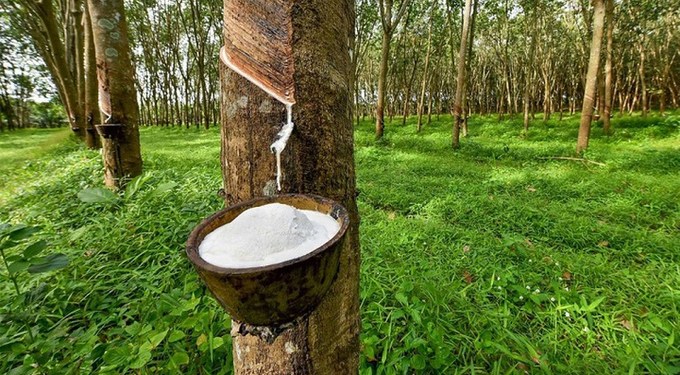

KOTTAYAM: The rubber plantation sector, which experienced a resurgence following a record price rise in August, appears to be facing uncertainty as prices have nosedived in the domestic market within a span of two months. After reaching an all-time high of Rs 247/kg on August 9, rubber price plummeted to Rs 187/kg as of Monday, causing panic among both farmers and dealers.

Given the extreme volatility prevailing in domestic rubber market, the Rubber Board has scheduled a meeting with major manufacturers on October 28 to address the situation. Its intervention comes after representatives of the Indian Rubber Dealers Federation (IRDF) met with Rubber Board executive director M Vasanthagesan and other officials on Monday.

Dealers attribute the price drop to the abstention of manufacturers, especially tyre companies, from market. This has put the rubber industry into a severe crisis, prompting dealers to seek the board’s assistance. “For the past eight days, none of the tyre companies have purchased rubber. They are refusing to buy the stock they have already ordered,” said Biju P Thomas, secretary, IRDF. According to Rubber Board statistics, prices recorded a 17% drop in October alone.

“As per prices published by the board, the RSS grade 4, was priced at Rs 187/kg on Monday. However, even at Rs 180/kg, there were no takers among companies. Most dealers are stuck with rubber purchased at an average price of `200/kg with no buyers in sight due to companies abstaining from the market,” Biju added.

The Rubber Board also views this situation as serious, especially when tapping season is reaching its peak. “The situation is leading to a free fall in rubber prices, which could have a serious impact on the entire rubber sector. The board intends to advise manufacturers to lift rubber from the market to maintain an equilibrium,” said an official with the board.

The farmers alleged that tyre firms have already imported ample stock to manipulate the domestic market during peak tapping season. Notably, the Rubber Board’s latest statistics show a 22% rise in rubber imports from April to September, with 3,10,413 metric tonnes imported in this period in 2024-25 compared to 2,54,488 metric tonnes in the same period in 2023-24. The companies also claim to have a significant inventory of finished products, which is why they have decided to temporarily abstain from market.

To address this, the board is planning to promote rubber export. Sources said it is organising a meeting with exporters next week to discuss this. “Despite current challenges, there remains a captive demand in domestic market. Even limited buying can help prevent free fall of prices,” said an official.

By focusing on exporting rubber and maintaining domestic demand, the board aims to stabilise the market and prevent further decline in prices.

Abhilash Chandran