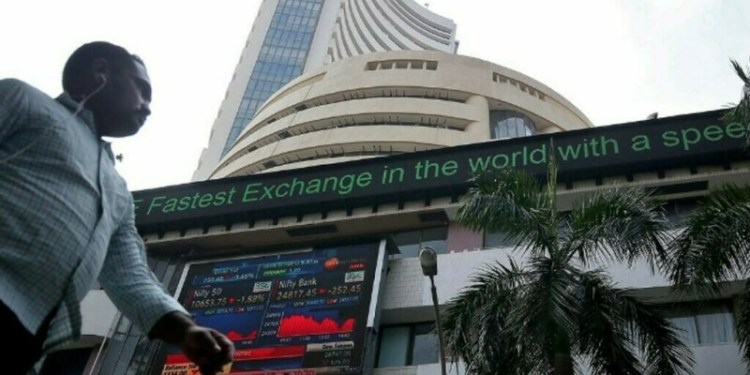

Indian shares rose on Monday, led by heavyweight financials and Larsen and Toubro (L&T), while investors awaited the domestic inflation print for clues about the timing of a possible rate cut.

The Nifty 50 index was up 0.6% at 25,113.2 points as of 11:22 a.m. IST, while the S&P BSE Sensex added 0.7% to 81,924.47.

The benchmarks fell about 5% over the last two weeks on worries of escalating Middle East tensions, slowing corporate earnings and foreign outflows.

Nine of the 13 major sub-sectors traded higher on the day, with financials gaining 1%. They slipped 5.2% in the last two weeks.

HDFC Bank, India’s largest lender by market value, added 1.9% and was the biggest boost to the Nifty 50.

Investors are moving money to financials after the sector’s recent underperformance, said Kranthi Bathini, director – equity strategy at WealthMills Securities.

The more domestically-focussed mid-caps fell 0.1% while small-caps rose 0.13%.

Construction bellwether L&T jumped 2% after JP Morgan started coverage on the stock with an “overweight” rating on expectations that the company is well placed to navigate capital expenditure cycles in India and the Middle East.

Focus will now be on domestic inflation data for September, due after the closing bell, which is expected to have overshot the central bank’s target.

Foreign outflows, earnings anxieties topple Indian shares for second week

The print will be parsed for clues on the timing of a rate cut after the central bank last week shifted its policy stance to “neutral”, signalling openness to reduce borrowing costs as early as December. Among other stocks, Wipro rose 2.2% after the IT firm said it would consider issuing bonus shares.

In contrast, DMart operator Avenue Supermarts slumped 8% after posting its slowest revenue growth in four years in the September quarter. Reliance Industries and HCLTech were flat.

They are due to kick off a results-heavy week with their earnings reports on Monday.

Source: Brecorder