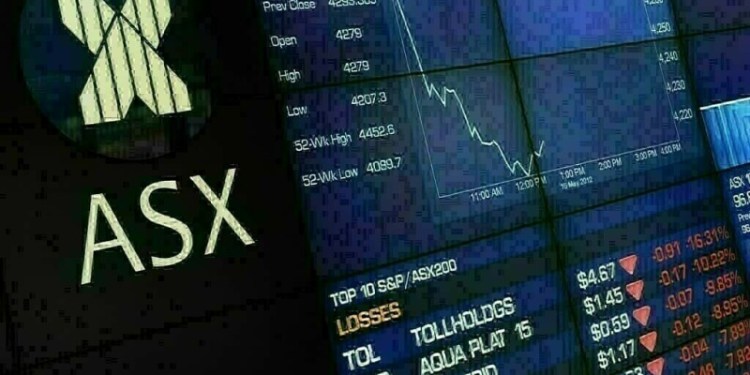

Australian shares struggled for a clear direction on Monday as gains by miners partially offset energy and gold stocks, while investors remained on the sidelines ahead of local inflation data due this week.

The S&P/ASX 200 index shed early gains of 0.2% to trade flat, as of 2236 GMT. The benchmark ended 0.1% higher on Friday.

Markets in Australia await data on inflation, a favoured measure for the central bank to assess its interest rate trajectory.

The Reserve Bank of Australia has said that the maintained cash rate of 4.35% is restrictive enough to bring inflation to its target band of 2%-3% while preserving employment gains.

Investor focus was also on a slew of quarterly corporate production and earnings reports this week, including from grocery chains Woolworths and Coles.

Shares of Australian miners advanced 0.5% as iron ore prices firmed on anticipation of further stimulus measures from China, the country’s largest trading partner.

Australian shares rise on commodity boost; QBE Insurance falls on regulatory woes

Mining giants Rio Tinto, BHP Group and Fortescue were up between 0.5% and 1.2%.

Technology stocks climbed 0.6%, catching the tailwind from a bounce on Nasdaq last week.

Shares of technology majors Xero rose 1.3%, while WiseTech Global was flat.

Domestic gold stocks emerged as the biggest percentage losers in the benchmark index, falling 1.6%, even as bullion prices edged up.

Gold miners Northern Star Resources and Evolution Mining were down 4.2% and 1.7%, respectively.

Energy stocks slipped 1.1% to their lowest levels since Sept. 23, as oil prices fell after Israel showed restraint in strikes on Iran, easing geopolitical tensions.

Energy major Woodside and smaller rival Santos fell 0.8% and 0.4%, respectively.

Banking stocks struggled for direction, with the sub-index largely flat in early trade before slipping 0.2%. Shares of Commonwealth Bank of Australia, the country’s largest bank, declined 0.2%.

Markets in New Zealand were closed for a public holiday.

Source: Brecorder