Shares of Chinese EV maker Nio are down more than 30% since the beginning of this year.

NIO will likely be volatile around Mar. 24 when the car group will release Q4 metrics.

Long-term investors could consider buying the dips in NIO, especially if they decline toward $20.

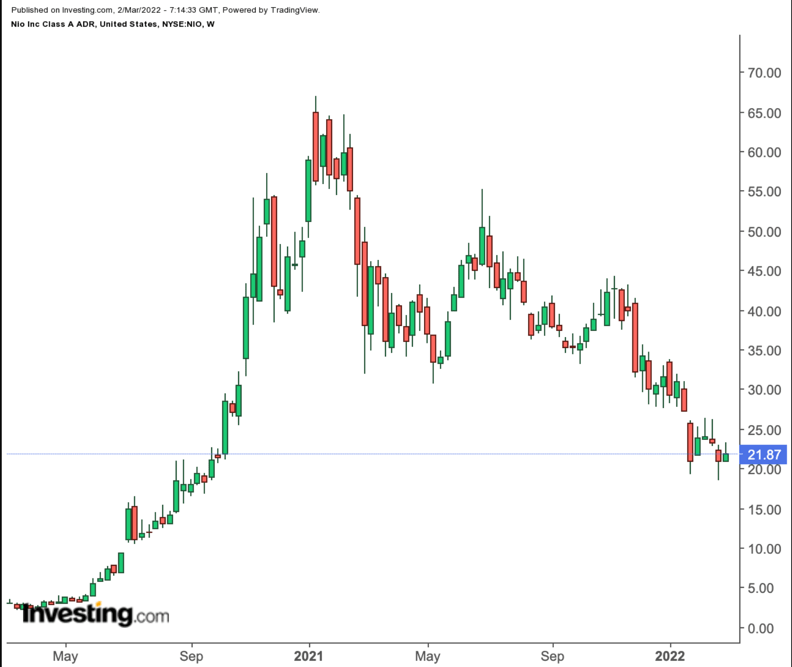

Shareholders in Chinese electric vehicle (EV) producer Nio (NYSE:NIO) have seen the value of their investment drop more than 59.2% over the past 52 weeks and 30.6% year-to-date (YTD). Meanwhile, the S&P Kensho Electric Vehicles Index is down 14.5% YTD.

NIO Weekly

NIO Weekly

By comparison, we can also look at shares of two other Chinese smart EV producers, namely Xpeng (NYSE:XPEV) and Li Auto (NASDAQ:LI)). Since the start of 2022, XPEV and LI shares have also lost 31.5% and 5.2%, respectively. Meanwhile, EV darling Tesla (NASDAQ:TSLA) stock is down 18.5% YTD.

Despite the recent declines, the first half of 2021 was a different story for NIO stock. On Jul.1, 2021, NIO shares went over $55 to hit a record high. However, on Feb. 24, 2022 shares saw a 52-week low of $18.47.

And yesterday, they closed at $21.87. The stock’s 52-week range has been $18.47-$55.11, with the market capitalization (cap) currently at $36.5 billion.

How Recent Metrics Came

On Mar. 1, Nio provided February 2022 delivery update. The EV group delivered 6,131 vehicles during the month, up 9.9% year-over-year (YoY). So far in the year, Nio has delivered 15,783, up 23.3% YoY.

Nio currently offers three models:

ES8 (six- or seven-seater electric SUV): it delivered 1,084;

ES6 (five-seater smart electric SUV): it delivered 3,309;

EC6s (five-seater electric coupe SUV): it delivered 1,738.

Since the company’s launch in November 2014, it has delivered 182,853 vehicles.

Management has also been preparing for March deliver of its ET7 model. The electric sedan is expected to have a range of up to 1,000 km or over 600 miles.

The carmaker will issue Q4 and FY2021 results on Mar. 24, so further share price volatility is likely around that time.

Next Move In NIO Stock?

Among 26 analysts polled via Investing.com, Nio shares have an “outperform” rating. Meanwhile, on InvestingPro, analysts’ 12-month average target price stands at $51.72.

However, according to a number of valuation models including P/E or P/S multiples, or terminal values, the average fair value for Nio stock is $20.84.

Put another way, shares could decline close to 5% from the current level.

Readers who watch technical charts might be interested to know that a number of Nio’s short- and intermediate-term oscillators are oversold. Although they can stay extended for weeks—if not months—the decline in price could also be coming to an end.

Our expectation is for NIO to find strong support around the $20 level. Although it might initially dip below it, shares are likely to bounce back before too long. Afterward, Nio stock would likely trade sideways while it establishes a new base.

Cash-Secured Puts on NIO

Price Now: $21.87

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in NIO stock now. They could expect the shares to make a move toward $51.72, or analysts’ price target.

Those who are experienced with options could also consider selling a cash-secured put option in NIO stock. As it involves options, this setup will not be appropriate for all investors.

Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own NIO shares for less than their current market price of $21.87.

A put option contract on NIO stock is the option to sell 100 shares. Cash-secured means the investor has enough money in his or her brokerage account to purchase the security if the stock price falls and the option is assigned. This cash reserve must remain in the account until the option position is closed, expires, or is assigned, which means ownership has been transferred.

Let’s assume an investor wants to buy NIO stock but does not want to pay the full price of $21.87 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for NIO stock to fall further, which it might or might not do. The other possibility is to sell one contract of a cash-secured NIO put option.

So, the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let’s assume the trader is putting in this trade until the option expiry date of May 20, 2022. As the stock is $21.87 at time of writing, an OTM put option would have a strike of $20.

So, the seller would have to buy 100 shares of Nio at the strike of $20 if the option buyer were to exercise the option to assign it to the seller.

The Nio May 20, 2022, 20-strike put option is currently offered at a price (or premium) of $2.32.

An option buyer would have to pay $2.32 X 100, or $232, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. The put option will stop trading on Friday, May 20.

Assuming a trader would enter this cash-secured put option trade at $21.87 now, at expiration on May 20, the maximum return for the seller would be $232, excluding trading commissions and costs.

The seller’s maximum gain is this premium amount if Nio stock closes above the strike price of $20. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of Nio stock is lower than the strike price of $20) any time before or at expiration on May 20, this put option can be assigned. The seller would then be obligated to buy 100 shares of Nio stock at the put option’s strike price of $20 (i.e., at a total of $2,000).

The break-even point for our example is the strike price ($20) less the option premium received ($2.32), i.e., $17.68. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on the choppiness in Nio stock in the coming weeks.

Investors who end up owning NIO shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.

Source: Investing.com

![[Geojit Comtrade] Daily report on Natural Rubber: December 4, 2012](https://img.globalrubbermarkets.com/2024/08/geojit-comtrade-daily-report-on-natural-rubber-december-4-2012.jpg?resize=120%2C86&ssl=1)