Pakistan Stock Exchange (PSX) maintained a bullish trend on account of positive economic indicators and relative stability on the political front, as the benchmark KSE-100 Index gained more than 800 points on Monday.

The KSE-100 started the session with a buying spree that largely continued till end of the day.

At close, the benchmark index settled at 86,057.52, up by 807.42 points or 0.95%.

“The session exhibited positive momentum following a reduction in political uncertainty, highlighted by the Senate’s approval of the 26th Constitutional Amendment Bill 2024, which passed with a two-thirds majority on Sunday evening. Subsequently, the National Assembly also ratified this contentious legislation,” brokerage house Topline Securities said in its post-market report.

President Asif Ali Zardari gives assent to 26th Constitutional Amendment

Key contributors to the index included MTL, UBL, ATRL, HUBC, and PIOC, which collectively added 274 points, it added.

Experts attributed the buying rally to positive economic indicators including the expectation of a lower inflation reading this month.

“The market is expecting a CPI reading of below 7% in October,” said Saad Hanif, analyst at Ismail Iqbal Securities.

“However, the latest adjustment in electricity tariff may lead to an uptick in inflation,” he added.

The analyst was of the view that development on the political front is also boosting market confidence.

The National Assembly, after weeks of political negotiations, passed the 26th Amendment Bill, a judiciary-related constitutional package, in the wee hours on Monday.

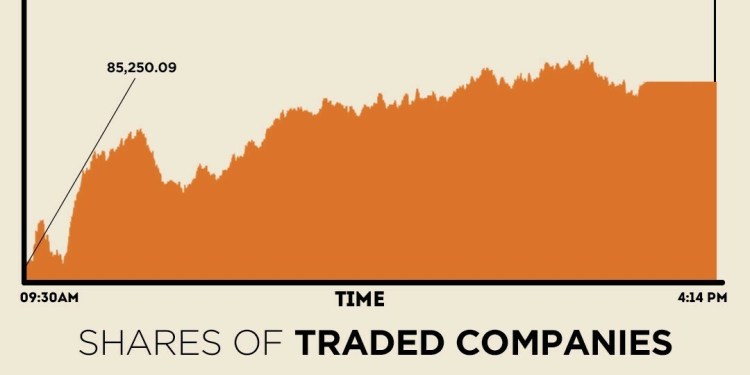

During the previous week, PSX witnessed a mixed trend after moving in both directions and finally closed on a negative note. The benchmark KSE-100 index declined by 233.31 points on week-on-week basis and closed at 85,250.09 points.

On Friday, profit-takers had held sway over the market as the KSE-100 lost 335 points.

The foreign investors also remained on the selling side and withdrew $11.614 million from the local equity market. Total market capitalization increased by Rs21 billion to Rs11.177 trillion.

Globally, Asian shares dipped in and out of positive territory on Monday, under pressure from weakness in Chinese stocks, but bitcoin scaled a three-month peak as “Trump trades” continued to ramp up.

Gold hit another record high on conflict in the Middle East and an extremely close U.S. presidential election, with the yellow metal expected to stay in favour among much global uncertainty.

Optimism over Beijing’s slew of stimulus measures first announced late in September has turned into caution in recent days as investors look to further details of more fiscal support from policymakers.

Equities in Hong Kong were last down 0.6%, while China’s blue-chip index swung between losses and gains. It last traded 0.4% higher, while the Shanghai Composite Index gained 0.36%.

That capped gains in MSCI’s broadest index of Asia-Pacific shares outside Japan which were last up a marginal 0.11%, a step back in sentiment after U.S. stocks posted a sixth straight week of gains on Friday.

Meanwhile, the Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.03% in the inter-bank market on Monday. At close, the currency settled at 277.69, a loss of Re0.08 against the greenback.

Volume on the all-share index increased to 474.95 million from 323.92 million on Friday.

The value of shares rose to Rs19.66 billion from Rs15.68 billion in the previous session.

Kohinoor Spining was the volume leader with 59.10 million shares, followed by Pak Int.Bulk with 27.87 million shares, and Flying Cement with 18.49 million shares.

Shares of 445 companies were traded on Monday, of which 269 registered an increase, 124 recorded a fall, while 52 remained unchanged.

Source: Brecorder