This article was written exclusively for Investing.com

New asset class

Bearish trend continues

1. Governments love blockchain and hate cryptos

2. Bearish reversal from the mid-November high

3. Other safe havens have taken up the bullish baton

Crypto bottom could be in; expect a rally to reignite the bullish fuse due to war and geopolitical tension

After weeks of spelling out the historical reasons why he believes Ukraine is nothing more than the Western portion of his country, on Feb. 24, Russian President Vladimir Putin ordered nearly 200,000 troops to invade Ukraine. The US, Europe, and Ukraine itself consider the Eastern European country a sovereign territory.

The invasion has sparked a series of geopolitical risks pressuring world governments its citizenry along with global financial markets—perhaps the most worrisome among recent threats.

Some market participants believe the relatively new cryptocurrency asset class can be used as both a hedge against inflation and as a safe haven asset during times of geopolitical turmoil. In early March 2022, with inflation raging, and the global political landscape deteriorating to a point where the potential for another world war is at the highest level since 1945, why haven’t digital currencies taken off?

New asset class

Bitcoin only burst on the scene in 2010, but the market for cryptos is even newer. Digital currencies only gained critical mass over the past five years.

The introduction of Bitcoin futures in late 2017 brought the leading crypto into the mainstream, pushing the price to over $20,000 per token. However, the token had been moving higher in extremely volatile conditions.

In 2010, Bitcoin was trading at five cents per token. In late 2013, the price rose to a high of $1,135.45 before falling back below $1,000 until 2017, when it exploded upward. Over recent years, the annual ranges have been nothing short of incredible:

In 2017, the range was from $762.38 to $19,862 per token

In 2018, the range was from $3,158.10 to $17,224.62 per token

In 2019, the range was from $3,355.25 to $13,844.30 per token

In 2020, the range was from $3,925.27 to $29,301.78 per token

In 2021, the range was from $28,957.79 to $68,906.48 per token

So far, in 2022, the range for cryptocurrency has been between $33,076.69 to $47,937.17. Bitcoin’s 2022 low has continued the pattern of higher lows, with 75% of the year remaining during which it can still attain a higher high.

Though geopolitical risks have been rising, three factors have weighed on cryptocurrency values through early March 2022. However, the potential for higher prices is climbing.

Bearish trend continues

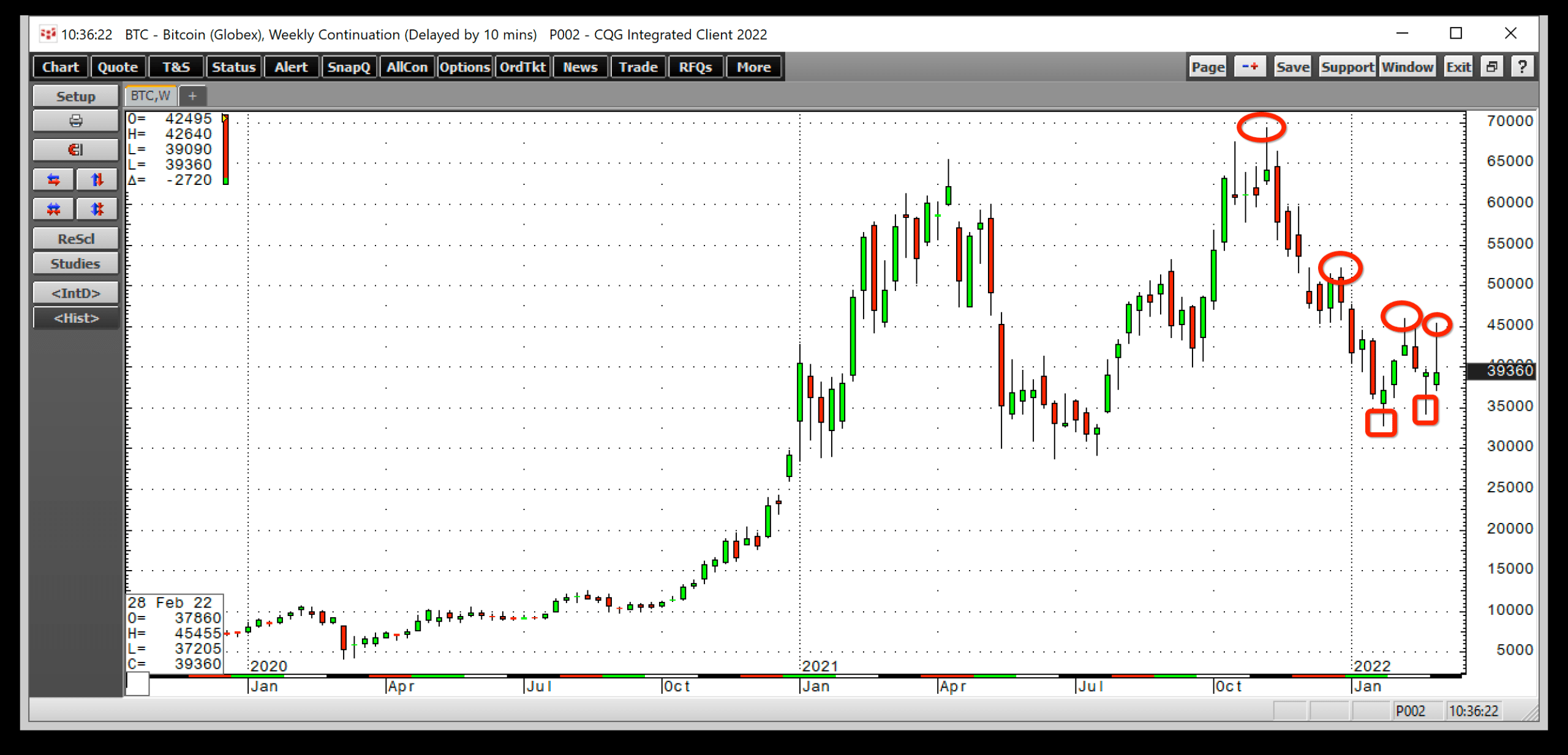

On Nov. 24, CME Bitcoin futures reached a record high of $69,355. Then they ran out of upside steam.

Bitcoin Futures Weekly

Bitcoin Futures Weekly

Source: CQG

Since then, Bitcoin has made lower highs. As the weekly chart highlights, Bitcoin futures fell to a low of $32,855 per token on Jan. 24 as the leading cryptocurrency lost more than half its value.

Since then, the price action has not violated the Jan. 24 low, and Bitcoin made a higher low of $34,295 in late February. The pattern of lower highs and recent higher lows is the development of a wedge formation, suggesting that a more significant move higher or lower is on the horizon.

Bitcoin is one of the most volatile assets, so it may not take long for the leading crypto to decide if it will blast off on the upside or fall to another lower low.

Three catalysts have stood in the way of a massive rally in Bitcoin and other cryptocurrencies over the past weeks in early 2022.

1. Governments love blockchain but hate cryptos

Speculators and many market participants have embraced cryptocurrencies as a mainstream asset class. However, governments have not been among the supporters.

Many regulatory criticisms center around the illegal uses of anonymous currencies that fly beneath the radar of government controls and law enforcement. However, the underlying fear is that cryptocurrencies disrupt the government’s ability to expand or contract the money supply by injecting or withdrawing legal tender from the global financial system.

Nonetheless, governments have embraced blockchain technology, which undergirds crypto assets, as it is the essence of the fintech revolution, increasing speed, efficiency, and record-keeping for financial transactions. At the same time, cryptocurrency’s threat to control the money supply makes the governments reject and hate the burgeoning asset class of the over 18,000 tokens floating around in cyberspace.

2. Bearish reversal from the mid-November high

The two leading cryptocurrencies, Bitcoin and Ethereum, have been highly volatile over the past years. On Nov. 10, 2021, both reached all-time highs. As well, both experienced a bearish reversal that caused prices to more than halve in value.

BTC/USD Daily

BTC/USD Daily

Source: Barchart

The chart shows that Bitcoin rose to a record high on Nov. 10 and closed the session below the Nov. 9 low, putting in a bearish key reversal pattern on the daily chart. The price collapsed after the reversal as sellers overwhelmed buyers.

ETH/USD Daily

ETH/USD Daily

Source: Barchart

The chart above shows that the second-leading crypto, Ethereum, put in the same bearish pattern on Nov. 10 and fell to below half the value at the Jan. 24 low.

The technical reversal caused many latecomers to the cryptocurrency asset class to lose money speculating on Bitcoin, Ethereum, and the numerous other cryptos that followed the leaders. After experiencing losses, innumerable market participants remain on the sidelines even as the cryptos show signs of bottoming.

3. Other safe havens have taken up the bullish baton

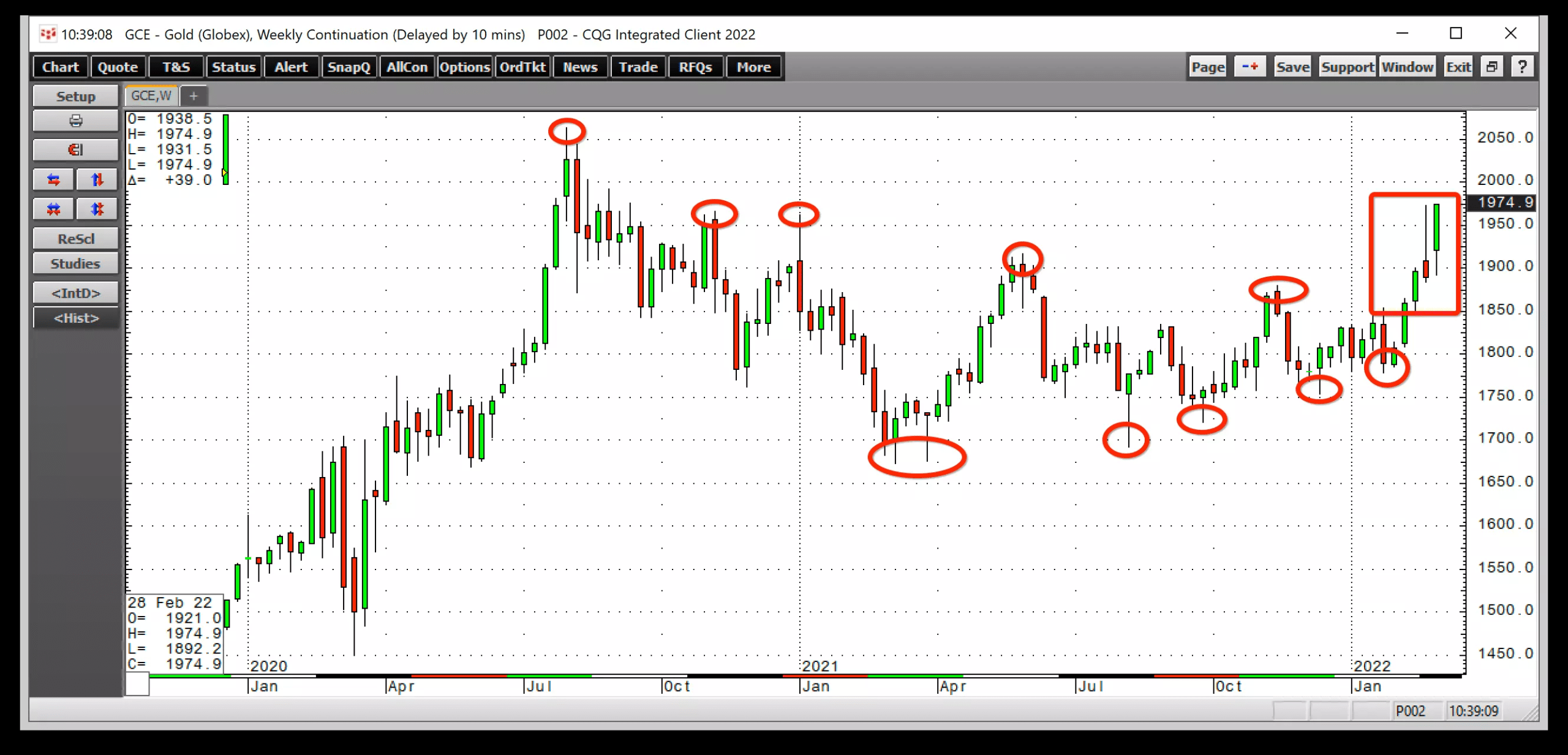

Long before cryptocurrencies existed, gold was the ultimate safe haven asset. But as Bitcoin and other cryptos exploded to their November 2021 highs, before imploding after bearish reversals, assumptions were made by many investors that another safe haven arena had emerged. During that period, the precious metal, the classic haven instrument, developed a wedge pattern of lower highs and higher lows, a bearish development.

Gold Weekly

Gold Weekly

Source: CQG

After making lower highs since August 2020, when gold reached its record peak at $2,063 per ounce, the precious metal began making higher lows in March 2021. During February 2022, gold broke out of that pattern, to the upside.

For over a year, $1,800 per ounce had been gold’s pivot point before it escaped from its wedge pattern on the upside. Gold was trading at over the $1,970 per ounce level at the end of last week, and this morning catapulted past $2,000. Clearly, the wedge pattern has transformed into a bullish trend.

As such, gold’s technical position is likely causing market participants to favor the precious metal over cryptocurrencies. Still, given the ease of moving cryptocurrencies during times of economic and/or political stress, their suitability as flight capital augers well for digital currencies to rise. Cryptocurrencies are easily transportable, anonymous, and liquid alternatives to other assets.

Crytpo bottom could be in; expect a rally to reignite the bullish fuse due to war and geopolitical tension

Soviet leader Vladimir Ilyich Lenin famously said:

“There are decades where nothing happens, and there are weeks where decades happen.”

His words ring prophetic after Russia’s invasion of Ukraine. It has changed the geopolitical landscape, forcing people worldwide to adapt to the risks of the new dynamic. I believe the war in Ukraine only furthers the case for the burgeoning asset class with China breathing down Taiwan’s neck and Russia seeking to recreate the former Soviet Union.

The reasons why Bitcoin, Ethereum, and other cryptos remain closer to their Jan. 24 lows than their Nov. 10 highs on March 7 are understandable. However, the geopolitical dynamic dramatically changed with the Russian invasion, thereby strengthening the case for owning cryptocurrencies.

I believe we will see new highs in this asset class just as we’ve seen for gold. Similarly, the odds now favor the crypto wedge pattern giving way to the upside.

Source: Investing.com