A powerful rally in the shares of companies that produced breakthrough vaccines to provide protection against the deadly coronavirus is showing signs of peaking.

Moderna (NASDAQ:MRNA) shares closed down almost 18% yesterday after the company’s sales and earnings missed analysts’ target by a big margin. The Massachusetts-based Moderna told investors its vaccine sales would be between $15 billion and $18 billion in 2021. Previously, the company had said it had signed agreements for $20 billion in anticipated 2021 vaccine sales.

In a statement, Moderna said longer lead times for international orders may shift some deliveries into 2022. The company cited a “temporary impact” as it attempts to expand its capacity to fill and finish vaccine vials.

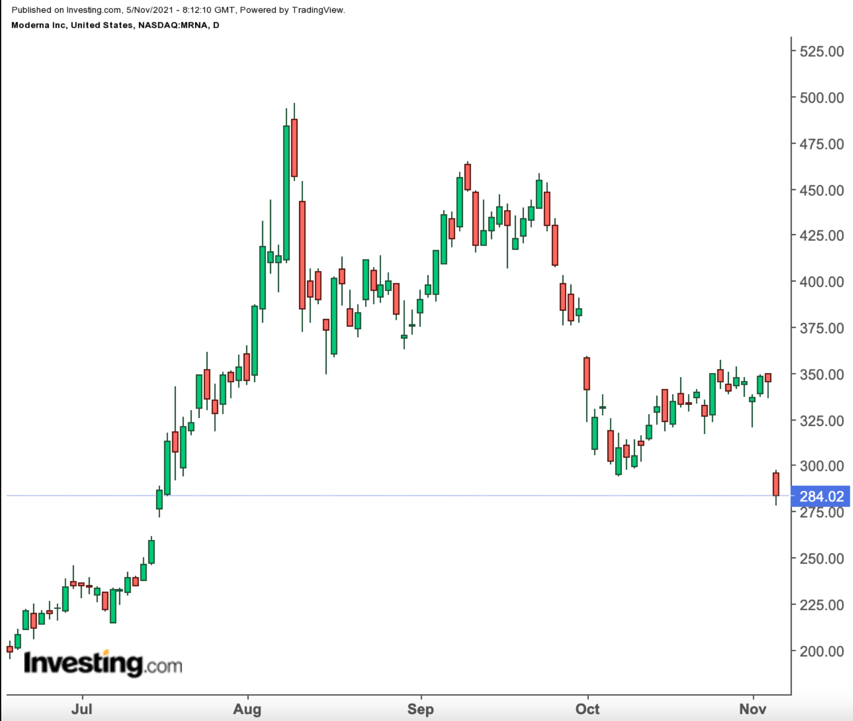

Moderna stock, which closed yesterday at $284.02, has lost a quarter of its value during the past three months and more than 40% since reaching a record high in August. Pfizer (NYSE:PFE), another global vaccine giant, has hardly budged during the past three months.

Pfizer Weekly Chart.

Pfizer Weekly Chart.

Even before Moderna’s earnings setback, investors in vaccine stocks were getting nervous on the long-term viability of this trade. Vaccine stocks got hammered last month after the drug-maker Merck & Company (NYSE:MRK) said a study showed its pill slashed the risk of getting seriously ill or dying from COVID.

Merck Weekly Chart.

Merck Weekly Chart.

Twenty months into the pandemic, a successful rollout of a COVID-19 pill could quicken and broaden the world’s recovery, diminishing the appeal for vaccine stocks.

The U.K. became the first country to authorize Merck’s take-home therapy yesterday.

U.K. Health Secretary Sajid Javid said in a statement:

“This will be a game-changer for the most vulnerable and the immunosuppressed, who will soon be able to receive the groundbreaking treatment.”

Vaccines Versus Therapies

Besides the Merck pill, there are other competitors and potential therapies emerging that could hit sales of the leading vaccine producers, including Moderna, Pfizer and Johnson & Johnson (NYSE:JNJ). A generic and low-cost anti-depressant, for example, may reduce the risk that COVID-19 will land an infected patient in the hospital, according to a Brazilian study published in the Lancet Global Health journal.

In the largest clinical trial evaluating the anti-depressant’s effect on COVID-19 to date, patients who received fluvoxamine were significantly less likely to require hospitalization than those who didn’t, according to a Wall Street Journal report.

India, one of the largest vaccine producers, is quickly expanding its exports after its earlier setbacks due to increased demand at home. The World Health Organization this week granted emergency authorization to a COVID vaccine co-developed by India’s medical-research agency and local manufacturer Bharat Biotech International Ltd. The WHO’s approval may accelerate the resumption of vaccine shipments from India, which halted exports in April to prioritize its own citizens amid a lethal second coronavirus wave.

According to Morgan Stanley analyst Matthew Harrison, vaccines continue to remain the primary prevention measure and largest market opportunity, but it’s unclear how big that market will be.

Harrison’s forecast for annual coronavirus vaccine sales over the long term ranges from $3 billion to $30 billion. He has equal-weight ratings on Pfizer and Moderna.

Bottom Line

We believe the best days to make money on vaccine stocks are behind us. More vaccine supplies, from the low-cost producers like India to the authorization of antiviral pills like the one Merck has developed, will continue to weigh on the sales of western vaccine producers, including Moderna and Pfizer.

Source: Investing.com