Market Review

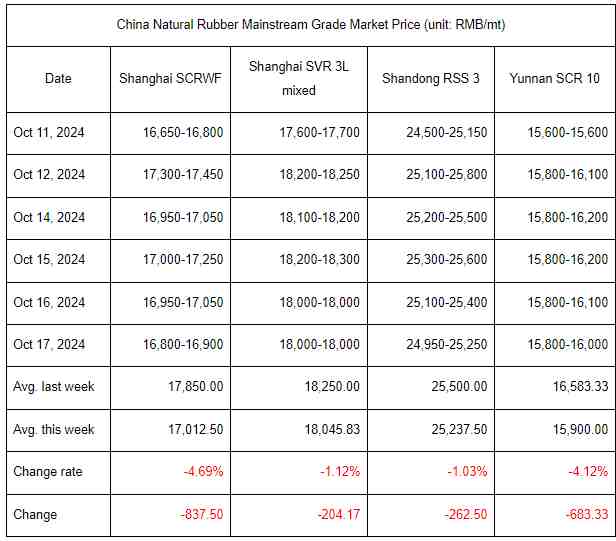

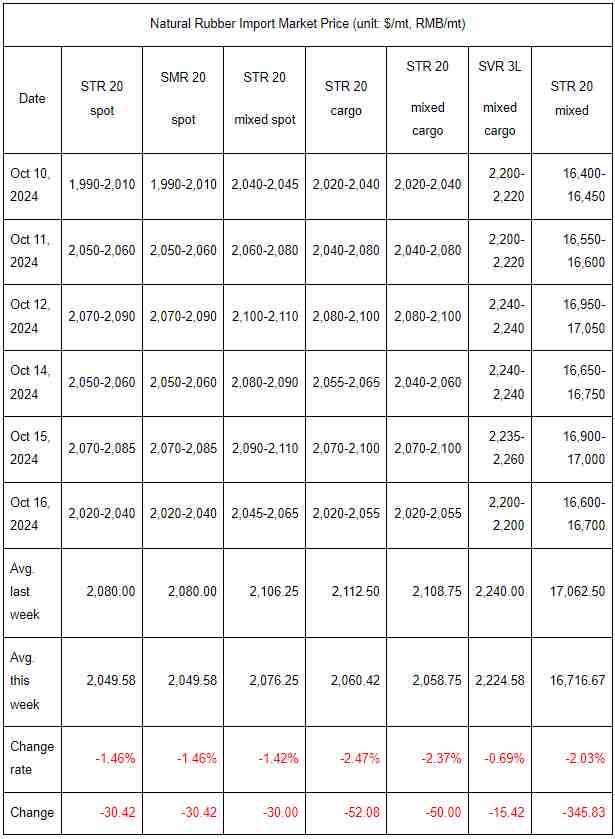

Prices of RMB-denominated natural rubber spot resources moved down, and the average price also slid WoW. Within this week, prices of Shanghai natural rubber futures fluctuated downwards. With the macro environment cooling down, the natural rubber price was mainly affected by changes in fundamentals. Yet, currently, the output of new rubber in China’s and overseas producing areas continues to ramp up. Thus, the purchase price of feedstock loosened slightly. The natural rubber supply was expected to advance. Therefore, the spot price of natural rubber went lower, in the wake of dropping futures prices. As seen from the demand, downstream enterprises still registered resistance to high-priced feedstock and mainly replenished inventory for rigid demand when the natural rubber price was lower. The trading atmosphere was passable in the spot market, and dealings were mainly concluded based on negotiations.

Market Forecast

Forecast: China’s natural rubber market may fluctuate weakly next week. With the macro sentiment to capital cooling down, changes in the commodity market are mainly influenced by its own fundamentals, and natural rubber is not an exception. As seen from the supply, the spot inventory of natural rubber is relatively tight at present. However, in overseas producing areas, the output of new rubber is released notably. Besides, high-priced feedstock spurs the enthusiasm for rubber tapping work. Thus, the supply of natural rubber is expected to move up, pressuring the price accordingly. Yet, owing to drops in natural rubber prices, downstream enterprises are inclined to stock up for rigid demand, bolstering the price from the bottom. Therefore, in the short term, the natural rubber market may fluctuate weakly. It is estimated that the weekly average price of SCRWF in Shanghai may be RMB 16,900/mt, and its mainstream prices may be in the range of RMB 16,500-17,500/mt. In the short term, players should pay attention to the macro sentiment change on the commodity market as well as the influence of the weather on feedstock output release.

Supply: There are rainfalls in South Thailand, but the output growth in Northeast Thailand is obvious. The purchase price of feedstock in producing areas may loosen, leading to a weak cost. Meanwhile, in the future, the output of natural rubber may ramp up, putting pressure on the price.

Demand: In the short run, the end consumption market may continue to remain soft. Tire enterprises may face high pressure from cost and inventory. The demand may hardly improve. Yet, drops in natural rubber prices may attract some players’ procurement when the price is low, underpinning the price from the bottom.