Multi-year high commodity prices could dent global economic growth

Spiking oil price puts energy import-dependent countries at severe risk

Dollar strength continues

Key Events

On Wednesday, futures on the Dow Jones, S&P 500, NASDAQ, and Russell 2000 and shares in Europe recovered after whipsawing between gains and losses as traders remain concerned about the effect Russia’s invasion of Ukraine will have on the global economy and specifically commodity supply as energy and materials prices soared.

Yields slipped as investors moved into safe haven sovereign bonds.

Global Financial Affairs

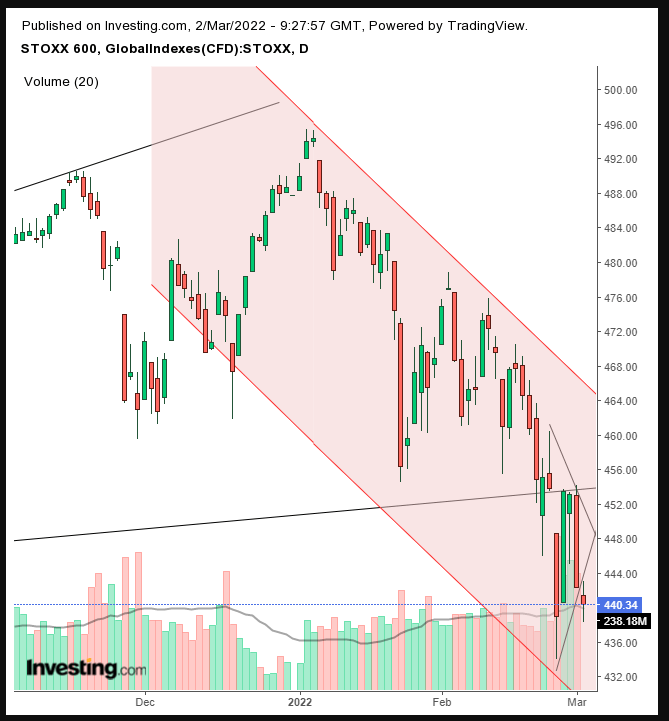

European stocks were marginally up after a poor performance yesterday. The STOXX 600 Index saw the same volatility seen in the US futures market. After rising and falling, prices recovered.

STOXX 600 Daily

STOXX 600 Daily

The pan-European benchmark may have completed a bearish pennant after topping out with a Rising Wedge.

Swedish telecommunications company Ericsson (ST:ERICb) dragged the sector lower after the U.S. Department of Justice declared the multinational did not adequately disclose its Iraqi operations.

Ericsson Daily

Ericsson Daily

The stock dropped 12%, extending the downside breakout of a top.

Earlier Wednesday, most Asian stocks were in the red. Hong Kong’s Hang Seng dropped 1.84%, underperforming the region, falling to two-year lows, as lockdown worries and soft auto sales there exacerbated global inflation spikes, supply disruptions, and ongoing worries about the conflict in Ukraine.

Falling 1.68%, Japan’s Nikkei 225 was the region’s second worst performer, with electrical machinery and transport shares leading the selloff as the expectation of a global recession increases.

Also, while Asian companies are less exposed to the Russia-Ukraine conflict than their European counterparts, countries reliant on oil imports are nevertheless exposed to the rapidly rising price of the commodity, which increases costs, depresses business investment, and reduces consumer spending. Japan is among the world’s top five oil importers.

The price of oil continues to skyrocket, hitting a new multi-year high ahead of an OPEC+ meeting after the IEA warned the war in Eastern Europe increased the risk to global energy security.

WTI crude jumped as much as 7.8%, crossing the $110 mark for the first time since Aug. 28, 2013.

Brent crude surged 7.64%, scratching the $113 level before retreating marginally, for the first time since June 27, 2014.

Brent Oil Daily

Brent Oil Daily

The price of Brent oil has broken free from a falling channel since the 2008 peak.

An array of commodity prices jumped the most since 2009, with wheat futures surging to a 14-year high and nickel rallying strongly.

A rush to protect capital boosted 10-year Treasuries, pushing yields lower, blowing out two continuation patterns.

10-year Treasuries Daily

10-year Treasuries Daily

However, rates found support above a huge symmetrical triangle between March 2021 and January 2022. We expect yields to bounce back up as long as this pattern holds, after the completion of a return move. However, higher rates will likely weigh on stocks.

The dollar extended a rally for the third straight day, challenging a bearish pattern.

Dollar Index Daily

Dollar Index Daily

The price has been finding resistance by an intraday high since Thursday of last week. Should the price close decisively higher, it will have blown out a Diamond top, which would likely propel the US currency higher along its previous rising trend, as marked by the rising channel.

Analysts expect Fed Chair Jerome Powell to signal that the Fed will continue with its plans to increase rates this month despite the war, as the US faces the worst inflation in four decades.

Gold retreated on both dollar strength and increased interest in Treasuries.

Gold Daily

Gold Daily

Technically, the yellow metal has been finding resistance by last Wednesday’s intraday high. We expect the price to continue higher, having completed a massive symmetrical triangle that’s been developing through all of 2021.

The rally in Bitcoin slowed after a two-day run, perhaps on dollar strength. There are also technicals affecting the mix.

Bitcoin Daily

Bitcoin Daily

The digital currency may be forming a small H&S continuation pattern, having completed a return move to a large H&S top.

Upcoming Events

The European Central Bank publishes the Account of its Monetary Policy Meeting on Thursday.

US initial jobless claims are released on Thursday.

The ISM non-manufacturing PMI is printed on Thursday.

Market Moves

Stocks

The STOXX 600 fell 0.4% but continues to waver

Futures on the S&P 500 were little changed

Futures on the NASDAQ 100 were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index fell 1.3%

The MSCI Emerging Markets Index fell 0.8%

Currencies

The Dollar Index rose 0.2%

The euro fell 0.3% to $1.1094

The Japanese yen rose 0.3% to 115.23 per dollar

The offshore yuan was little changed at 6.3211 per dollar

The British pound fell 0.02% to $1.3318 but is fluctuating

Bonds

The yield on 10-year Treasuries advanced one basis point to 1.74%

Germany’s 10-year yield rose to -0.03%

Britain’s 10-year yield increased eight basis points to 1.20%

Commodities

WTI crude was up 5.21% at $108.83 a barrel

Brent crude rose 5.5% to $110.70 a barrel

Spot gold fell 0.9% to $1,926.50 an ounce

Source: Investing.com

![[Geojit Comtrade] Daily report on Natural Rubber: December 4, 2012](https://img.globalrubbermarkets.com/2024/08/geojit-comtrade-daily-report-on-natural-rubber-december-4-2012.jpg?resize=120%2C86&ssl=1)