Indian shares are set to open marginally higher on Monday, with market reaction to the earnings of top private lender HDFC Bank, as well as Kotak Mahindra Bank and Tech Mahindra in focus.

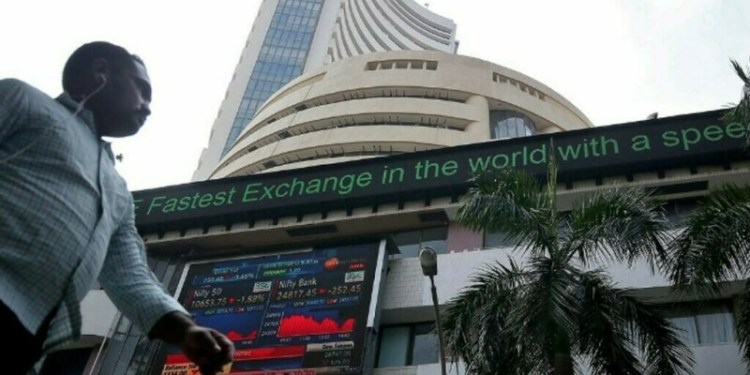

The Gift Nifty was trading at 24,927.5 as of 07:14 a.m. IST, indicating that the benchmark Nifty 50 will open slightly above its Friday’s close of 24,854.05.

The NSE Nifty 50 and S&P BSE Sensex dropped about 0.4% and 0.2% in the previous week, third such consecutive week of losses.

Sustained foreign outflows from India, due to investors redirecting funds to China on stimulus package and relatively cheaper valuations as well as a mixed earnings season so far have led to the drop, according to analysts.

Markets reaction to results of top private lender HDFC Bank, the heaviest stock in the benchmark indexes, will be crucial for the trajectory on Monday. HDFC Bank posted a standalone net profit above analysts’ average forecast in the September quarter.

The lender also said it aimed to lower its loan-to-deposit ratio to pre-merger levels in the next two to three years.

Private lender Kotak Mahindra Bank could see some selling pressure on the day, after it reported a sequential margin contraction and asset quality deterioration in the second quarter.

Information technology company Tech Mahindra, which reported a quarterly revenue growth over the weekend, will also be in focus.

Foreign institutional investors have sold Indian equities in the previous 15 sessions in a row, on a net basis.

They net offloaded domestic shares worth 54.86 billion rupees ($652.7 million) on Friday, according to provisional data from National Stock Exchange.

Indian shares rebound after 3-day slump

Foreign selling is on track to hit a record high in October.

The Nifty is down 3.7% this month, set for worst monthly performance since September 2022.

Source: Brecorder