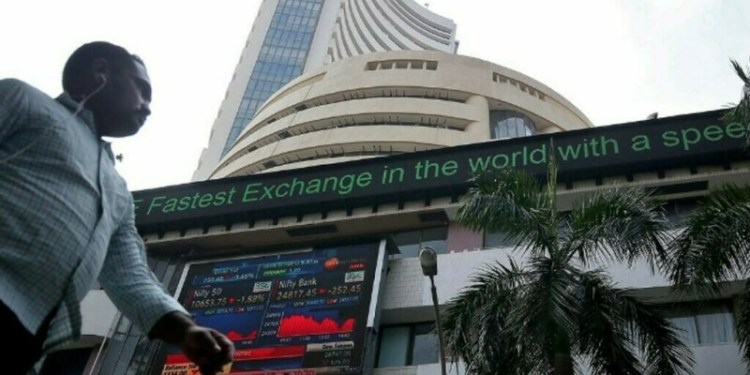

Indian shares are set to open flat on Tuesday, with lacklustre earnings and sustained foreign selling weighing on markets, while caution over the Middle East conflict dragged global equities lower.

The Gift Nifty was trading at 24,815 as of 08:03 a.m. IST, indicating that the benchmark Nifty 50 will open near its Monday’s close of 24,781.1.

Foreign outflows from Indian equities continued for the 16th consecutive session on Monday, as investors redirected funds from India to China on the recently-announced stimulus measures and relatively cheaper valuations.

Foreign institutional investors have sold about $10 billion worth of Indian stocks so far in October, surpassing the previous record monthly outflow of $8.35 billion in March 2020, the onset of the COVID-19 pandemic.

The benchmarks settled lower on Monday, as dull earnings and another bout of profit booking overpowered a post-results rally in top private lender HDFC Bank.

After rising about 15% in the last four months on policy continuity and macroeconomic stability, the Nifty 50 witnessed selling pressure this month, shedding about 5.7% since hitting a record high on Sept. 27.

Asian markets opened lower on the day with the MSCI Asia ex-Japan index dropping 0.4%.

Indian shares rebound after 3-day slump

Wall Street equities logged losses overnight as caution loomed on rising geopolitical tensions in the Middle East.

While markets remained largely risk-averse due to uncertainty over US presidential elections and demand recovery in China, safe haven asset gold hit record highs.

Source: Brecorder