Market Review

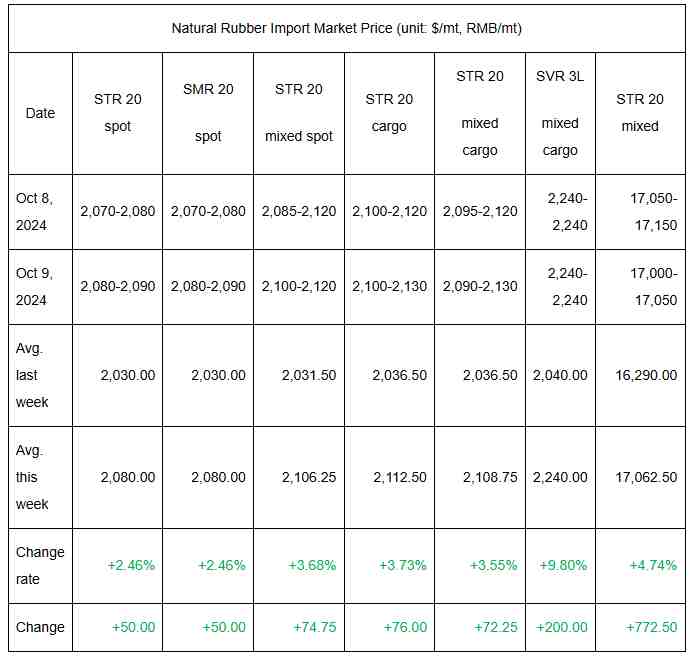

Prices of RMB-denominated natural rubber spot resources advanced, and the weekly average price also perked up from the pre-holiday week. Within this week, prices of Shanghai natural rubber futures fell from highs. Yet, ahead of the National Day holiday, a bullish macro environment drove up the commodity price. Coupled with favorable fundamentals, the price of natural rubber went up greatly. After the holiday, despite the price drop, the average price of natural rubber also rallied from the pre-holiday week. Thereafter, with macro sentiment cooling down, bulls closed out positions due to profit gains. The commodity market fell from high levels, and the natural rubber price saw a downtrend accordingly. As seen from the spot market, the spot price of SCRWF and mixed rubber declined, in the wake of dipping futures prices. Downstream enterprises purchased a small number of resources for rigid demand. However, owing to the tight supply of Vietnamese rubber, traders were inclined to keep the price firm. Thus, the decrement in natural rubber prices was limited. It was heard that shiploads arriving at ports were mainly for delivering orders.

Market Forecast

Forecast: China’s natural rubber market may continue to inch down next week. As seen from the macro environment, with macro sentiment cooling down, changes in the commodity market may be mainly influenced by its own fundamentals. Yet, affected by co-movement, the natural rubber price may edge down. However, in terms of the spot market, the feedstock price in producing areas is expected to stay high, so the cost may support the natural rubber price. Meanwhile, the spot inventory of natural rubber may remain low. The supply of some grades may continue to be tight. Meanwhile, after the price drop, downstream enterprises may stock up when the natural rubber price is lower, propping up the price from the bottom. In the short run, the natural rubber price may inch down. It is estimated that the weekly average price of SCRWF in Shanghai may be RMB 17,450/mt, and its mainstream prices may be in the range of RMB 16,500-18,000/mt. In the short term, players should pay attention to the impact of macro sentiment change on the commodity market.

Sentiment: With macro sentiment cooling, the commodity market is likely to fall back. Affected by the co-movement, the natural rubber market may trend sideways. Players should eye on the influence of macro sentiment changes on the commodity market.

Supply: In the short run, the purchase price of feedstock in Thailand may remain high. Thus, the cost may continue to support the natural rubber price. Traders may be inclined to keep the price firm. Coupled with low spot inventory and tight supply of some grades such as Vietnamese rubber and mixed rubber, the natural rubber price may be underpinned constantly.