SINGAPORE, Oct 14 (Reuters) –

-

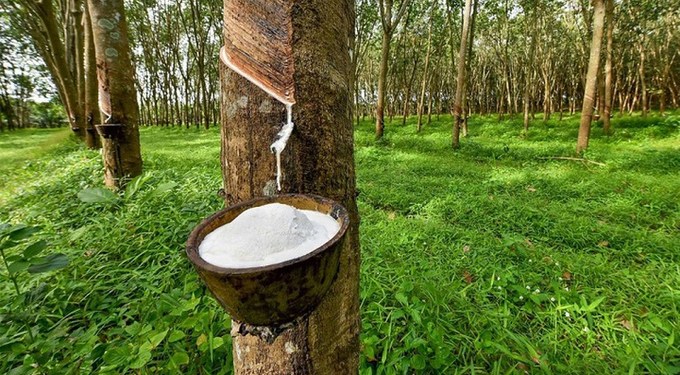

Japanese rubber futures recovered on Monday, after falling for three straight sessions, buoyed by continuous weather disruptions across global rubber-producing regions and lingering optimism from China’s slew of stimulus measures.

-

The March Osaka Exchange (OSE) rubber contract JRUc6, 0#2JRU: was up 7.1 yen, or 1.84%, at 393.5 yen ($2.64) per kg, as of 0215 GMT.

-

The January rubber contract on the Shanghai Futures Exchange (SHFE) SNRv1 rose 275 yuan, or 1.53%, to 18,225 yuan ($2,574.95) per metric ton.

-

Although softer economic data from top consumer China capped an upside in prices.

-

Frequent weather changes have caused a decline in rubber production in major domestic and foreign production areas, with global raw material prices continuing to rise to multi-year highs since the beginning of this year, Chinese stock trading site Tonghuashun Futures said in a note.

-

There is still a risk of weather disturbances in Southeast Asian production areas in the fourth quarter, the site said.

-

Additionally, although the current macro sentiment has cooled, policy measures introduced to stimulate domestic economic growth so far can benefit the consumption of natural rubber, as the commodity is strongly related to real estate and infrastructure, Tonghuashun Futures said.

-

Top producer Thailand’s meteorological agency warned of heavy rains that may cause flash floods during Oct. 13-19.

-

China’s consumer inflation unexpectedly eased in September, while producer price deflation deepened, heightening pressure on Beijing to roll out more stimulus measures quickly to revive flagging demand and shaky economic activity.

-

Finance Minister Lan Foan told a news conference on Saturday there will be more “counter-cyclical measures” this year, but did not provide details on the overall size of the stimulus package, which investors hope will ease deflationary pressures in the world’s second-largest economy.

-

The front-month November rubber contract on Singapore Exchange’s SICOM platform STFc1 last traded at 196.5 U.S. cents per kg, down 0.7%.

($1 = 149.2200 yen)

($1 = 7.0778 yuan)

Reporting by Gabrielle Ng; Editing by Sherry Jacob-Phillips