This article was written exclusively for Investing.com

US inflation continues to rise unabated; even falling energy prices in late 2021 did nothing to slow the ramp up. But looking towards 2022 and thinking about the stock market and the potential impacts inflation can have, one must wonder how the markets will digest slower earnings growth on top of persistent inflation.

S&P 500 earnings are forecast to rise by about 9% over the next twelve months, down from about 23% in May 2021. However, when considering inflation and the consumer price index that recently came in at 7.5% year over year, 9% earnings growth doesn’t seem that great for an S&P 500 trading around 20 times its next twelve months earnings estimates.

Growth Evaporate When Accounting For Inflation

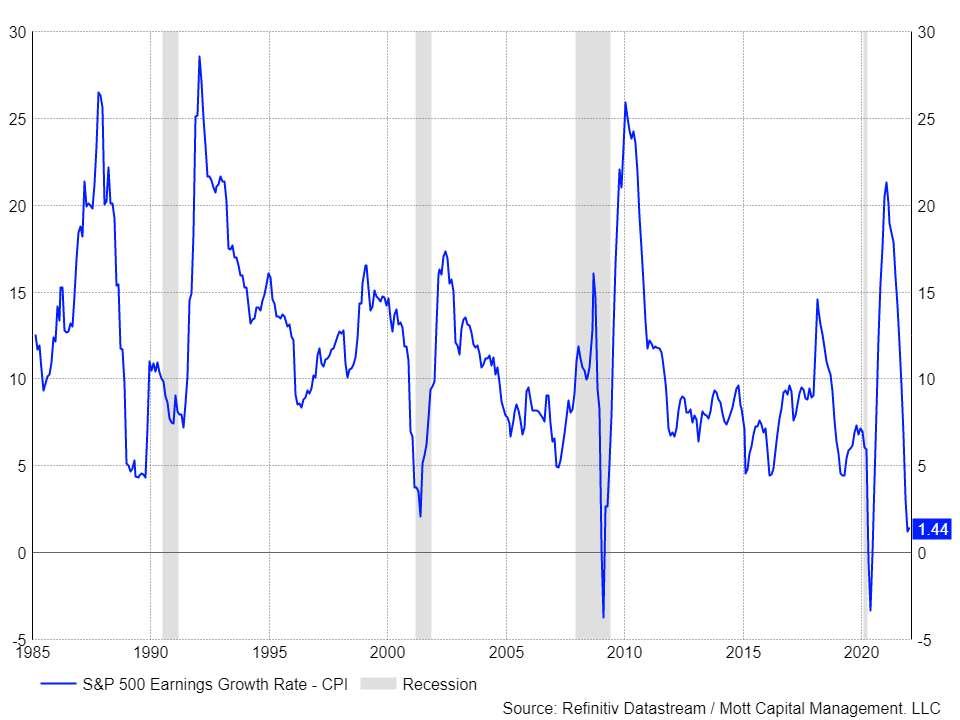

When subtracting the year-over-year change in CPI, real earnings growth for the S&P 500 will be pretty bad, at 1.5%. The only time the number was lower when accounting for the CPI was in the recessions of 2009 and 2020.

S&P Earnings Growth Rate

S&P Earnings Growth Rate

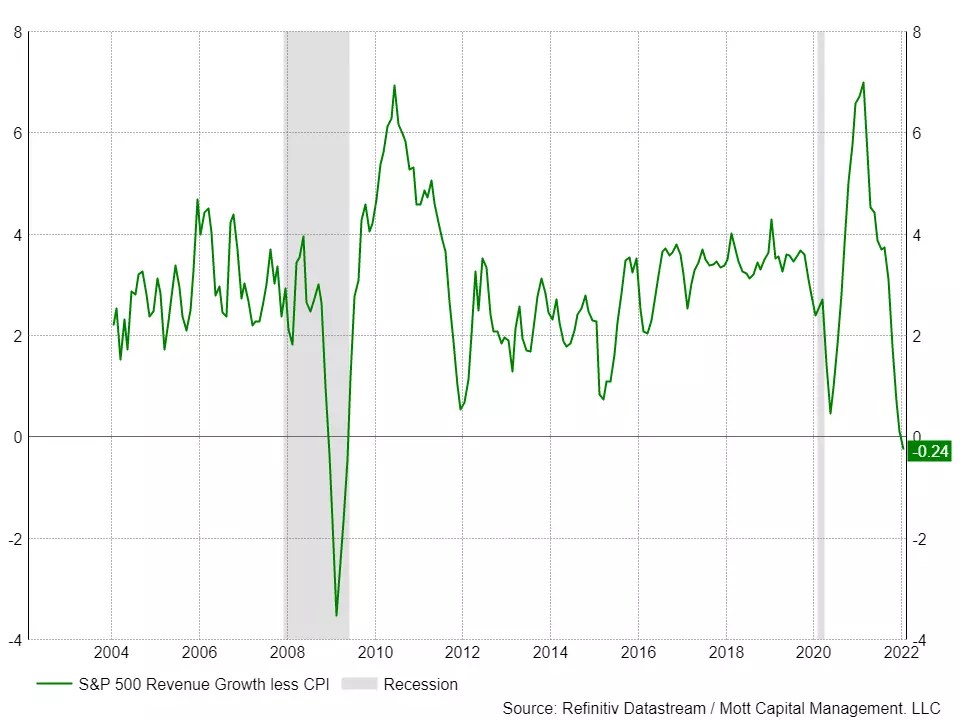

Those earnings growth estimates less CPI may be too high and never be reached. Sales growth for the S&P 500 is expected at 7.5% over the next twelve months, accounting for the CPI means that sales growth will be 0%. So for the S&P 500 to have any earnings growth, it will have to come on the heels of margin expansion, which probably means passing the rising costs on to the consumer. Otherwise, there is a good chance earnings estimates will prove too high, and if inflation doesn’t subside, even earnings growth could turn negative when subtracting CPI.

S&P Revenue Growth Less CPI

S&P Revenue Growth Less CPI

Stock Pickers Market

This means as an investor, being a stock picker and trying to find the companies that can grow earnings and revenue at rates exceeding inflation may be more important than ever. If that wasn’t challenging enough, finding those companies at reasonable enough valuation to account for rising real yields will make that feat even harder.

Many growth stocks have seen their valuation soar during the coronavirus pandemic as investors used low real-rates to value these companies, and as a result, their valuations went too high. Now, as real-rates rise to account for all this inflation and expectations that the Fed will raise the Federal Funds rate, many of these stocks are seeing their values decline. Additionally, it isn’t easy to know just how much growth some of these stocks have pulled forward over the past two years, which means slower growth in the future, making estimates potentially too high.

Materials and commodity sectors can continue to thrive as long as prices in those asset classes continue to rise. If prices stay high and companies can control their costs, they could see revenue and earnings growth which may outpace the broader markets’ growth rates and account for rising inflation rates.

We are in for a tricky period as investors try to figure out the market’s direction given the higher and longer than expected inflation, as well as how the Fed will handle it. Rising inflation hasn’t been an issue for the stock market in a very long time, so trying to navigate through it may see much confusion along the way. As real rates rise, contracting PE ratios on top of revenue and earnings growth which may underwhelm investors, will only make for a very challenging investing backdrop.

Source: Investing.com