This article was written exclusively for Investing.com.

Lots of action in cryptocurrencies in 2021

Events have pushed prices to successive record highs

New tokens continue to come to the market every day

Rose Finance: a new arrival

A huge price spike and correction on ROF

Volatility can be a nightmare for investors. However, it creates a paradise of opportunities for nimble traders with their fingers on the pulse of markets or assets that exhibit wide price variance.

At the same time, traders and investors love nothing more than a trending bull market. Bull markets appeal to our emotions even as they trigger our greed impulses. A hot stock tip is a reason many investors will buy a company’s shares. When the media’s spotlight focuses on a particular company, volume in its stock tends to soar.

I’ve been trading and investing in markets across all asset classes for over four decades. I have never seen anything like the price action or appreciation cryptocurrencies have offered market participants.. In 2010, when Bitcoin was trading at five cents per token, one dollar bought twenty tokens.

On Oct. 20, 2021, eleven years later, Bitcoin reached another new record high at $67,680. Anyone that held those twenty tokens for eleven years turned a one-dollar investment into a $1,353,600 fortune. The rise reflects the decline in currency values along with the growth of an asset class that offers an alternative means of exchange, and a speculative frenzy not seen in our lifetime.

Each day, new tokens are coming to the market, hoping to replicate Bitcoin’s success. Some will succeed, but most will fail. Rose Finance (ROF) is a new arrival, and the price of the token—likely driven by feverish investors looking for what equity markets call the next ten-bagger—has exploded higher over its early days in October 2021.

Lots of action in cryptocurrencies in 2021

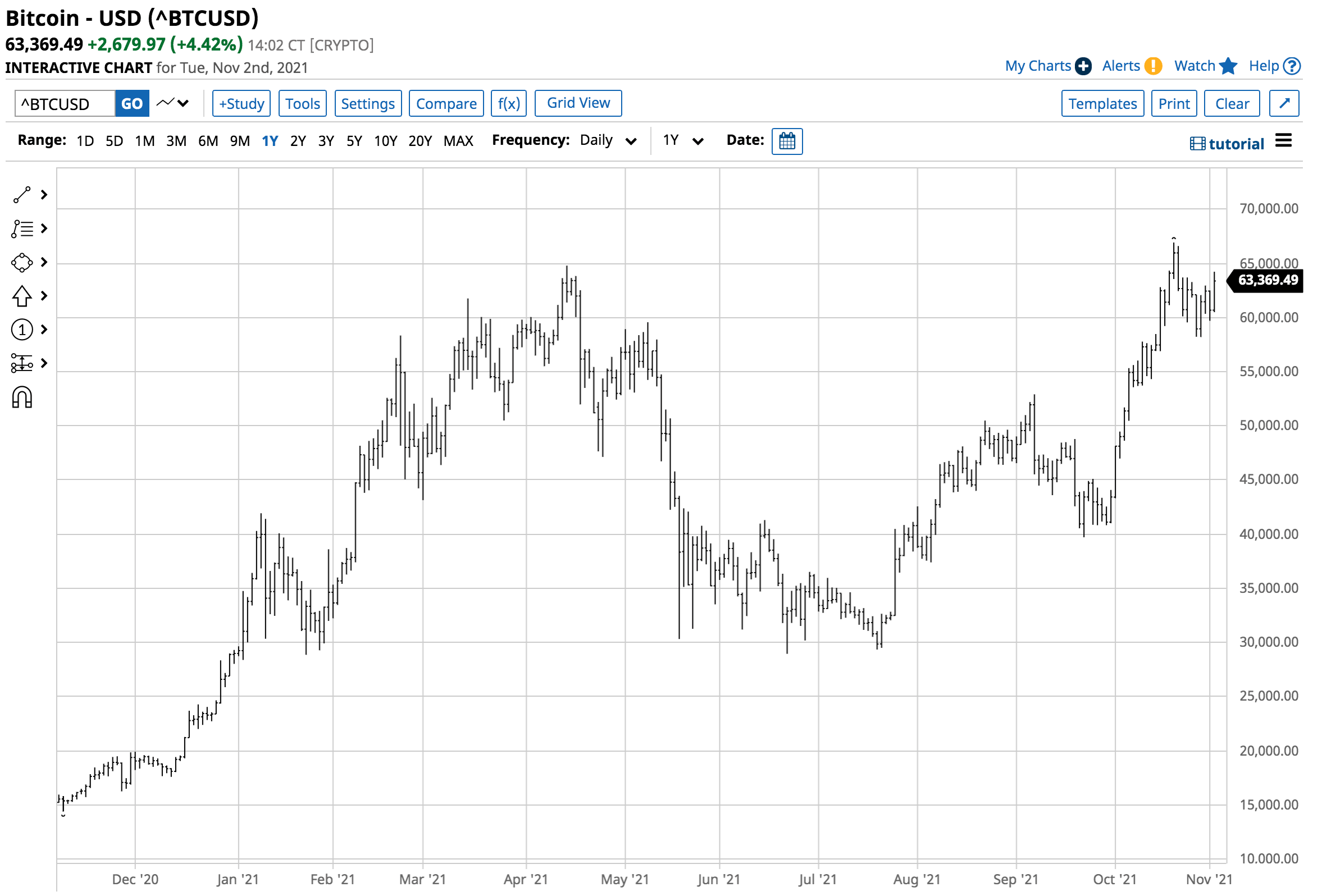

In 2021, Bitcoin posted an impressive gain.

BTC/USD Daily

BTC/USD Daily

Source: Barchart

After settling at $28,986.74 on Dec. 31, 2020, Bitcoin was trading at the $63,370 level on Nov. 2, an over 118% gain. The price action in Ethereum, the second-leading cryptocurrency, has been even more impressive.

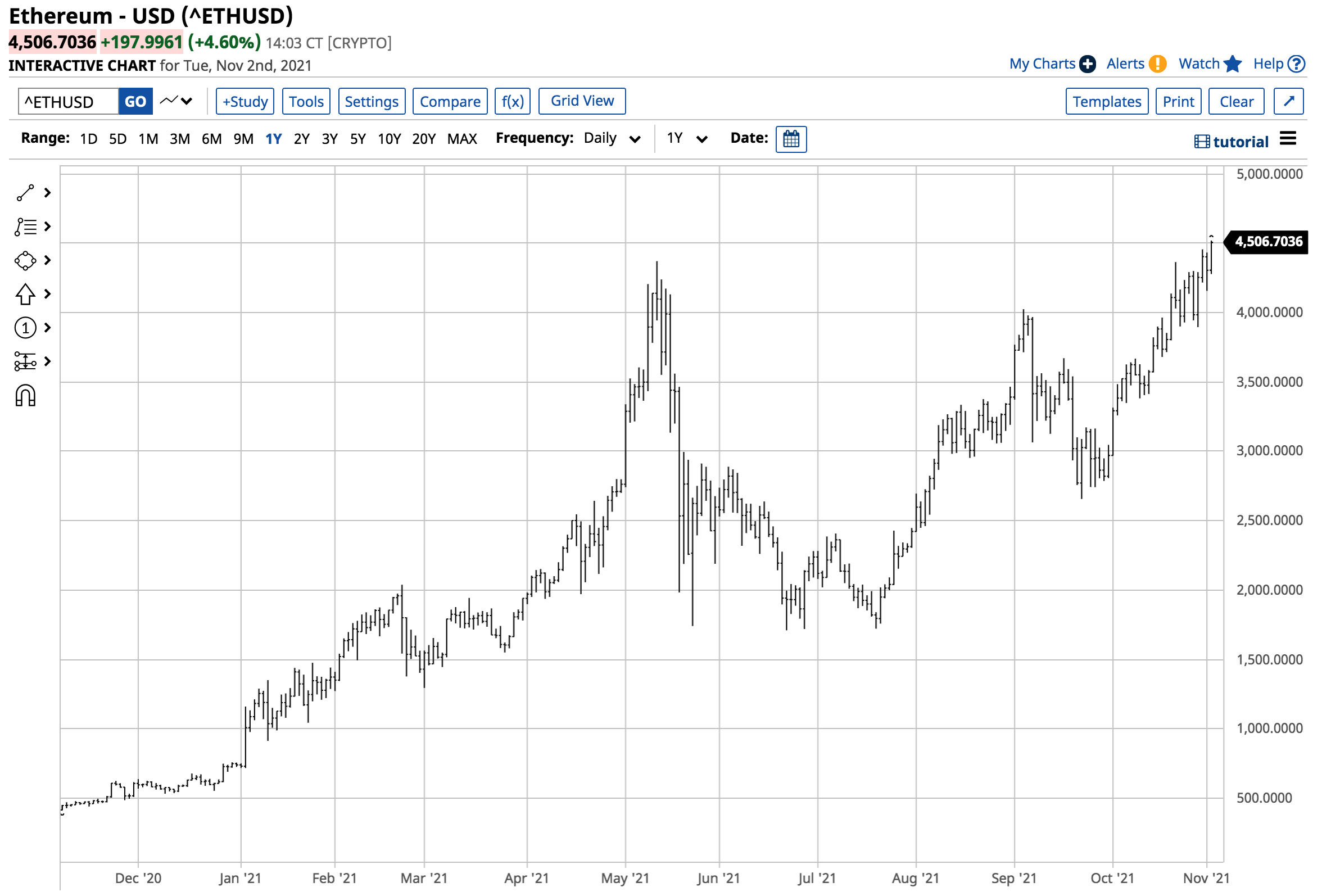

ETH/USD Daily

ETH/USD Daily

Source: Barchart

Ethereum moved from $738.91 on Dec. 31 to the $4,500 level on Nov. 2. The cryptocurrency moved over six times higher over the past ten months.

The moves for both digital tokens did not occur in a straight line as there were corrections. However, cryptos overall continue to remain in a bullish trend of higher lows and higher highs.

Events have pushed prices to successive record highs

Over the past years, events have helped increase acceptance of the cryptocurrency asset class as mainstream assets, and means of exchange have expanded the addressable market for digital tokens. In February, Ethereum futures began trading on the CME, pushing the price higher. In April, the Coinbase (NASDAQ:COIN) crypto exchange listing on NASDAQ was another event that increased the asset class’s visibility and tradability.

The latest event was the Oct. 19 introduction the ProShares Bitcoin Strategy ETF (NYSE:BITO). All three events pushed prices to new highs, which is nothing new. The CME launch of Bitcoin futures in December 2017 pushed the price of the leading cryptocurrency over $20,000 for the first time.

New tokens continue to come to the market every day

At the end of 2020, 8,153 cryptocurrencies comprised the asset class. On Nov. 2, 2021, the number stood at 13,513, a 65.7% increase in the number of new tokens available to investors. Moreover, at the end of last year, the asset class’s market cap stood at $767.482 billion compared to $2.728 trillion on Nov. 2, an increase of over 3.55 times the level on Dec. 31, 2020.

Bitcoin and Ethereum continue to be the leaders as they account for over 63% of the market cap. Many new arrivals will wind up as dust collectors in cyberspace, but some are diamonds in the rough, and these could offer incredible price appreciation.

The bull market in Bitcoin and Ethereum is spurring a speculative frenzy with market participants throwing money at new arrivals in a wealth quest not seen since the US gold rush in the 1850s that caused migration from east to west in the United States.

Rose Finance: a new arrival

Rose Finance’s (ROF) website describes the token as a “project towards mass growth by taking advantage of the social network.” Rose Finance’s proprietary growth engine seeks to attract followers and ‘likes’ at “the most optimal rate to increase engagement and retention.”

The token and its protocol are brand new amid a four-phase rollout leading to the launch of a “Rose Wallet” that will hold the ROF tokens.

As of Nov. 2, ROF was the 5,088th token, in the top 60% of the asset class. However, ROF tokens have only been around since Sept. 23, 2021.

Huge price spike and correction in ROF

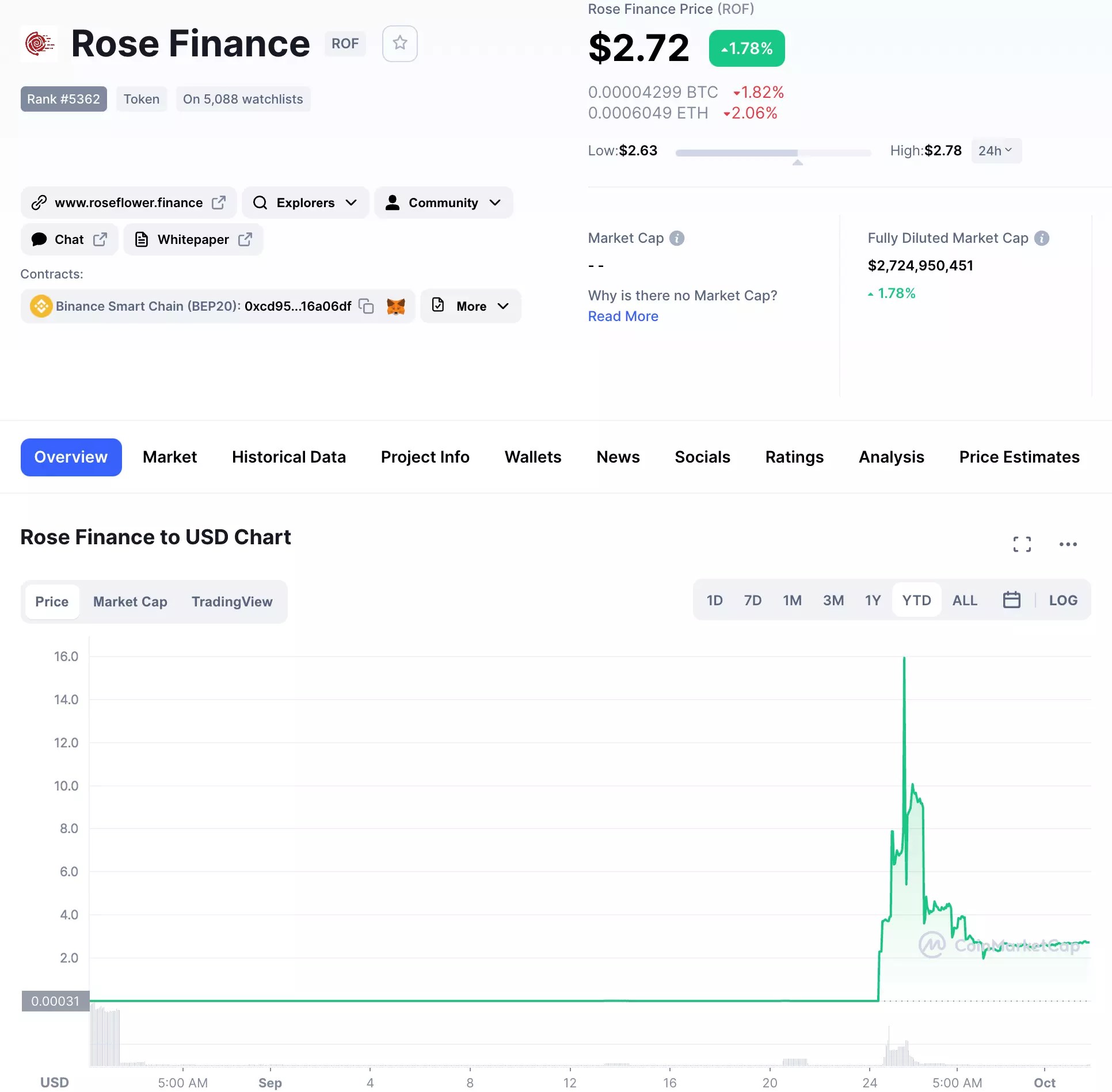

The earliest investors and holders of ROF tokens saw an incredible price jump and experienced fantastic returns from the price on Sept. 23 to the high on Oct. 26.

Source: CoinMarketCap

The chart shows that ROF was at $0.0002687 per token on Sept 23. On Oct. 26, it rose to a high of $15.94. A $1 investment on Sept. 23 was worth over $59,000 on Oct. 26, not bad for just a little over one month. At the $2.72 level on Nov. 2, that one dollar was worth over ten grand.

Rose Finance

Rose Finance

Source: Investing.com

Ranked 6057 on Nov. 4 by Investing.com, ROF is now trading at $3.32567.

Rose Finance is another one of thousands of examples of the speculative frenzy that has gripped the cryptocurrency asset class in 2021. This post isn’t a recommendation of the token, just an illustration of how rapidly and forcefully the asset class is growing.

Only invest capital you are willing to lose as the risk is always a function of the potential reward. Incredible rewards carry similar risks. The buyer must beware.

Source: Investing.com