Major stock markets in the Gulf were mixed in early trade on Monday as geopolitical tensions rose in the region and investors braced for third-quarter earnings.

Tensions were up with the prospect of a retaliation against Iran, the continued violence in Gaza and Israel’s relentless push against Hezbollah in Lebanon.

Saudi Arabia’s benchmark index dropped 0.6%, hit by a 6.1% slide in ACWA Power and 0.7% decrease in Al Rajhi Bank. Among other losers, oil giant Saudi Aramco was down 0.2%.

Oil prices – a catalyst for the Gulf’s financial markets – wiped out nearly all gains made last week after data showed China’s inflation rate declined and a lack of clarity on the country’s economic stimulus plans stoked fears about fuel demand in the world’s biggest crude importer.

The markets were also depressed by worries that the possibility of an Israeli response to Iran’s Oct. 1 missile attack could disrupt oil production, though the US has cautioned Israel against targeting Iranian energy infrastructure.

Lower prices and disruptions to crude exports impact fiscal balances in countries reliant on oil income.

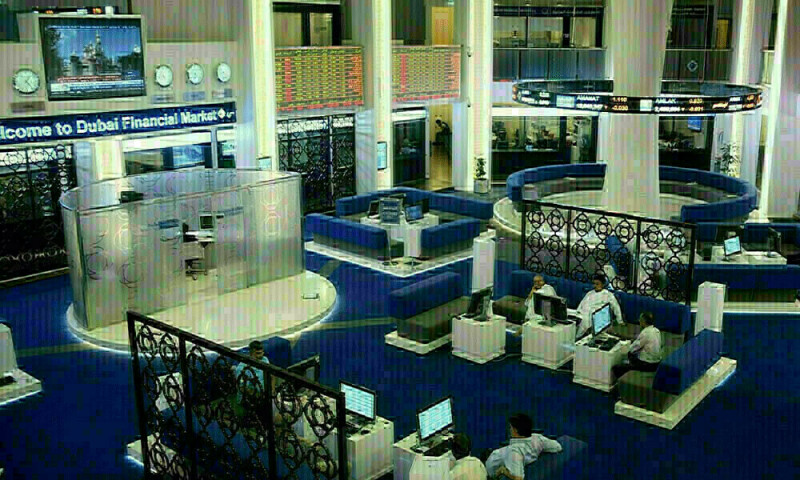

The Qatari index eased 0.1%, with Islamic lender Masraf Al Rayan losing 0.3%. Dubai’s main share index gained 0.5%, with top lender Emirates NBD rising 1.8%.

In Abu Dhabi, the index was up 0.3%.

On Friday, a reading on US inflation and consumer confidence kept expectations for the path of Federal Reserve interest rate cuts intact.

Markets had been fully pricing in a cut of at least 25 basis points (bps) with a chance for another outsized 50 bps cut.

Most Gulf markets ease on Mideast conflict; Saudi gains

Monetary policy in the Gulf Cooperation Council (GCC) often aligns with the Fed’s decisions as most of the regional currencies are pegged to the US dollar.

Source: Brecorder