It was a shock gold longs hadn’t experienced despite the travails of the past year. So when it happened, it left many asking: Is this possible at this heightened state of the gold market?

We’re talking about the historic plunge of nearly $100 from Thursday’s highs on New York’s COMEX that brought the benchmark April contract from its intraday peak of $1,976.50 an ounce to a session low of $1,878.60.

Half of the drop occurred over the length of the session, as the market settled at $1,926.30. The real jolt happened in the next 60 minutes of after-hours trade.

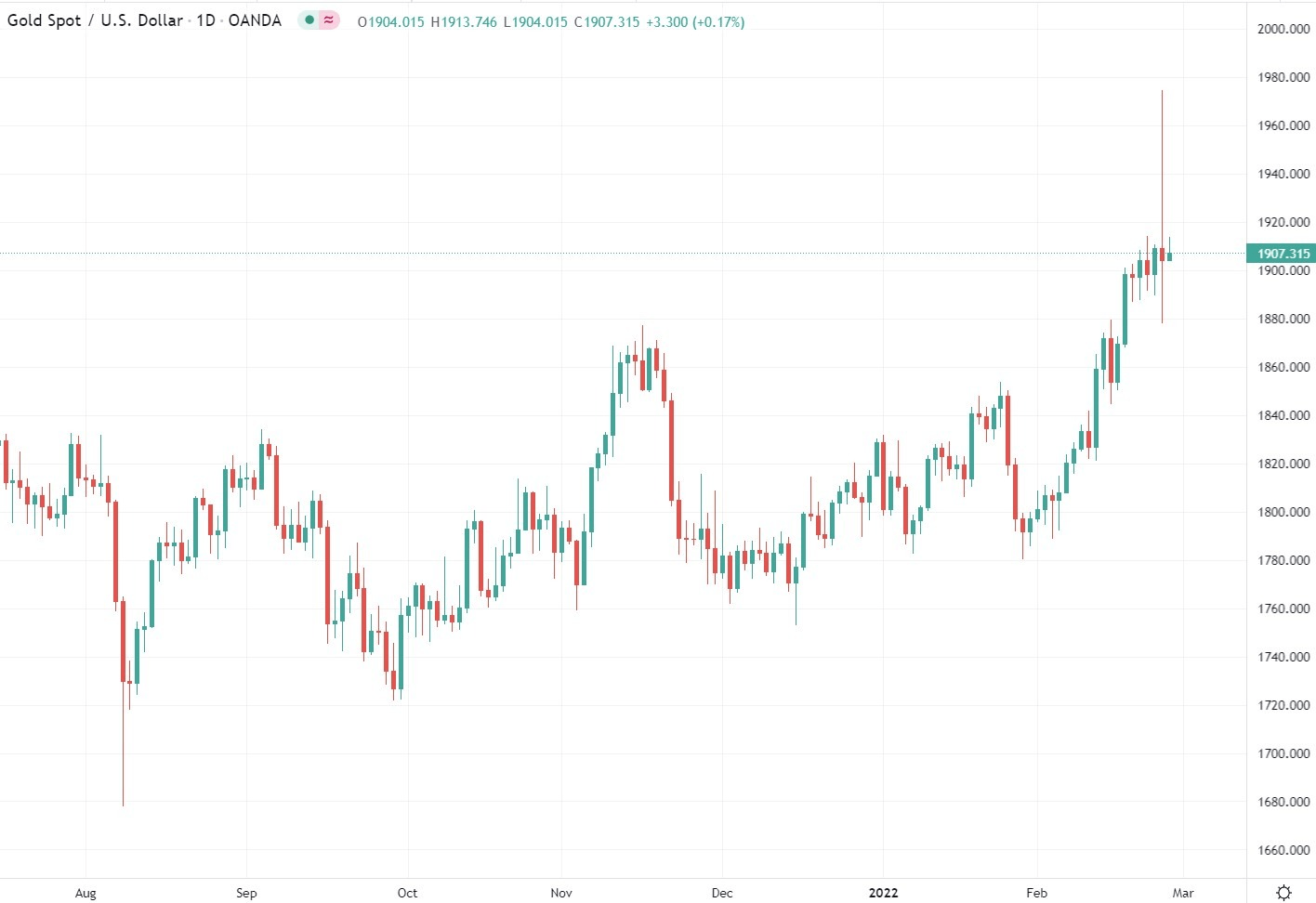

Gold Daily

Gold Daily

Source: Eamonn Sheridan. See the long red candle toward the end, representing the drop of nearly $50 on the day.

A mid-afternoon lull in Russia’s aerial, land and sea invasion of Ukraine—along with new sanctions on Moscow by President Joseph Biden that did not torpedo financial markets—blew off a chunk of Thursday’s geopolitical premium in gold.

What stunned many was that a 5% plunge on the day could still happen in a market that had almost everything bullish going for it: US inflation at 40-year highs; a Russia-West showdown unlikely to end anytime soon; and continued weakness in stocks that could divert more funds towards havens like gold.

“The very fact that amidst one of the worst geopolitical military crises, gold witnesses a $98 historic fall, raises questions on where gold is headed actually,” said Sunil Kumar Dixit, commodities strategist at skcharting.com.

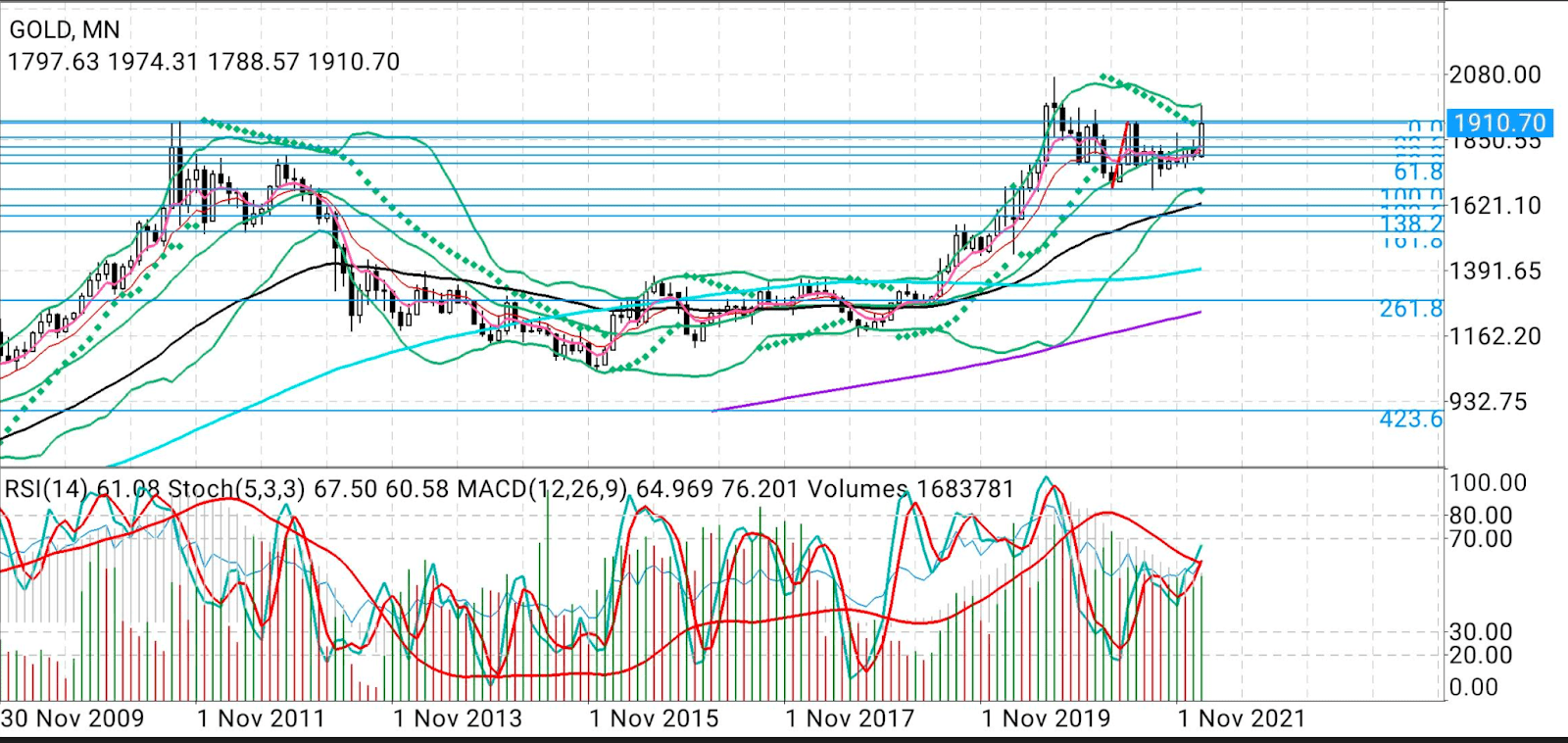

Gold Weekly

Gold Weekly

Source: skcharting.com

To be sure, there was no lasting damage to gold’s upward momentum from Thursday’s blip lower.

At the resumption of overnight trading after the 5:00-6:00 PM ET (22:00-23:00 GMT) break, April gold was back with its mojo, soaring to an intraday high of $1,925—almost to where it left off at settlement.

Yet, the incident from the previous day serves as a reminder of the wild intraday swings gold was still capable of within its heightened bullish state.

“The second-to-last candle” in Thursday’s session “is not a pretty one for the gold bulls,” economist Eamonn Sheridan remarked in a post on the ForexLive platform.

Sagar Dua, another analyst, concurred in a blog posted on FX Street.

“The precious metal nosedived with much more acceleration than it showed while scaling higher,” Dua wrote.

“It seems that the third law of motion kicked in and the yellow metal fell like there is no other day.”

It’s a dynamic that would serve gold bulls well to remember, ahead of Friday’s Personal Consumption Expenditure Index that could see another inflation spike supportive to bullion.

The so-called PCE Index jumped 5.8% in the year to December, growing at its fastest pace in four decades. For the year to January, economists tracked by Investing.com have forecast a growth of 6%.

Goldman Sachs said on Thursday that the rally in gold could get to a new record high of $2,350, aided by demand for ETFs, on the back of the situation in Ukraine.

At Investing.com, our reading shows gold could go even higher, to $2,500.

But at that point, we could also see intraday reversals of between $100 and $150 from the highs to the lows.

Gold Monthly

Gold Monthly

Source: skcharting.com

“Gold needs daily and weekly close above $1,916-$1,921 for a continuation of the bullish breakout, which aims to retest record highs above $2,075 amidst the global crisis,” said Dixit of skcharting in his study of spot gold.

But he also cautioned that a sustained move below $1,916 could push prices lower for a retest of the $1,894-$1,887 levels.

“Once below $1,878, you can see gold extend its weakness to $1,864-$1,844.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.

Source: Investing.com

![[Geojit Comtrade] Daily report on Natural Rubber: December 4, 2012](https://img.globalrubbermarkets.com/2024/08/geojit-comtrade-daily-report-on-natural-rubber-december-4-2012.jpg?resize=120%2C86&ssl=1)