Fed doubles tapering speed, projects multiple rate hikes

ECB, BOE policy decisions on tap

Treasury yield curve steepens

Key Events

US futures, along with European shares, all soared on Thursday, extending yesterday’s rebound during the Wall Street session. Contracts on the Dow Jones, S&P 500, NASDAQ and Russell 2000, jumped on hopes that Federal Reserve tightening—which the central bank on Wednesday announced it would accelerate—will manage inflation without slowing down economic growth.

Markets are also waiting for ECB and BoE decisions scheduled for later today.

The dollar fell and gold opened higher.

Global Financial Affairs

Yesterday, the Fed said it would double the speed at which it’s rolling back its emergency bond purchasing program scaling to $30 billion a month. The central bank also projected a 75 BPS interest rate hike over the course of 2022, via three rate adjustments, plus a number of hikes in 2023 to rates up to 1.6%, and to 2.1% in 2024.

As well, the Federal Reserve warned of the potential risks from the latest COVID variant to the economy. Adding to the headwinds: a potential US-China standoff after the House of Representatives voted to ban imports from the Xinjiang region because of forced labor and human rights abuses.

The market narrative is now saying investors are confident the world’s most powerful central bank will successfully strike a delicate balance between reining in overheating inflation while at the same time not upsetting a fragile economic recovery. We can’t say where this optimism stems from, given there’s been a long run of awkward, if not clumsy, policymaking coming from the Fed, ever since COVID made its global appearance, not to mention when inflation reared its head.

We’d be shocked if markets won’t get volatile, even violently so, as global central banks begin tightening, especially during the worst global health crisis in a century.

Futures on the Russell 2000, the stocks most sensitive to a smoothly running economy, led the gainers on Thursday, after technology firms powered Wednesday’s rally during the New York session.

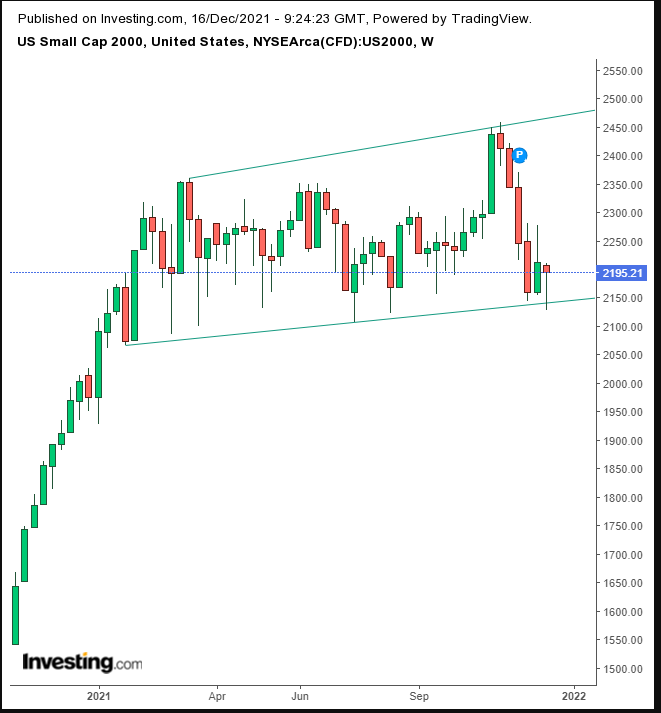

US2000 Weekly

US2000 Weekly

Yesterday, the Russell 2000 index advance created a weekly bullish hammer—pending a weekly closing price—at the bottom of a rising range. This move increases the likelihood of a return to retest the benchmark’s 2,458.85 record high, registered on Nov. 8.

This morning, stocks in Europe popped, with all sectors participating, gaining the most in a week.

Earlier Thursday, Asian benchmarks were mainly green. Japan’s Nikkei 225 finished up 2.1%, outperforming regional peers. Australia’s ASX 200 was the only regional index that fell, -0.4%.

Meanwhile, the S&P 500 Index climbed 1.63% on Wednesday, to within 0.05% of its Dec. 10 record close.

SPX Daily

SPX Daily

Now, the bulls have to prove they have what it takes to break the 4,720 price line, to resume the up move of the excessively rising channel. Conversely, if they fail, the price will again fall below 4,500, which would mark a top.

The broad benchmark has provided a wild ride for traders. The gauge dropped after the release of the FOMC statement. However, afterward, bulls came rushing out of the woodwork, pushing the index higher during the final two hours of the session.

Yields on the 10-year benchmark Treasury slipped.

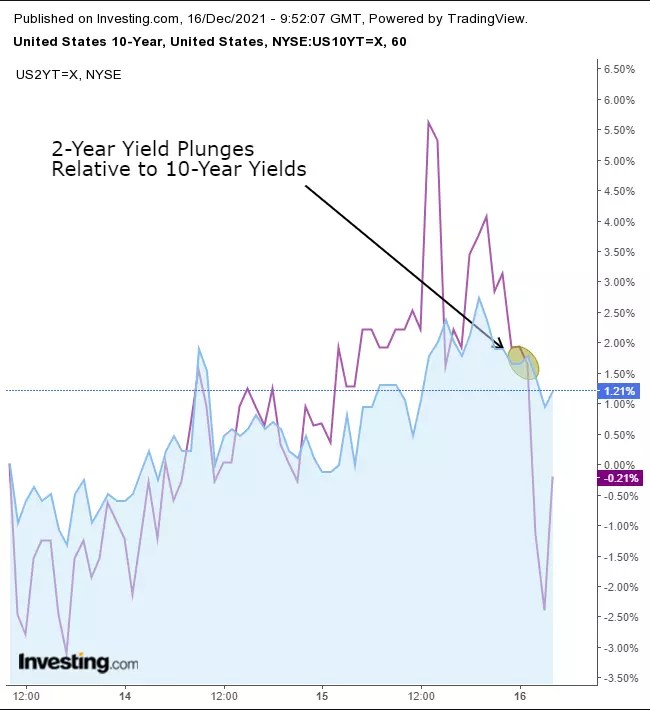

10Y:2Y Yield Curve

10Y:2Y Yield Curve

After narrowing over the past few weeks, with the advent of higher rates, the spread between 10- and 2-year yields steepened.

The dollar fell for a second day.

Dollar Daily

Dollar Daily

The drop is threatening to turn a bullish pennant into a double top.

Gold opened higher and continued gaining, rebounding from a two-day selloff.

Bitcoin was little changed after a back-to-back pair of daily rallies.

Oil opened higher, boosted by the same optimism propelling equities—that the Fed will manage a challenging time for the economy and that Omicron will not lead to lockdowns hurting oil demand.

Up Ahead

The BoE and ECB both release rate decisions on Thursday.

US Housing Starts, Initial Jobless Claims and Industrial Production all print on Thursday.

S&P Dow Jones Indices quarterly rebalance becomes effective after markets close on Friday.

“Quadruple witching” occurs in the US on Friday when options and futures on indexes and equities expire.

Market Moves

Stocks

The Stoxx Europe 600 rose 1.4% as of 8:19 a.m. London time

Futures on the S&P 500 moved up 0.4%

Futures on the NASDAQ 100 climbed 0.5%

Futures on the Dow gained 0.3%

The MSCI Asia Pacific Index rose 0.7%

The MSCI Emerging Markets Index added 0.7%

Currencies

The Dollar Index fell 0.1%

The euro rose 0.2% to $1.1306

The Japanese yen was little changed at 114.12 per dollar

The offshore yuan was little changed at 6.3733 per dollar

The British pound rose 0.2% to $1.3286

Bonds

The yield on 10-year Treasuries was little changed at 1.45%

Germany’s 10-year yield was little changed at -0.36%

Britain’s 10-year yield was little changed at 0.74%

Commodities

WTI crude advanced 1$ to $71.61 a barrel

Brent crude rose 1% to $74.62 a barrel

Spot gold rose 0.5% to $1,785.69 an ounce

Source: Investing.com