruptions in the Middle East amid heightened tensions between Israel and major oil producer Iran.

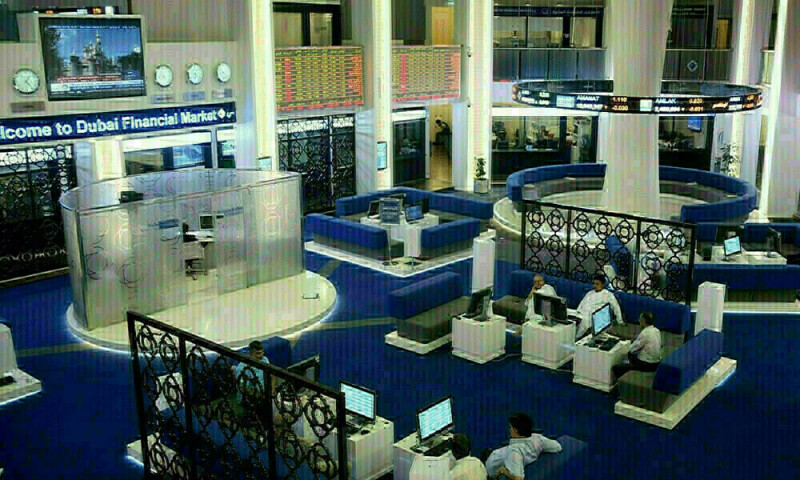

Dubai’s main share index added 0.1%, with Parkin Company advancing 2%.

Most Gulf markets ease amid regional tensions

The market is awaiting the Consumer Price Index inflation report due on Thursday for insight into the Fed’s rate path.

Markets are pricing in an 82% chance of a 25-basis-point cut next month, the CME FedWatch tool showed.

Monetary policy in the Gulf Cooperation Council (GCC) often aligns with the Fed’s decisions as most of the regional currencies are pegged to the US dollar.

Source: Brecorder