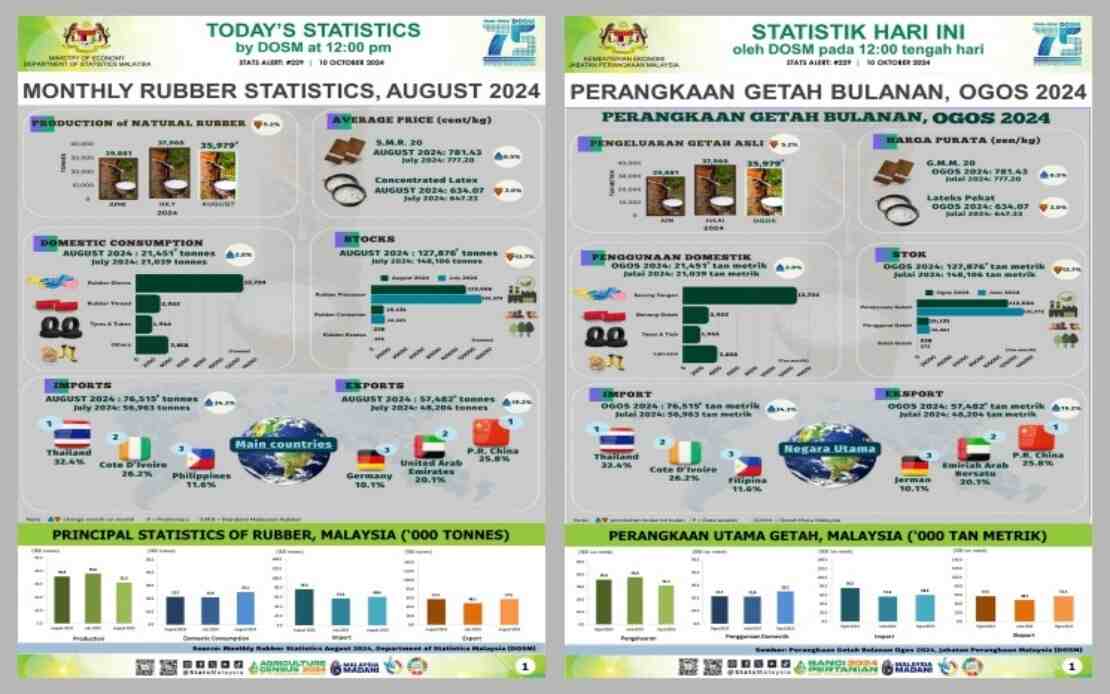

KUALA LUMPUR, Oct 10 (Bernama) — Malaysia’s natural rubber (NR) production decreased by 5.2 per cent to 35,979 tonnes in August 2024 against 37,960 tonnes in July 2024, according to Statistics Department Malaysia (DOSM). Year-on-year comparison showed NR production rose by 14.9 per cent from 31,309 tonnes in August 2023.

Year-on-year comparison showed NR production rose by 14.9 per cent from 31,309 tonnes in August 2023.

Chief statistician Datuk Seri Dr Mohd Uzir Mahidin said Malaysia’s NR August production was mainly contributed by smallholders at 88.1 per cent versus 11.9 per cent by the estates sector.

“Total stock of August’s NR fell by 13.7 per cent to 127,876 tonnes versus 148,106 tonnes in July 2024. Rubber processor factories contributed 88.0 per cent of the stocks followed by rubber consumer factories (11.8%) and rubber estates (0.2%),” he said in a statement today.

DOSM said Malaysia’s NR exports amounted to 57,482 tonnes in August, a 19.2 per cent rise against 48,204 in July contributed by NR-based products such as gloves, tyres, tubes and rubber thread.

“China remained as the main destination for NR exports, which accounted for 25.8 per cent of August’s total exports, followed by the United Arab Emirates (20.1 per cent), Germany (10.1 per cent), the United States (US) (9.6 per cent) and India (8.3 per cent).

“Gloves were the main exports of rubber-based products, valued at RM1.6 billion in August, a 14.6 per cent rise versus July 2024 of RM1.4 billion,” it said.

Quoting the August 2024 Malaysia Rubber Board Digest, DOSM said the Kuala Lumpur rubber market was mixed with prices moving upward.

It added that the average monthly price of concentrated latex recorded a 2.0 per cent fall to 634.07 sen per kilogramme (kg) in August against the preceding month’s 647.23 sen/kg while scrap fell 1.0 per cent to 664.26 sen/kg in August from 670.80 sen/kg in July 2024.

“Generally, market sentiment was supported by gains in the regional rubber futures markets amid traders’ concern about NR supply disruption due to inclement weather forecasts in the major producing countries.

“Market sentiment was also boosted by optimism of a rate cut tracking US data coupled with hopes of more stimulus from China to sustain economic recovery,” it added.

— BERNAMA